Tire dealers provided us with valuable information regarding their profit margins for tire service and tire sales, indicating which one generates higher profitability. You may be surprised, as our data found the segment of tire dealer sales with the highest profit margin has nothing to do with even selling tires.

Gross profit margin is an essential financial indicator that is calculated by subtracting the cost of goods sold, which includes direct expenses like manufacturing, wholesale prices, or supplier costs, from the total revenue.

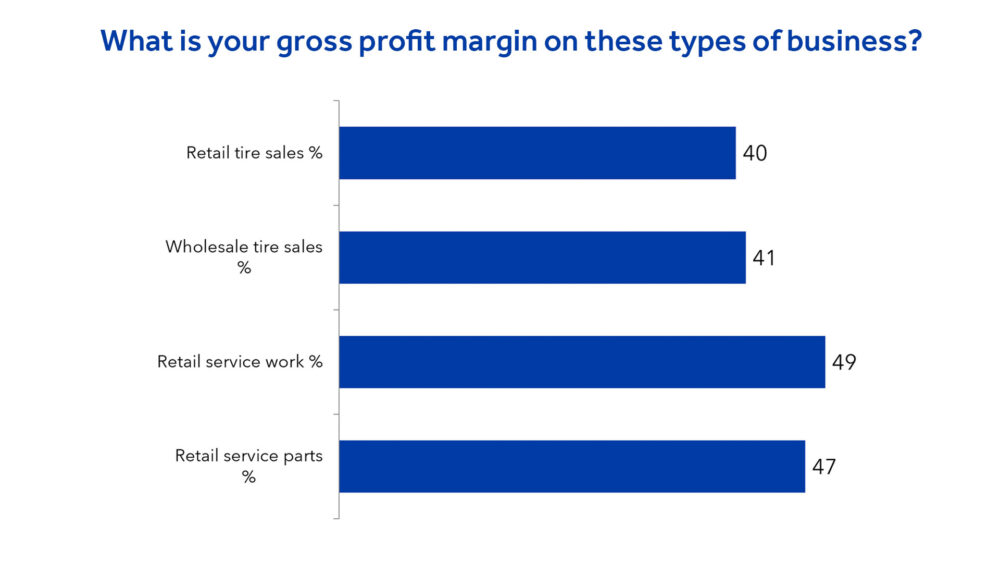

According to our data, tire dealers’ highest gross profit margins come from retail service work – a margin of 49%. Tire dealers’ second-highest gross profit margin comes from retail service parts at 47%. Meanwhile, wholesale tire sales and retail tire sales drop to 41 and 40% profit margins, respectively. That means that tire dealers see the most profit margins from retail tire service, not tire sales.

