Here we are at the beginning of the year – how did the industry do last year? What might we expect in 2023? Short answer: Despite continued challenges and uncertainty, the industry has continued to adapt and perform robustly while driving activity has resumed in aggregate. In this article, I touch on a variety of topics spanning the aftermarket and the broader economy. To start, let’s look at total vehicle miles traveled (VMT).

VMT Trends

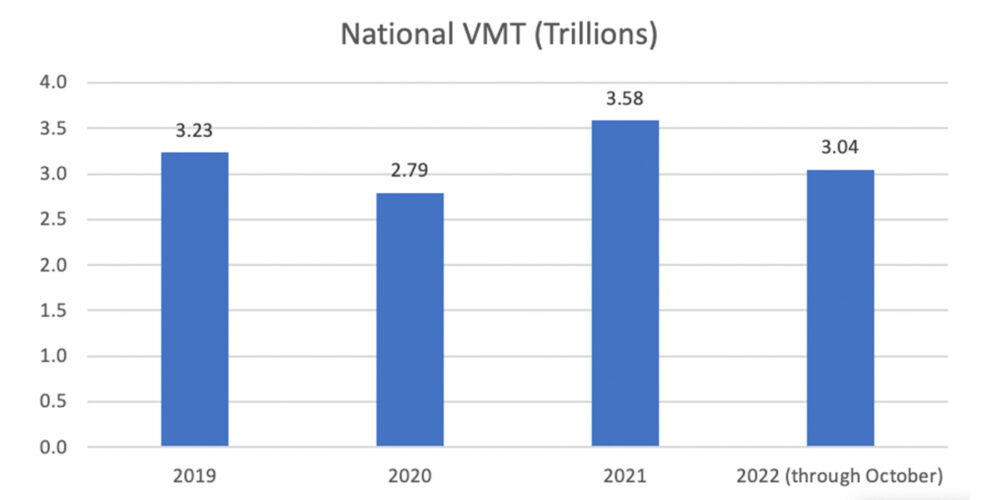

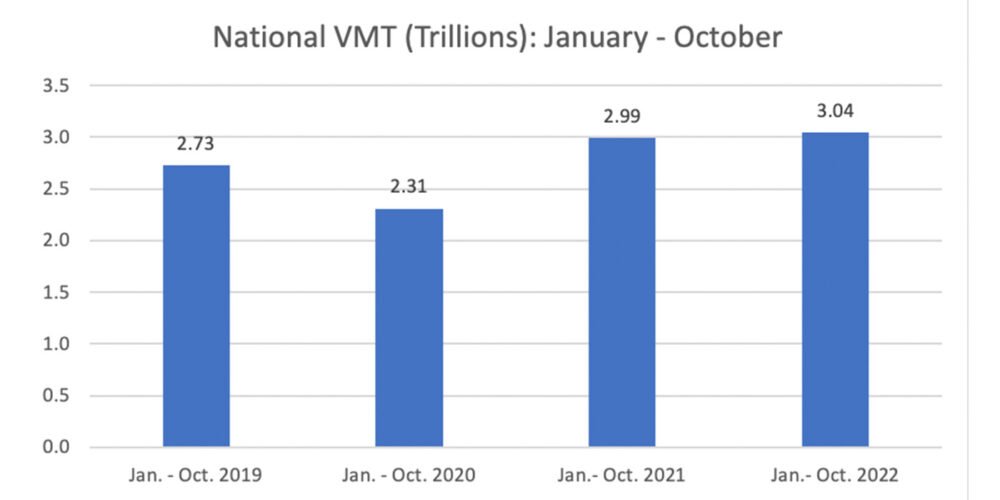

VMT for the first 10 months of 2022 has already surpassed VMT for the entire year of 2020 (Chart 1). When we compare the first 10 months of 2022 to the same periods for the previous years, we see that VMT has exceeded pre-pandemic levels (Chart 2).

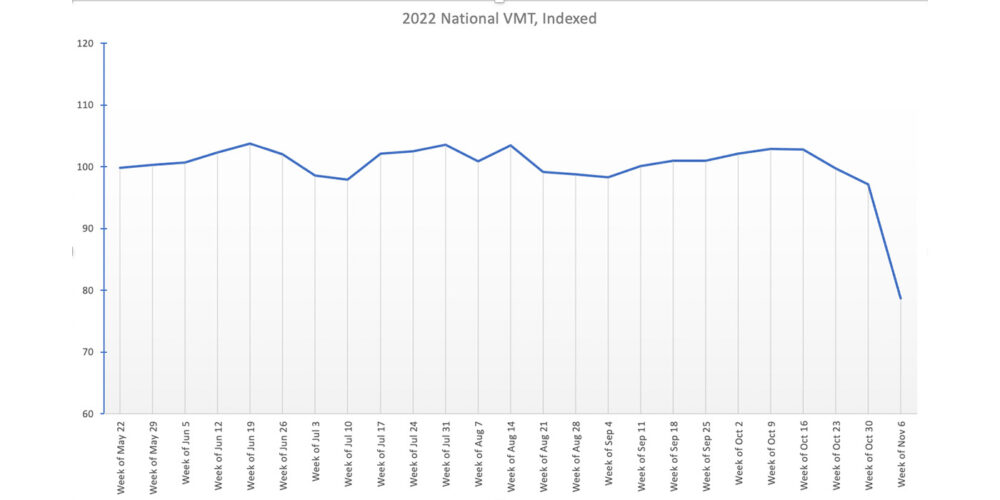

Since Memorial Day weekend, VMT has been fairly steady across the country, with the only significant drop occurring during the week of November 6, likely due to Hurricane Nicole and Veteran’s Day (Chart 3).

