The five mistakes already discussed were:

The five mistakes already discussed were:

Mistake 1…Failure to Prepare and Properly Package Your Business

Mistake 2…Failure to Properly Price the Business

Mistake 3…Failure to Sell Your Business Before You Need to Sell Your Business

Mistake 4…Failure to Leverage the Right Professionals

Mistake 5…Failure to Maintain Confidentiality During the Sales Process

Mistake 6 … Failure to Play a Positive Role in Interacting with a Buyer

As an expert in your business, you can play a valuable role in staying engaged and working in partnership with your broker. While some brokers, especially those who previously sold real estate, go out of their way to keep buyers and sellers from directly interacting, this is rarely the best method to achieve a successful sale in the shortest amount of time.

Although your broker will work hard to find qualified buyers for your business, no one has more motivation to sell, or inside knowledge of the business, than you do. You can play a key role in instilling confidence in the buyer that the business can be purchased and managed successfully. A buyer who can visualize himself running the business is more apt to have a comfort level after interacting directly with the seller and developing a sense of rapport.

Buyers traditionally are significantly apprehensive about the challenges that they face in purchasing a business, and anything that you can do to help the buyer envision himself in your role increases the likelihood that he will have the courage to make a decision to submit an offer and close on your business.

The questions that you get from buyer interaction will also give you insight into how a buyer perceives your business and their concerns.

Seeing your business through the buyer’s eyes will help you in future discussions with prospects and recognizing (and hopefully doing something about) whatever problems or deficiencies are keeping buyers from seriously considering a purchase.

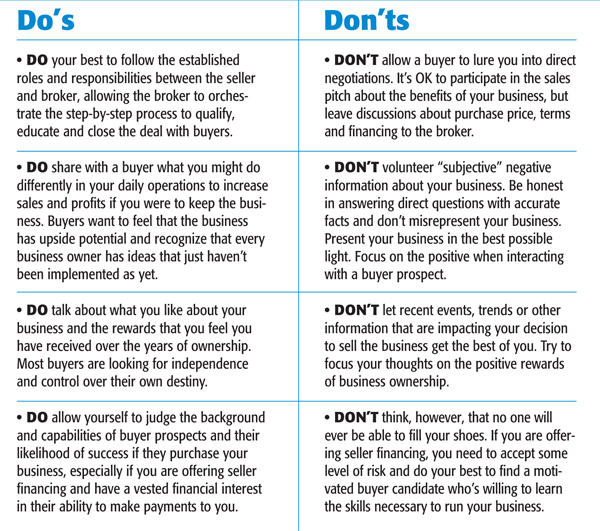

You and your broker should have defined roles and responsibilities in the sales process so that there are no misunderstandings and you work as a team. Here are a few suggested guidelines for the do’s and don’ts of communications with buyer prospects:

Mistake 7 … Failure to Recognize the Difference Between Serious Buyers and Tire Kickers

Did you know that only 2% of the people who inquire about businesses on the Internet “businesses for sale” sites will actually purchase one? The other 98% are suspects who lack the courage and conviction to follow through.

Many are searching for the illusory “perfect” business, while others expect the seller to finance the whole business, have other unrealistic expectations or trouble making a decision. Be wary of wasting time on those who aren’t serious about purchasing a business. It takes away valuable time from your interaction with those buyers who really do want to buy.

Many buyers exhibit a great deal of interest and submit a Letter of Intent or Offer to Purchase. Unfortunately, some buyers will then get cold feet and have second thoughts, or will let the smallest of obstacles stop them in their tracks.

DIY sellers can become time constrained in properly managing their business when their time is consumed by unqualified or less-than-serious buyer candidates. Buyers who are not pre-qualified and are not prepared to make an offer will not feel guilty about wasting your time.

A good business broker does not pre-judge a buyer prospect, but is skilled at discerning the serious buyers who are financially qualified to buy your business. It is important to focus time and energy on serious buyers, not tire kickers who are out to waste your time with “analysis paralysis,” finding things wrong with your business, and making low ball offers to test your desperation.

Mistake 8 … Failure to Keep Your Foot on the Gas During the Sales Process

It is a mistake to lose sight of what it takes to get to the finish line. Finding a buyer or even securing an Offer to Purchase does not mean that your business is sold. However tempting it may be to relax, a sudden fall in sales and profits, or a loss of key employees, might trigger a buyer to look for a way out of the deal or renegotiate price. Other deals fall through because of inability to secure financing, unforeseen environmental conditions, family or partnership disagreements with the buyer, or not getting approval from a franchisor.

