With the start of a new year, business owners like you are reviewing their financials, setting budgets and zeroing in on their KPIs, readying themselves for the opportunity a new year brings. You’ve got 12 months of potential bottom-line growth ahead of you. But where will that growth come from? And how will you go about growing it?

Tire Review put those questions to a panel of industry experts to examine areas of opportunity where your shop can bring in more customers, streamline processes and gain profitability. Call them what you want—maybe productivity hacks or tricks of the trade—either way, they’ll help your dealership work smarter in 2020 to gain profitability for years to come.

Leverage Customer Data

What if you could be there for customers the instant they realize they need vehicle maintenance? Well, you can be, thanks to a little front-end work by collecting data on your customers, then creating marketing campaigns catered to their needs—which, in turn, translates to dollars.

For shops looking to build that data on their customers, filling out a customer profile at the point of sale is key so that the shop can later market to certain customer segments, says Dave Vogel, general manager of ASA Automotive Systems.

“It really starts with proper reporting, as basic as that sounds,” he says, adding that vehicle make and model, the vehicle’s VIN number, license plate and customer information are the essentials. “You have to have the data so that it’s well organized where you can easily extract it and do something with it.”

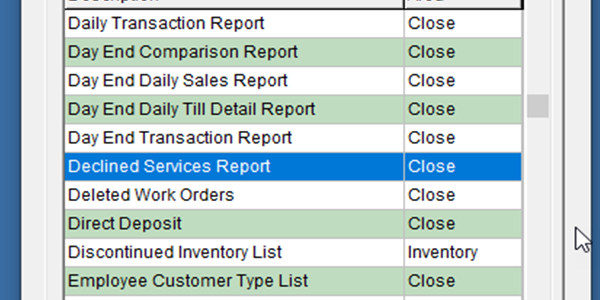

Transactional and quoting data is also important when creating a customer’s profile, especially regarding the services that customers decline, Vogel says. For example, a customer comes in for an oil change, but the technician finds that their vehicle also needs new brakes. If they decline the brake service, the shop has a perfect chance to follow up with the proper targeted marketing so the necessary repair stays top of mind, Vogel says.

“So, rather than trying to convince a market that you don’t know is willing to shop with you, this one is already your customer and you know specifically what they need,” Vogel says. “You’re not trying to recommend something that doesn’t fit them.”

Targeted marketing has proven profitable for Jessica Carrino and her family’s store, Sparks Tire & Auto, a single-location shop in St. Charles, Missouri. Jessica, the shop’s marketing manager, doesn’t have a marketing background, but combine her data saavy and the 30-plus years in the auto industry her father, Ron Tinner, has under his belt, and the two continuously create marketing campaigns that have boosted the shop’s profitability by simply using customer data.

“I’m able to segment my marketing based on the customer data,” Jessica explains. So, say she wants to send out coupons for oil changes to customers who’ve spent more than $1,000 with the shop in the past year. Or, maybe she wants to target customers who own Dodge Vipers who have visited the shop in the last two years. She can select these criteria from the NAPA Tracs software that the shop, a NAPA AutoCare Center, uses to create these customer profiles.

“By really focusing on getting the right offer to the right list, you’ll see a much higher return on your investment,” she says. “We have personally seen that.”

Jennifer Thronson, president of marketing and rewards platform Bay IQ, adds that customer behaviors have also changed in the way they want to receive these messages. She says Bay IQ focuses on sending emails and texts to customers. The service, which integrates with most shop management systems, also sends automatic reminders for scheduled maintenance, declined services, special promotions and more. A major part of the software is its rewards program, which allows customers to earn points on purchases at the shop to use on return visits. This allows service advisors an opportunity to get customer contact information at the counter to send these automated messages.

“Based on the VIN, make, model, year [of the vehicle] and mileage, we pull the maintenance schedules and are automatically communicating with customers trying to get them to come in to complete the maintenance due at the shop,” Thronson says. “The rewards program provides incentives to get customers to return to shops more often and spend more money when they do.”

