While most dealers provide online tire sales, a large percentage still prefer in-store, and may not even provide an online option. So, what’s the difference?

When it comes to deciphering tire dealer sales, unraveling where the revenue streams converge can be tough. I compare cutting through this data to embarking on a safari through the dense financial foliage of the tire industry, in pursuit of the ever-elusive golden sales-profit idol. I mean, figuring out what to charge for services, services to provide at point-of-sale and adapting to the ever-adapting tire landscape is a tall task, and it can get confusing. However, worry not, Rollin’ with the numbers explorers; for I am here to decode this data for you.

Many tire dealers have established some sort of online presence, but not all. It’s true for the majority of tire dealers who took our survey, too, but more than a third at 36%, are still committed solely to the traditional in-store brick-and-mortar tire selling experience.

Of the 64% of respondents who said they sell tires online, 51% reported that online sales yield higher profits – while on the flip side, 21% believe that in-store sales reign supreme. 28% of respondents who sell tires online believe that online and in-store tire sales offer comparable profit margins.

So, with more than half of our respondents reporting higher profits via online tire sales, why do more than a third of our respondents stick to in-store tire sales only? Aside from obvious issues like shipping costs, the data detailing in-store service pricing and profits may have something to do with that…

When tire dealers sell tires in-store, they build trust and relationships that can bring customers back for installation and other future service needs. That connection suffers when customers buy tires online from you. That’s a big checkmark in the “pro” category. The con, of course, is that you’re missing out on the wider customer base you’ll find online.

Another pro for in-store? More upsell opportunities.

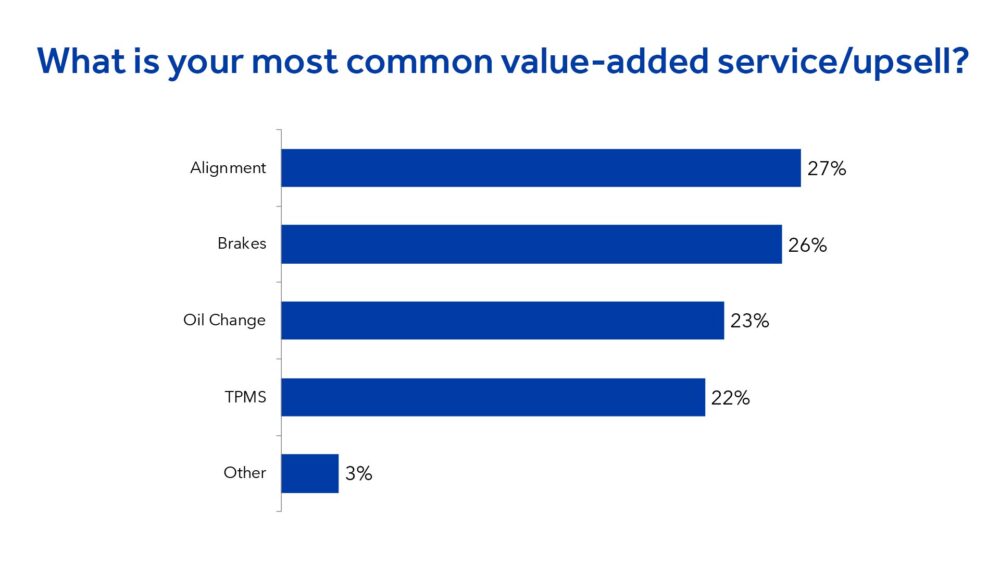

Our respondents say that the most popular added upsell is alignment service, followed by brakes, oil changes and TPMS calibrations. When a customer buys a set of tires online, it will be more difficult to communicate the importance of future add-on services at the point of sale and will be tougher to get them in your store for the actual services.

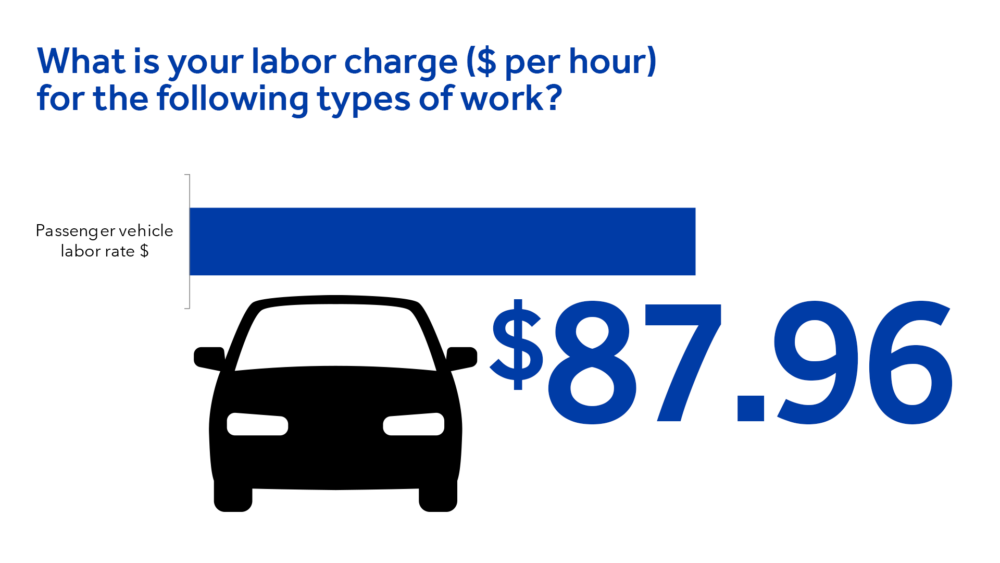

With that being said, in-store tire sales also increase the likelihood of tire installation happening at your shop. Among our respondents, 53% said they charge anywhere between $76-100 for tire installation, and a combined 33% charge even more! Not to mention the cost of labor for passenger vehicles. Our respondents say they charge $87.96 per hour on average.

While most of our respondents do have an online and in-store presence, figuring out which one to hone in on could be tough. If you’re successful in upselling, tire installation and service revenue, focusing on in-store sales may be the best path for you. However, as the digital landscape grows in the tire industry, you may find it beneficial to consider evolving with the industry by pushing your online presence.