Vehicle miles traveled (VMT), rising costs and other data painted a picture for 2023, but there’s more to the story. For example, how are tire dealers and shop owners weathering the storm from economic uncertainties this year and beyond? On this episode, we’re reviewing data from 2023 that tells us a lot about automotive trends moving forward – including how those trends directly affect the tire industry.

You may know Mike Chung, the senior director of market intelligence at Auto Care Association. He provided us with some great data for Tire Review’s December issue, where he reviewed different topics about the aftermarket and economy, starting with an indicator that can tell us a lot about aftermarket trends: VMT or vehicle miles traveled.

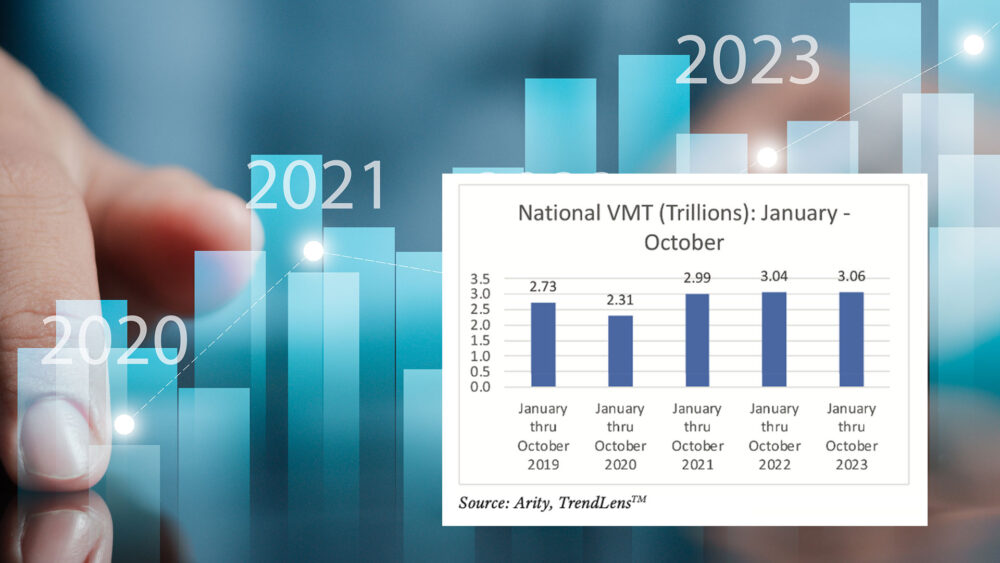

This data shows VMT from January to October this year as just slightly higher, at 3.06 trillion miles than the same period last year, 3.04 trillion miles. Chung said the Auto Care Association expects VMT totals to slightly increase compared to last year by the end of 2023.