Like other platforms, dealers can create targeted marketing campaigns for certain promotions or other incentives using Bay IQ. After investing in the software and using the rewards program, Thronson says many shops, especially with the rewards program, see an increase in customer visits and spending. On average, she said shops using the rewards program saw increased visits from 1.2 visits per year to 2.5 and are seeing the average repair order increase by up to $100 per visit.

“Annually, shops can see $500 more per customer just by enrolling them in the rewards program,” she says.

Manage Your Shop’s Inventory

With the number of SKUs increasing each year, having a solid strategy for inventory management is key to maximizing your profitability off tire sales. According to a survey of American Tire Distributors’ customers, two-thirds of independent tire dealers stock more than 250 tires at any given time, but less than one-third stock more than 1,000 tires, underscoring the issue of stocking complexity for dealers.

“Knowing which tire to sell and ultimately stock is complex, and there are many things that need to be considered including front-end margin, back-end margin, promotions and consumer preference, just to name a few examples,” ATD says.

As part of your inventory strategy, ATD suggests dealers establish minimum and maximum stocking limits and stock the most popular sizes in their local market. In addition, a shop’s POS systems can be integrated with replenishment systems that enable dealers to follow their stocking strategy, while also allowing them to see the long list of SKUs their distributor provides.

According to Max Finkelstein Inc., increasing inventory turns comes down to dealers paying attention to what they merchandise, balancing and weighing opportunistic purchasing with carrying and financing costs and following profitability over emotion and routine.

Chris Fox, managing partner for 10 Best-One of Indy stores, remembers in the early ’90s when the store he worked at stocked five to eight different sizes with 15-200 tires in each size. Fast forward to today, and he says, “Every year, they come out with [around] 64 new SKUs. With new tires coming into the market you need to stock, it makes it a lot tougher to spend time analyzing tire lines and prices to make the right decision for your company.”

Fox says at Best-One of Indy, 60-day inventory benchmarks are set to increase inventory turns and drive sales. Stores divide tires into A, B and C movers, with a strategy to stock as many A movers as they can and rely on distributors to fill in their inventory.

“With so many different sizes and so many different brands, set benchmarks and live by those benchmarks,” says Fox, “Rotate your inventory on a regular basis. If that tire sits there, that’s [lost] money.”

Tire Inventory Tips

- “I run reports to see tire aging,” says Fox. “If I see tires on a 90-day report or 180-day report, I pull the tires out of that location, and we don’t stock them there anymore.”

- Have a designated location for special order tires, Fox says. When you have one spot for special orders, it’s easy for shop managers and service advisors to monitor. That way, if they’ve called the customer and they haven’t come in for their tires, the shop team can send the tires back.

- Conduct quarterly or even ongoing “random cycle count” audits along with annual total inventory reconciliation, American Tire Distributors advises. Dealers may also consider integrating their POS system with their distributor because it can improve overall inventory management and assist with continually analyzing opportunities to boost total store profitability.

- Communication, coordination and collaboration are key in working with retail partners, Max Finkelstein Inc. says. Many distributors have improved their capabilities and are valuable consultants to these dealers.

Hone in on Alignments

In the tire and auto service business, having more reasons to talk with the customer and be a resource for them is always a good thing. An investment in touchless alignment inspection has given many shops that opportunity, which then translates to profit.

Mark Rhodes, owner of Plaza Tire Service with locations in Missouri, Kentucky, Illinois and Arkansas, has seen that proven time and time again.

The scenario plays out a little something like this: The customer comes in for an oil change. Shop staff writes up a work order, but before they take the vehicle to the oil change rack, they run it through Quick Check or Quick Check Drive technology developed by Hunter Engineering that uses lasers and sensors to measure total toe and camber as well as take a photo of the vehicle’s license plate. All this happens in three to five seconds and can be displayed on a screen in the waiting room for customers to compare their results to other vehicles. If a customer’s results show up in red, that’s an indication that the shop should put the vehicle on an aligner.

“It gives us more opportunity,” says Rhodes, who has utilized Hunter’s Quick Check and Quick Check Drive at his stores, some of which have had the technology for the past 10 years.

