Fleet tire consumption is growing along with population and middle-class expansion regardless of the economic and transportation setbacks related to COVID-19. Thanks to the shift in mobility that is taking place to 2026 and beyond, which includes greater efficiencies in commercial transport and the use of car- and ride-sharing fleets for personal transportation, the fleet tire market is experiencing robust growth.

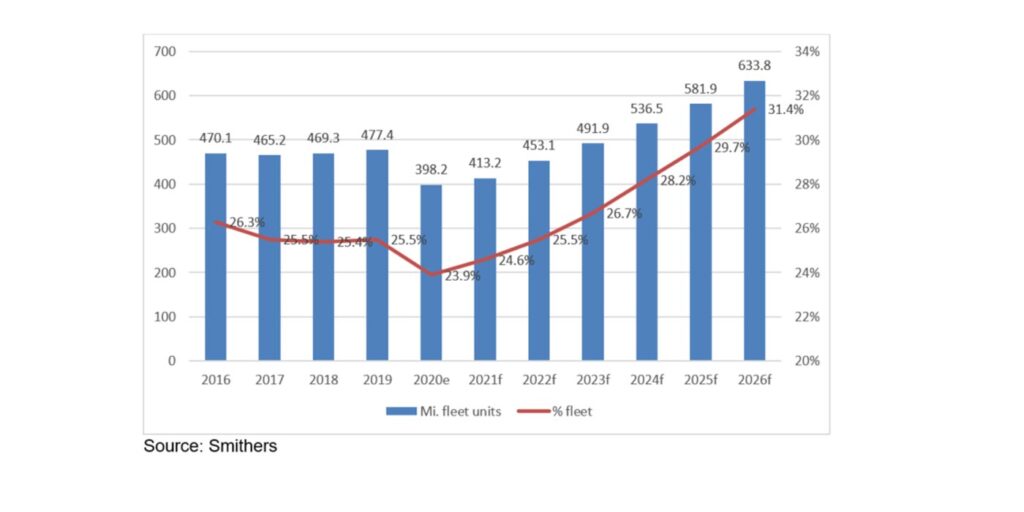

In the market report “The Future of Fleet Tires to 2026,” Smithers estimates demand from the fleet channel for light vehicle and truck and bus tires at $64.6 billion in 2021. It is expected to outpace the overall tire market in its recovery from the COVID-19 downturn, growing 8.7% per year through 2026. In unit terms, this translates to over 413 million units in 2021 and nearly 634 million units in 2026, with an annual growth rate of 8.9%, decisively faster than the overall tire market.

The attractive fleet tire growth rate is the product of an overall rebound from the still-low base year of 2021. It is also related to a rebound in the rate of fleet penetration, first returning to its historical range by 2023, and then rising further as mobility trends, vehicle technology and scale economies of larger fleets begin to transform the composition of vehicle and tire markets. This activity is ahead of the confluence of autonomous and shared fleets that will occur beyond the forecast period.

Industry Setbacks Related to COVID-19

The COVID-19 pandemic and the adopted closures and restrictions set back the economy, vehicle sales and usage, and fleet vehicle sales, use, tire wear and tire replacement. In addition to reduced economic activity, employment and commuting, shared transportation (e.g., taxis, buses, ride-sharing) was scaled back. Fleets deferred new vehicle purchases in many areas. But there were also opportunities revealed, such as the growth of e-commerce and delivery vehicles, which will help shape the fleet tire market for years to come.

COVID-19 also caused a pullback in the massive investments taking place in electric and autonomous vehicle and tire development. This shifted the uptake curves of these technologies out perhaps two years. Smithers sees these trends resuming to help expand the fleet market around the middle of the forecast period and to support broader transformation of mobility and tire markets beyond that.

Current and Emerging Participants

The fleet tire market includes virtually all the participants in the global tire market – at least when it comes to participants of scale. Michelin, Bridgestone, Goodyear and Continental are all prominent global leaders in terms of having fleet vehicle tire offerings and technologies and programs to support fleet customers, particularly larger ones. The value chain has additional players such as profitable fleet management companies (outsourcing partners of some fleets, especially of corporate cars) as well as sensor companies and external technology vendors with tools that can help automate tire inspection on a scale that makes sense for high-volume fleet traffic.

