The onset and advancement of the pandemic caused severe disruption to tire business conditions globally.

Sales across the tire industry contracted, with manufacturers Michelin and Goodyear reporting second-quarter sales declines of approximately 20% and 41%, respectively. In turn, mergers and acquisitions (M&A) activity was impacted with certain active sales processes being put on a temporary or longer hold, and/or a postponement of pursuing a sale until conditions settle and a level of visibility returns. Transaction activity can thrive in both strong and soft business environments; however, activity is hamstrung in environments of high uncertainty such as that which we experienced in the second quarter.

The silver lining is the industry experienced a strong rebound in May and June as consumers received stimulus checks and spent these dollars on needed replacement, repair and maintenance for their vehicles; and aggregate miles traveled continued their rebound from the temporary 40% drop off in April amid the height of COVID-related stay-at-home restrictions. These factors, among others, led the U.S. Tire Manufacturers Association (USTMA) to revise their 2020 shipment estimates upward, providing an added layer of confidence in the ongoing recovery.

In addition, strategic buyers pushed forward with specific transactions despite market conditions, and corporates used this period to undergo internal review and identify non-core assets targeted for divestiture, thus fostering and maintaining some level of M&A activity which will likely show up in third- and fourth-quarter results. Finally, while brick and mortar operations faced significant challenges throughout the second quarter, weekly e-commerce aftermarket sales have increased by nearly 50% since the beginning of May – a trend we expect will continue through the second half of the year.

Key Takeaways:

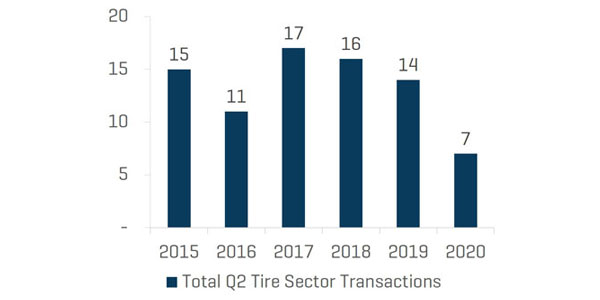

- Unprecedented economic shutdowns, stay-at-home orders and related disruptions associated with the pandemic saw the M&A climate experience its lowest volume transactional quarter since we began tracking industry activity

- Transaction activity was supported by strategic consolidation objectives, with the “essential” nature of the businesses acquired ensuring a level of stability, and special situations including bankruptcy sales

- We expect third-quarter M&A activity to remain very light, before a possible rebound in activity during the fourth quarter.

Historical M&A Trends by Period / Sector

Total Transaction Count

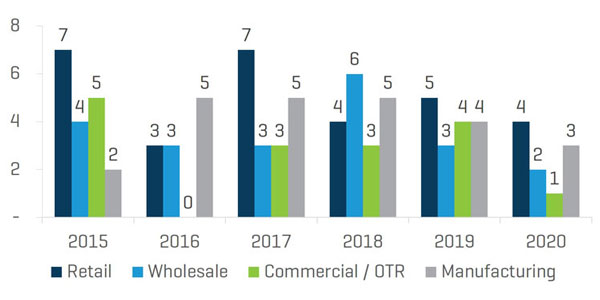

Transaction Per Sector

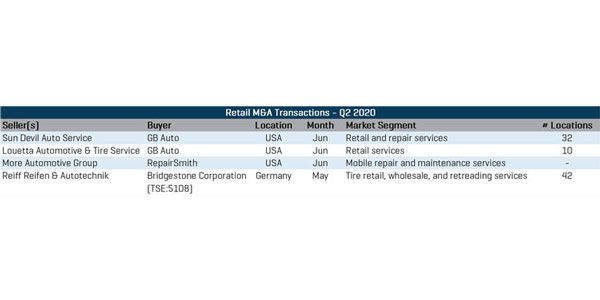

Retail M&A Transactions – Q2 2020

GB Auto Services Inc. – Greenbriar Equity-backed GB Auto announced the acquisitions of Phoenix-based Sun Devil Auto Service and Houston-based Louetta Automotive & Tire Service, during the second quarter. Sun Devil operates 32 repair shops with a presence across Arizona (20 locations), Nevada (eight locations), and Texas (four locations), while Louetta Automotive runs 10 locations, all of which are located within the greater Houston area. Established in 2017, GB Auto has rapidly expanded its footprint via acquisitions over the past three years to a total of 167 locations across the Western U.S. With its continued acquisition activity in the second quarter, GB Auto is now the seventh-largest independent retail tire and auto repair dealership in the United States.

