Various sources show that some of the developments are more positive than others. Yes sales of W-, Y- and Z-rated tyres grew by more than 12% last year. And, yes, this segment offers some of the best margins available.

But with the exception of 4×4 tyres, the high performance segment is the only passenger segment that is growing. Tyres below V in terms of speed rating and with diameters of less than 15 inches suffered the most. So rather than being just a profit-centre, aren’t high performance tyres becoming the “bread-and-butter” foundation of the future?

The ERMC-compiled Europool figures report that the total U.K. passenger car market amounted to 16,111,696 units in 2005 (down 1.9% on 2004). This compares with a slightly larger drop in the Europe-wide total of 117,242,516 (down 2.9% in 2004).

However, due to the way these numbers are compiled (excluding tyres that are not produced within reporting countries) they are perhaps overly optimistic. As industry insiders will be aware, the total market is actually more than 10% larger and has fallen significantly more than 1% – 2% in recent years. New figures compiled by market research company GfK put the total market at 18.49 million units, down 13% over 2004 in terms of volume (21.33 million in 2004 and 22.58 million in 2003).

Looking at the high performance segment’s 12% growth (Europool figures), you could be forgiven for thinking that the market would recoup its 13% volume loss in terms of value. While this is true to some extent, GfK’s analysts report that total market value was also down by a slightly less significant 11%. According to these figures the total U.K. market was worth £982 million in 2005 compared with £1.108 billion in 2004 and £1.112 in 2003.

As you might expect, the value-per-unit trade-up was evident in products retailing between £76 and £100 (likely to be high-performance tyres). This price range represented 18% of the market in 2005, up three points from 2004. According to GfK, sales in the budget price bracket (£50 or less) dropped 3 points from 44% of the market in 2004 to 41% in 2005. All other price bands remained relatively static, with some slight growth at the top of the sector in the £126 – £150 range.

Ahead of the game

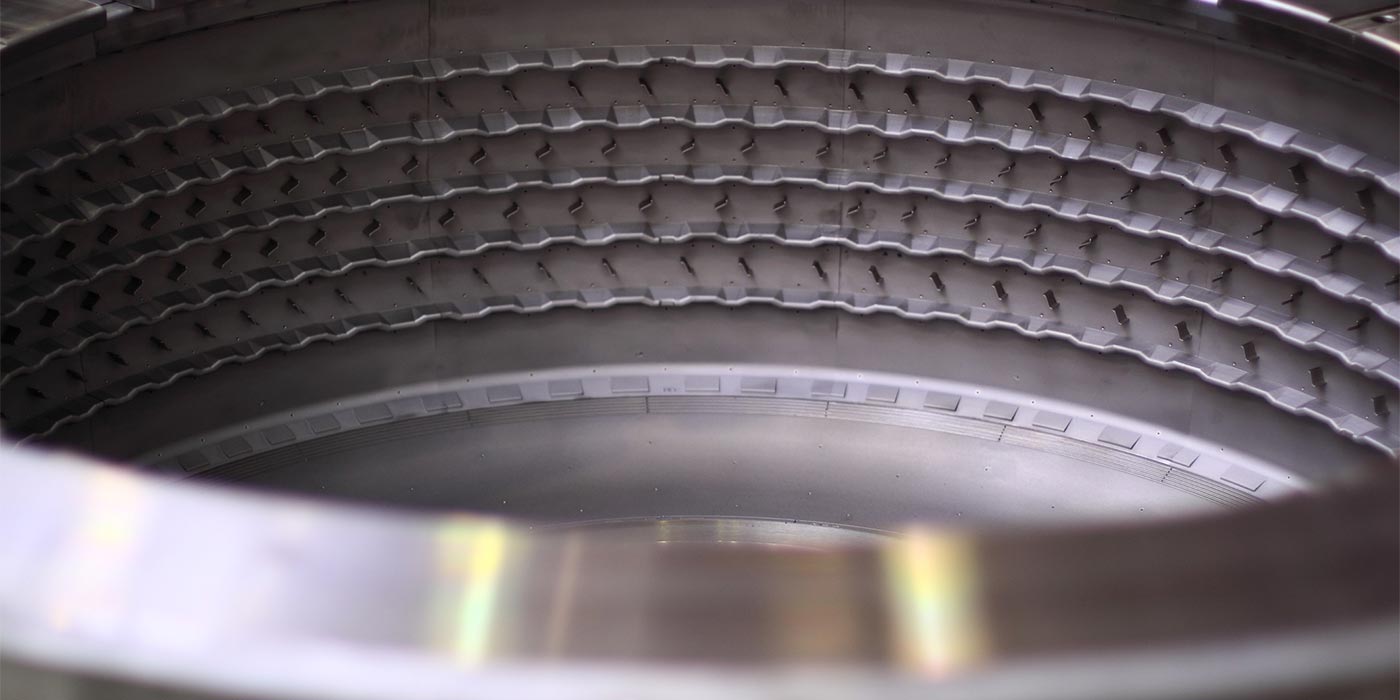

This trend is something that Continental AG made the most of at the recent launch of its new ContiSportContact 3 tyre. The German manufacturer’s U.K. market calculations are much more optimistic than the ERMC and GfK figures. Conti executives expect a whopping 24.2 million units to be sold in 2006, 21.4% of which will be W/X/Y-rated. This is expected to rise to 26.1% of a 26.1 million unit U.K. replacement market by 2009.

In this respect the U.K. business is some way ahead of the European average. Continental reports that the pan-European average is currently 13.3% W/Y/Z fitment on 153.5 million units. The European average is only expected to reach the U.K.’s strong position by 2009 when W/Y/Z tyres are expected to be fitted to 16.5% of 163.5 million-unit European replacement market. As a result, companies that are already well established as “high performance brands” are benefiting from the market’s shift in focus.

Take Pirelli for example. The Italian manufacturer’s exclusively high performance approach appears to have helped it gain market share from its more generally quality focussed competitors. According to GfK’s data, Pirelli is now joint U.K. market leader with Michelin, having gained 2 points both in terms of volume and value.

GfK puts the joint leaders’ (volume) market share at 9% each, with Goodyear following close behind at 7%. Continental, Dunlop and Firestone are all said to hold joint third place with 6% total market share. In terms of value, Pirelli and Michelin both appear to be neck-and-neck with GfK quoting the manufacturers as holding 12% shares each. The only difference between the manufacturers is the figures show this as a two-point loss for Michelin and a two point gain for Pirelli.

Tyres & Accessories asked Pirelli for confirmation of the statistics. However, the Italian manufacturer was typically guarded in its response. “We remain on course with our overall market share targets and in particular our high performance market shares,” a Pirelli spokesman told T&A refusing to comment on the specific details involved.

“The figures quoted have not been supplied by Pirelli UK Tyres Ltd. so it is pleasing that our actions have been noted by third parties or our competitors. We have an excellent team in marketing that has developed sound strategies that the customer base find both relevant and of direct interest with regards to business improvement, with a sound sales team that interfaces with the client in applying these tools,” he added. Which left T&A wondering if there was a more indirect way of saying yes.