The sales process can be a minefield beset with hidden problems. If you ever played Chutes & Ladders as a kid, you know what it’s like to go backward or start the game from the beginning. Losing a buyer when in sight of the closing table can happen with the roll of the dice.

What’s important is for you to remain focused on managing your business for maximum profitability and stability. Losing a serious buyer after you are already planning your post-closing trip around the world can be a gut-wrenching experience. Having to re-evaluate your Asking Price because profits have dropped in the meantime can be like rubbing salt in the wound.

Don’t make the mistake of taking your foot off the gas during the sales process. Even in good times, it can take a while to find the right buyer and navigate the complexities of getting to the closing table.

In the meantime, keep driving yourself and your business on a steady course, just as if you were keeping the business long term.

Mistake 9 … Failure to Consider How Your Business Sale Will Be Financed

Few buyers will be in a position to be able to pay cash for your business. In today’s business-for-sale marketplace, all cash sales are unrealistic, unless you are willing to make the Asking Price extremely attractive as compared to other available business opportunities. Today’s buyers are more likely to need help in securing third-party financing or rely on you for seller financing of 50-80% of the Asking Price.

It is important to consult with your accountant for tax advice on the implications of spreading the sales proceeds over a multi-year period.

A good business broker will have contacts with major national banks that finance business acquisitions and real estate under an SBA loan guarantee program. A broker who can get your business “pre-qualified” by a lending institution has provided your business with a sweet marketing advantage.

The key to pre-qualification and bank financing are tax returns and financials that  demonstrate the ability of the business to generate a cash flow that more than covers the debt service and leaves the buyer sufficient funds to provide reasonable compensation. Yes, the bank will take into consideration non-cash expenses like depreciation and amortization, as well as the seller’s current compensation and benefits. However, if you are planning to sell your business in the foreseeable future, don’t make the mistake of being greedy and loading up your tax return and P & L with so many personal expenses and perks that the business shows no profit or a big loss.

demonstrate the ability of the business to generate a cash flow that more than covers the debt service and leaves the buyer sufficient funds to provide reasonable compensation. Yes, the bank will take into consideration non-cash expenses like depreciation and amortization, as well as the seller’s current compensation and benefits. However, if you are planning to sell your business in the foreseeable future, don’t make the mistake of being greedy and loading up your tax return and P & L with so many personal expenses and perks that the business shows no profit or a big loss.

If your business doesn’t look good on paper, then it’s time to accept the reality of seller financing if you wish to get a fair price for your business. Keep in mind that even if the buyer has a significant amount of cash to invest, the buyer is more likely to leverage that cash and purchase a larger business with a higher cash flow or perhaps an automotive service enterprise with multiple locations.

Mistake 10 … Failure to Negotiate

Fishing for the right buyer can take time, even with the best of advertising and marketing materials to attract interest. With hard work and luck, serious buyers will find the bait and be lured into the opportunity.

Hopefully, multiple buyers will show an interest. You may receive more than one offer, significantly strengthening your negotiating position. Nonetheless, you need to be prepared to negotiate and listen to the advice of the professionals that you hired to provide guidance.

There may come a time when an offer comes in and you have to act on it. Procrastination or indecisiveness in accepting a reasonable offer or negotiating a compromise can be a mistake, as you risk losing a serious buyer.

Art Blumenthal Sales Tips

1. You can play a key role in instilling confidence in the buyer that the business can be purchased and managed successfully.

2. A good business broker does not pre-judge a buyer prospect, but is skilled at discerning the serious buyers who are financially qualified to buy your business.

3. A broker who can get your business “pre-qualified” by a lending institution has provided your business with a sweet marketing advantage that will attract buyers like bears to honey.

4. Be prepared to be flexible and available for serious buyers.

Leveraging more than 30 years of experience as both an aftermarket business owner and aftermarket technology executive, Art Blumenthal LLC provides business intermediary and advisory services to both buyers and sellers of industry businesses of all sizes. Art is a member of IBBA (International Business Brokers Association, Inc.). For more information, or to initiate a no-obligation confidential consultation, visit www.art-blumenthal.com