The most significant current trend indicator is the aggressive expansion of General Motors in the fleet space. The company’s BrightDrop EV delivery vehicle could transform how fleets operate and are managed, with implications for tire development, management and replacement. While major OEMs such as Ford, Daimler, Volvo and Tesla (among others) are already involved, Smithers sees OEMs becoming much more active in this area of enhanced and broader EV offerings to fleets.

BrightDrop announced Walmart as new EV customer and expanded its collaboration with FedEx at the Consumer Electronics Show in January 2022. The BrightDrop EV600 is an all-electric light commercial vehicle that is made for the delivery of goods and services. Walmart signed an agreement to reserve 5,000 of the EVs with goal of operating a zero-emissions logistics fleet by 2040.

New Technology Investment

Technology has been the target of increasing investment for years, and it will continue to be the focus of major auto and tire companies. Connected, electric and autonomous shared transport are strategic imperatives for automakers, tire manufacturers and their suppliers, tech firms and governments. Tires will need to join rest of vehicle in connectivity through sensors or other systems, providing real-time data on tire inflation, condition and wear. Increasingly, required for reasons of emissions and sustainability, growth of EVs will be driven by political and regulatory imperatives and mandates. The advantage will go to fleets that can more readily afford them and the needed charging infrastructure.

Increasing Light-Vehicle Demand

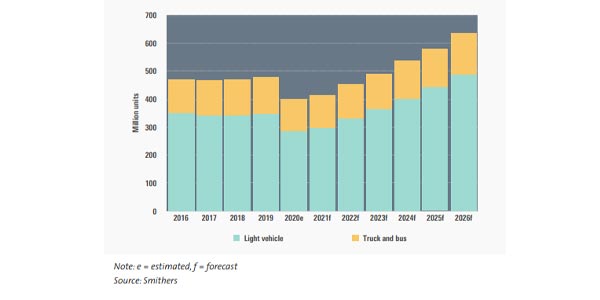

In value terms medium and heavy-duty trucks (and buses) dominate the fleet tire market at roughly twice the size of light vehicles (passenger cars in light trucks). Although in volume terms, light vehicles (a strong fleet market already mostly in Europe) dominate. Light-vehicle demand is experiencing higher growth, as ownership begins to migrate more toward fleets, which have been common in the more mature truck segment for many years already. But significant opportunities are seen in truck segments such as last-mile delivery, which has received a major long-term boost from changes brought about by COVID-19 and e-commerce. In general, smaller vehicles will be growing the fastest within their relevant segments.

During the forecast period, compact demand growth will outpace every vehicle segment except for CUVs. This reflects the practicality of the small cars for urban fleets, especially of the shared transportation variety, where higher-occupancy vehicles may be in less favor in the post-pandemic mindset. The mid-size segment is the most significant in terms of fleet tire demand volume and value, but its performance relative to the compact segment has been inferior. Full-size market performance has been more sluggish still, by fleet tire standards.

The evolution of the light truck segment of the market will be shaped by new powertrains, vehicle ownership and use (greater conventional fleet penetration, car-sharing and urbanization), emissions reduction imperatives (fuel economy mandates) and connected/autonomous driving. It consists of sports utility vehicles (SUVs) and their subsegment, compact SUVs (aka crossover utility vehicles, or CUVs, which we treat as a separate segment), and other light trucks, which includes primarily pickup trucks. Driven especially by the global CUV trend and the preference for smaller vehicles, as well as by delivery vans, the light truck category will significantly accelerate volume and value growth within the fleet tire market.

The major component of medium and heavy truck segment fleet tire demand is accounted for by high-utilization, heavy-duty applications, such as line and long-haul national and transnational goods transport. It is also the most mature segment, where efficiencies have long encouraged larger fleets. However, it is regional fleet vehicles that have been more resilient during COVID-19, where a lot of the last-mile delivery vans are classified. Thus, regional trucks will lead growth, followed by vocational fleets in the mixed and severe service market.