RepairSmith – In June, mobile repair company RepairSmith announced its acquisition of More Automotive Group, a California-based mobile repair and maintenance services provider. More Automotive delivers on-site repair and preventative maintenance, and also operates an off-site repair facility reserved for more complex work. The acquisition allows RepairSmith to service More Automotive’s locations and fleets, adding location-based mobile service availability, and builds upon the acquirer’s “complete at-home service” initiative launched in 2019.

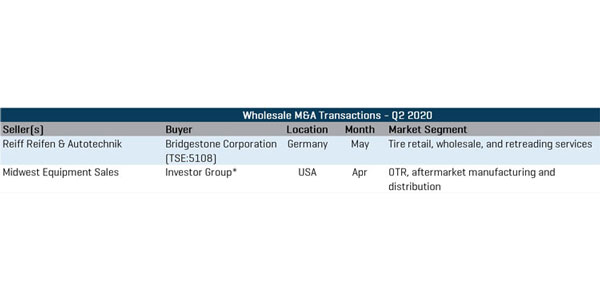

Wholesale M&A Transactions – Q2 2020

Bridgestone Corporation – In May, Bridgestone Corp. announced the acquisition of German-based Reiff Reifen & Autotechnik in a deal with the insolvency administrators for Fintyre Group, which announced in February 2020 that its German group members (including the acquired company) had filed for bankruptcy. Reiff Reifen, a tire retail, wholesale, and retreading company, operates 42 retail locations and a tire retreading facility, and employs more than 500 professionals across the country. Bridgestone management believes the acquisition supports its ongoing strategy to become a “mobility solutions leader” and increases its focus on providing “premium tires, trusted mobility solutions and customer-centric retail networks.”

Commercial/OTR M&A Transactions – Q2 2020

Tecum Capital – In April, Tecum Capital partnered with Provariant Equity Partners and Centerfield Capital Partners on the recapitalization of Columbus, OH-based Midwest Equipment Sales (“MWE”). MWE offers branded and private label aftermarket replacement tracks and tires used on utility machines and construction equipment, selling products both through an independent dealer network, and directly to end users online. MWE’s founder and CEO, James Cline Jr., retained a 35% stake in the company as part of the recapitalization, and will continue leading MWE for the foreseeable future.

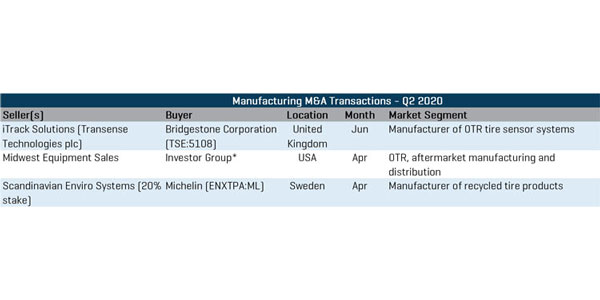

Manufacturing M&A Transactions – Q2 2020

Bridgestone Corporation – Bridgestone Corp. announced its acquisition of the iTrack Solutions OTR tire management platform from U.K.-based Transense Technologies plc, in June 2020. The iTrack platform, which provides tire monitoring systems to help OTR customers optimize operations through increased productivity and profitability, had previously been offered to Bridgestone customers under a joint collaboration agreement with Transense. The acquisition enhances Bridgestone’s strategy to provide sustainable and advanced mobility data analytics solutions to a growing OTR transportation sector.

Michelin – In April, Michelin announced a minority investment and anticipated long-term partnership with Swedish tire recycler, Scandinavian Enviro Systems. The deal, which includes Michelin acquiring 20% of the target’s shares, as well as a joint supply agreement between the two companies, builds on Michelin’s “all sustainable” vision, which targets 80% sustainable content in the company’s products by 2048. Further, the partnership looks to 1) scale Enviro’s tire recycling and related patented pyrolysis technological capabilities, and 2) expand the applications for the materials recovered through the pyrolysis process to other adjacent market segments.

This article is courtesy of Stout, a global advisory firm specializing in investment banking, transaction advisory; valuation advisory; disputes, compliance and investigations; and management consulting. Charts appear courtesy of S&P Capital IQ and Stout Research.