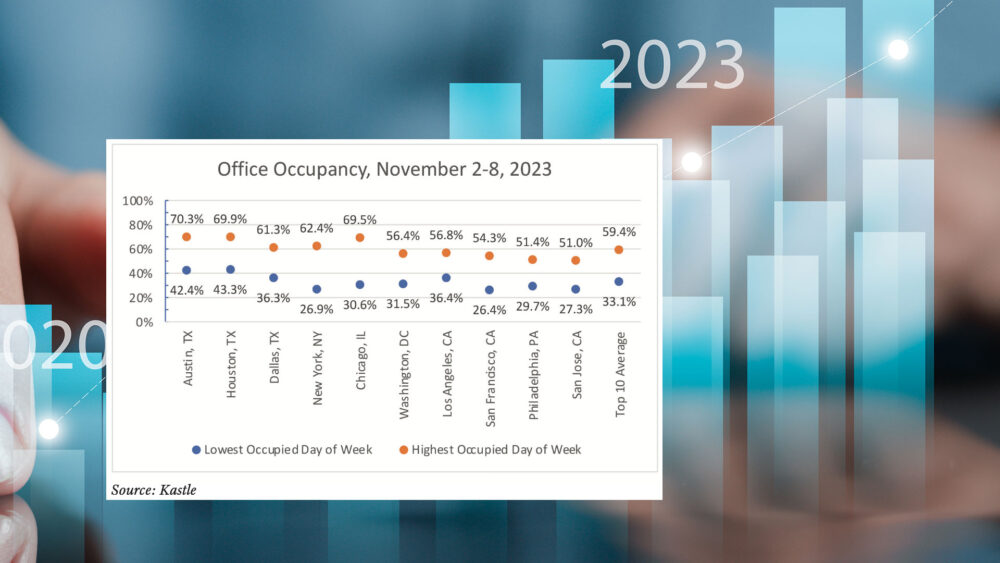

The number of in-office employees has also remained relatively steady. In some of the biggest cities in the US, employees are in office as much as 70% of the time. The more folks head into the office, the more they drive. The more they drive, it’s more likely they will need regular maintenance. As a dealer or shop owner, you know this is great for tire sales and service, considering the routine intervals linked with maintenance and replacement.

Retail aftermarket spending has kept pace with these driving habits.

Similar to the previous year, the rise in inflation played a role in pushing up retail prices. Nevertheless, sales surged by over 8% from 2022 to 2023, surpassing the average inflation rate for the entire year.

All this data is great, but how have tire dealers and shops in the real world responded to high inflation and interest rate issues in the past few years?

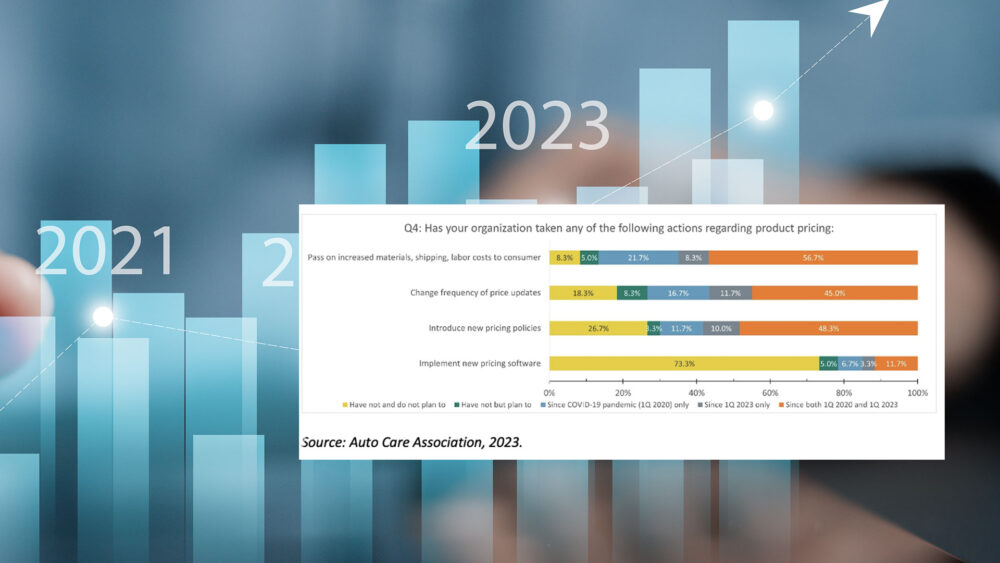

According to a survey of Auto Care Association members from July, 56% of aftermarket companies have passed on higher materials, shipping and labor costs since 2020. 48% said they introduced new pricing policies in the same period.

Higher material cost has also affected dealers and shops negatively.