“We then take the information provided from the Quick Check and cover that with the customer. We use it as a kind of a soft-sale education,” Rhodes says. “By running all vehicles through it, naturally, it increases your chances of selling more, and it takes the guesswork out of [if the customer needs an alignment].”

Alex Smith, product manager for Hunter Engineering’s lane inspection solutions, says according to company data, about 50% of vehicles on the road today are out of alignment.

“But only half of those vehicles will show irregular tire wear,” he continues. “So, if you’re trying to diagnose alignment condition based on tire wear, it’s a lot of money that walks out the door if you’re not actually taking measurements and comparing them to OEM specifications. On the flip side, you could end up selling your customers unnecessary work.”

David Boyle, president and CEO of Tire Profiles Inc. (TPI), said next to fuel and insurance, replacing tires is the third-largest expense that the consumer will have over the course of the life of their vehicle, which could add up to $4,000 or more. TPI’s TreadSpec 2.0—a drive-over alignment inspection system—uses lasers, sensors and cameras to capture vehicle data, measure alignment and tread depth. Its mobile version, called GrooveGlove, collects the same data and uploads it to a cloud for salespeople to show during customer interactions. Boyle calls the technology “an opportunity for the industry to help consumers manage their tire expenses,” while giving dealers a sales opportunity.

“It’s really about capturing a higher percentage of your opportunity than you are today,” Boyle says. “It’s a very professional, transparent way to communicate to the consumer so that they’re in a very different buying position than they typically are in this industry. It’s about giving the customer information and then allowing them to buy, as opposed to being sold to.”

A shop’s ROI on alignment inspection equipment can be realized within a few months to a year depending on the sales staff at the store. Hunter’s Smith says, on average, an alignment brings in about 65% gross profit for the store, a larger percentage compared to other service work.

“Being able to check the car for an alignment every time is key,” Smith says, “it’s good customer service and a great value for the customer.”

Forge Your Own Path to Profitability

No matter your business model, it’s important to understand what your shop’s profitability is on tire sales. Over the past 10 years, dealers have been increasingly pinched when it comes to margins on tires, which is why forming partnerships with manufacturers and distributors or taking advantage of associate dealer programs can help you squeeze the most out of your tire sales.

These programs often come in the form of spiffs, and each brand offers different rewards for the volume you move. Many times, spiffs come in the form of benefits—such as special pricing, bonuses, “back-end money,” trips or additional money paid out once certain unit goals are reached, just to name a few. Depending on the spiff, the direct seller of the tire, whether that be the shop manager, service advisor or tire dealer themselves, benefits.

The way dealers can take advantage of these programs and make money is as individualistic as the way they run their business. Or, some dealers choose not to participate in favor of their own business model.

One of them is Craig Wortham, co-owner of Alyeska Tire with his father, Jerry, with multiple locations in Alaska. Craig says he avoids “back-end money” programs, and instead, asks manufacturers to return what each store would make on the spiff back on their invoice. From there, 49% of the profits from each store are shared with the location’s employees through a bonus program. The other 51% of the store’s profit is reinvested back into the company to “create more opportunity for more people or for expansion.”

“We feel like it’s an investment into our employees,” Craig says. “It works out best for us, too, because the more profit we make off of a tire, there’s some built-in incentive for the employee to sell a profitable product.”

Some manufacturers also share Craig’s view on his shop’s pathway to profitability. Abhishek Bisht, global head, new markets and channels for Apollo Tyres, says for Vredestein, dealer profitability means profit at the time of sale, immediately.

“Profitability for our dealers is kept clean and simple—make money at the sale—removing the need for us to ‘re-inject’ profitability into the stream for dealers through spiffs or large associate dealer back-end programs,” Bisht says. “No waiting for a back end to restore what should have been made at the time of sale, monthly specials to try and find a few more points or complicated programs to maximize and shuffle around.”

Whichever way your store’s path to profitability points, be sure to track and review it frequently to maximize your opportunities for growth.

Check out the rest of the January digital edition of Tire Review here.