Tire dealers cite limited demand as a reason for not stocking a larger variety of EV tires in 2024. EV tire and service trends from last year may point to why dealers in some parts of the country are bullish, but it isn’t like that everywhere.

On this week’s show, we’re looking at regional EV trends and how they affect EV tire sales and EV service. Following these demands and understanding where EV hotspots in the country are can better prepare you and your customers for current EV trends.

Nationally, EV services accounted for an average of 10% of tire dealer revenue last year, according to a recent Tire Review survey.

47% of dealers nationally think demand for EV services will slightly increase this year. However, EV service demand expectations for 2024 vary greatly by region.

For example, in the Northeast, 30% of dealers from states like Connecticut, Massachusetts and New York foresee a significant increase in EV work, while just 9% in the West expect a major jump. This is probably because EV hotspots like California and Nevada are used to regular EV work, so they don’t foresee any major changes.

Understanding these regional differences allows you to anticipate local conditions versus national averages. Say a shop in the West sees 1,000 EVs a year. If they have 200 more EV customers this year, that’s not much in terms of growth for them. However, a shop in the Midwest might only see 100 EVs per year in contrast. If they have even 50 more, it feels more like they have a major increase on their hands and need to make changes to adhere to those customers.

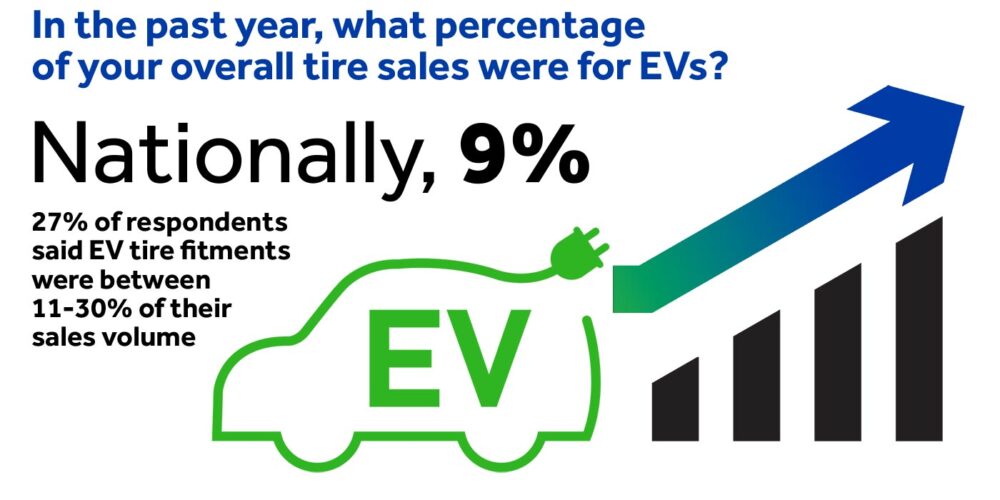

On EV tire sales, the story is similar. Nationally, 9% of tire sales were fitments for EV vehicles last year. There were still over a quarter of shops saying EV tire fitments were between 11-30% of their sales volume, though.

What about 2024 expectations? Do our respondents expect to sell more or less EV tires this year?

In the Northeast, 20% anticipate at least a slight increase, with 40% forecasting a big increase in how many EV tires they’ll sell. Nearly every region expects some sort of growth, with only 8% of our Southern respondents expecting some sort of decrease.

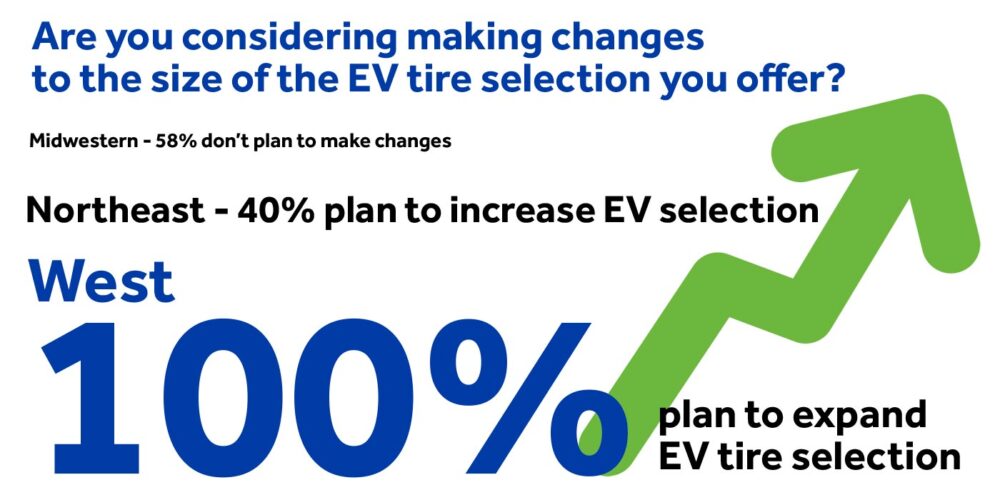

Whether tire dealers plan to expand their EV tire selection tells a different story, though.

Nationally, 45% said their EV tire catalog will stay about the same. Again though, we see big regional gaps.

58% of Midwestern dealers don’t plan to add EV tires, while 40% in the Northeast said they plan to increase their EV selection. But in a hotspot like the West, 100% of respondents from that region said they plan to expand EV tire selection.

Why the differences?

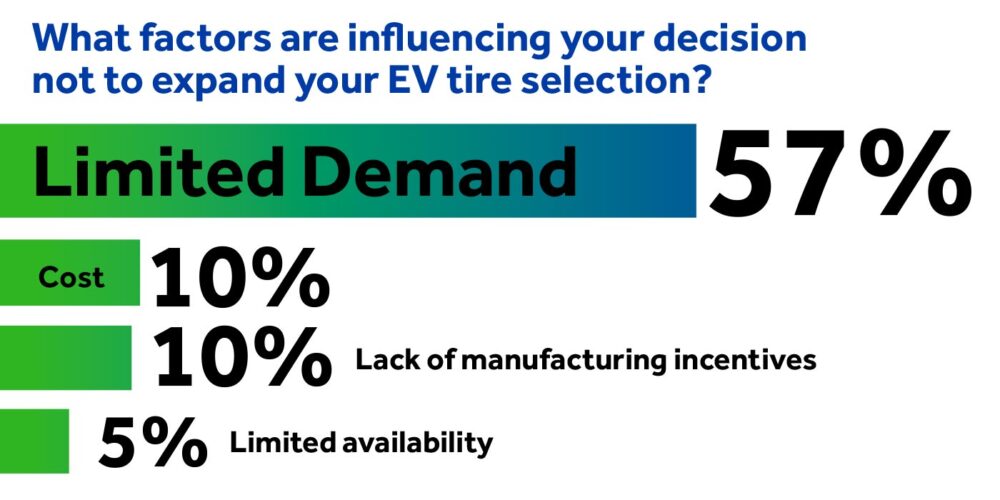

Over half who aren’t expanding their EV tire selection cited limited consumer demand. However, cost, lack of manufacturing incentives and availability challenges were also noted. Others claim a lack of cost and performance benefits to customers compared to premier non-EV tires. More than anything, this data underscores how local market conditions shape dealer perspectives on EVs.

For dealers in the Midwest and other regions with lower EV penetration, consumer interest is driving a “wait and see” approach. But for those in EV hotspots like the West, positioning for future growth is already underway.

While regional divides exist, the national EV wave is coming. By tailoring your strategy to local demand, you can ride it successfully.