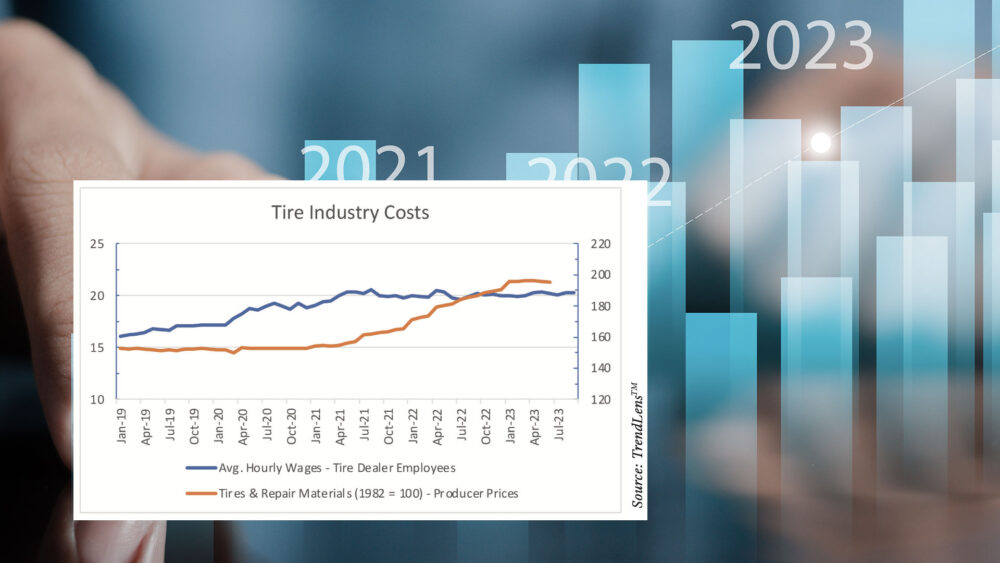

According to this data, the cost of doing business has increased for the tire industry. The producer price of tire and repair materials has significantly increased in the last two years. However, tire store managers seem to be keeping labor costs unchanged, which may adversely affect both customers and employees because of high inflation.

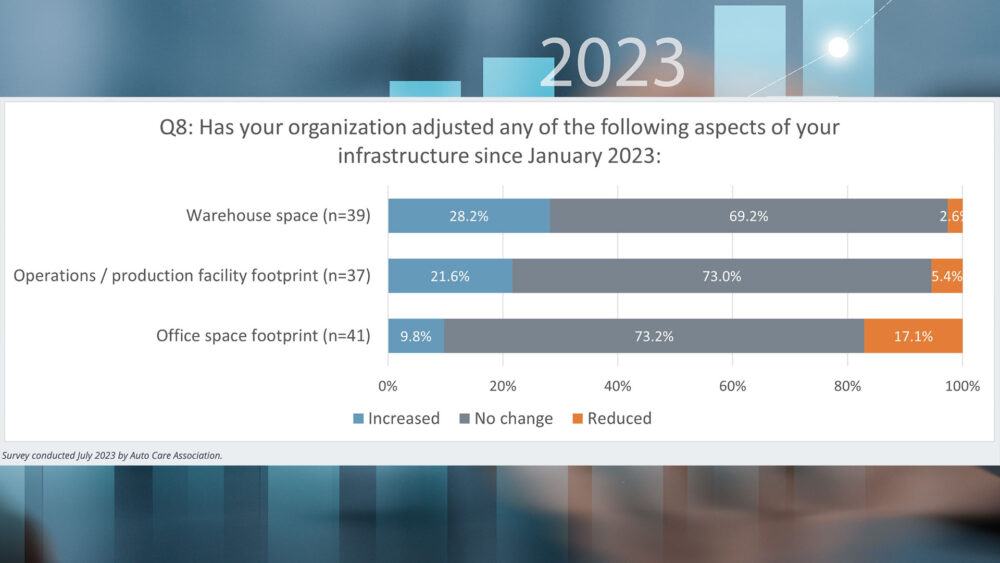

Chung said tactics tire dealers and shops have taken in the face of this adversity include diversifying supply sources, investing in facility space, reviewing inventory levels more frequently and increasing inventory of critical final products.

While the majority of companies haven’t altered their warehouse, production, or office spaces, 28% have expanded their warehouse areas, and 21% have increased their production facilities.

VMT and rising costs may paint a picture for 2023, but they don’t show the entire story. Tire dealers and shop owners have maintained a steady course, showcasing resilience and adaptability in the face of inflationary and financial uncertainties. This bodes well for 2024, as it’s clear that no matter the dynamic shifts in the industry, the tire industry and automotive aftermarket will keep rolling on despite the intense economic pressures brought on in 2020.