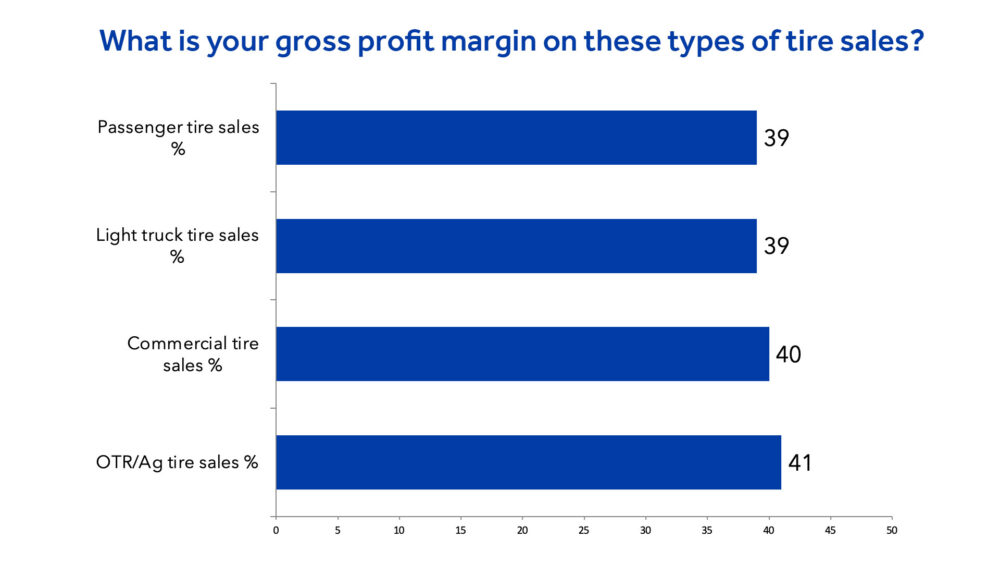

As for segment-specific tire sale margins, OTR/Ag sales boasted the highest profit margins at 41% among tire sales. This doesn’t come as a surprise, considering the specialized expertise required for the selection and fitting of OTR and Ag tires. Dealers with an understanding of this field can confidently offer solutions to cater to customers’ unique needs, justifying premium pricing for their knowledge and service.

There is essentially no distinction among respondents regarding specific types of tire sales and the corresponding profit margins. For example, commercial tire sales came in a close second at a 40% gross profit margin, while light truck and passenger tire sales each maintain a 39% profit margin.

Does this mean tire dealers should just say “sayonara” to tire sales completely? Not at all. Customers in the community still value an independent tire dealer’s work, and would rather come to you for their tire needs, including new equipment and service that comes with it.

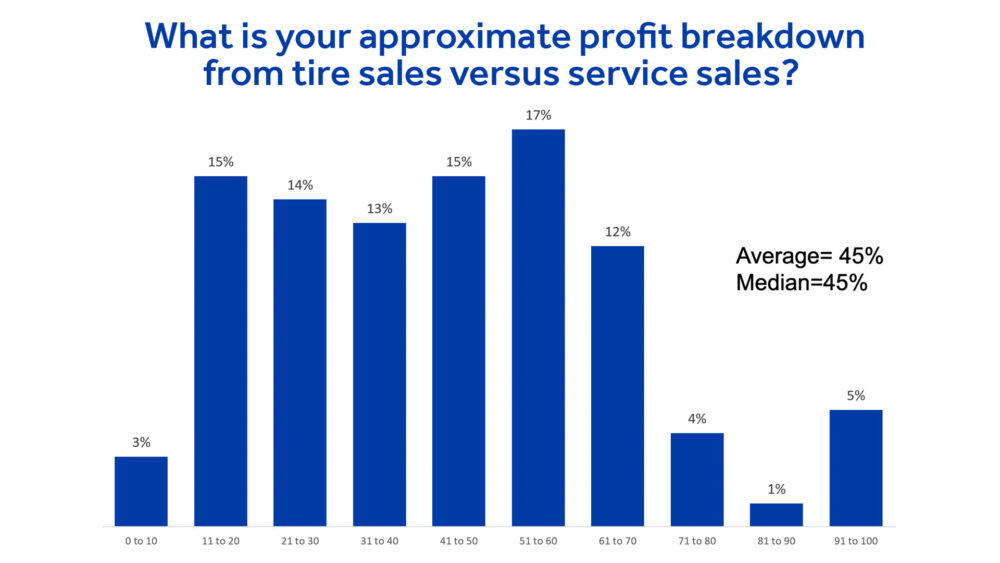

According to our data, our respondents say 45% of total profits come from tire sales on average. Still, though, 39% of respondents said anywhere between 51-100% of profits come from tire sales, showcasing the value communities place in your tire and service options.

Staying tuned to your profit margins is crucial for tire dealers to navigate the market successfully and find areas for growth or improvement. If you notice heavy profit margins with service work sales but see very low margins in tire sales, it may be time to rethink your selling strategy. Consider cross-selling services, like offering free tire service on a new set of tires, and analyze your pricing strategies, like how you bindle services and offers, to ensure you are getting the highest profit margins possible.

How are your tire sales profit margins looking? Let us know!

So, that’s today’s show, but for more business intelligence data to help boost tire dealer profitability, be sure to watch out for our next episode.