This bodes well for tire replacement and service, particularly given the regular intervals associated with maintenance and replacement.

Consumer Considerations

Are consumers ready, willing and able to pay for their tire needs? In 2021, we saw several instances of increased consumer liquidity (and by extension, disposable income) as the federal government distributed stimulus checks. This year has seen high inflation and concerns of a recession. While there is a movement toward student loan forgiveness, legal challenges have arisen, suggesting that relief is not imminent. Consumer confidence dropped throughout the year as the war in Ukraine dragged on and as inflation persisted, even while unemployment remained low.

Consumer confidence and the capacity to take on more debt, as measured by consumer loans via credit cards and revolving plans, (i.e., does not include mortgages or car loans) suggests that consumers are not in a good state of mind or finances to absorb more debt.

According to Morning Consult, the percentage of Americans planning to buy a vehicle was lower as of May: 9.6% for new, 5.7% for used. With the average age of vehicles continuing to climb (12.1 years as of January 1, 2022, based on S&P Global Mobility data), the decreased appetite for new vehicle purchases bodes well for the aftermarket in general. Vehicle owners are likely to purchase new tires if the need is urgent – say, a flat tire that cannot be repaired. Given the stretched wallets of many consumers – gas, food, other day-to-day necessities – it stands to reason that many vehicle owners will delay tire replacement a bit.

Steadily Rising Cost of Business

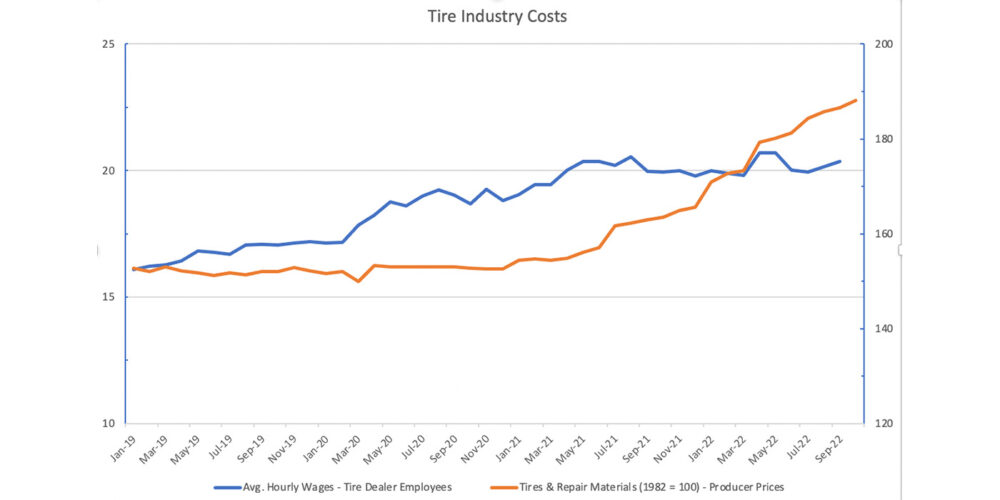

Inflation hasn’t just hit the consumer – it is more expensive to do business as well. Chart 4 tracks the producer price of tire and repair materials alongside average hourly wages for tire dealer employees.

Wage rates have not risen at the same rate as materials – with a competitive employment market and workers demanding higher wages in response to inflation and a tight labor market, it becomes a challenge to raise prices to absorb additional costs – will customers be willing to pay higher costs? Not only are consumers stretched thin, but the service market is also competitive, and driving habits have changed since the onset of the pandemic.

Impacts on Tires – Office Occupancy

Remote work continues to impact the automotive aftermarket. Kastle reports that as of Nov. 9, average office occupancy across 10 major U.S. cities was at 47.5%. It has been a very gradual climb to this figure since the onset of COVID-19 in early 2020.

As people continue to work remotely, let’s look at another consideration that can impact the demand for tire maintenance and replacement – driving habits.

Impact on Tires – Driving Behavior

Fewer drivers commuting to the office could imply less congestion. Less congestion can lead to higher travel speeds and less hard braking. Telematics provider Arity noted a year ago, “During 2020, data showed drivers spending a good amount of time driving faster than 80 miles an hour. In 2021, speeds are still up compared to 2019, but not as high for as long.” Depending where you are, you may see different demand patterns from your customers. For example, some of your customers’ trips may have evolved to be mixed purpose, occur at different times of day and on different days of the week, be longer in duration, and be characterized by higher speeds and less frequent braking. Other customers may be commuting during the same times as before the pandemic but experiencing different traffic conditions and wear patterns on their tires and brakes.

And, with the change in driving patterns and purposes, there is the possibility that consumers are thinking of an electric vehicle (EV) for their car.

Impacts on Tires – EV Adoption

The high instant torque of EVs is associated with faster wear and tear of tires. Electric vehicles have gained traction in recent years (see what I did there?), with the adoption of alternative powertrain vehicles (this includes battery electric, hybrid electric, plug-in hybrid electric and fuel cell) rising to 9.4% in 2021, after an incremental increase from 2.9% in 2016 to 5.4% in 2020, according to the Auto Care Association’s 2023 Factbook, based on S&P Global Mobility data.

The recent “Joint EV Trends and Outlook Forecast” produced by Auto Care Association and Automotive Aftermarket Suppliers Association (AASA) notes that, “Current estimates show EVs reaching approximately 30% of new car sales in the U.S. by 2030 –a number that is expected to increase rapidly thereafter,” according to lead author Strategy &. As more drivers move to EVs, the potential for increased maintenance/replacement frequency, as well as new tire development appears to be promising.

Industry Performance and Outlook

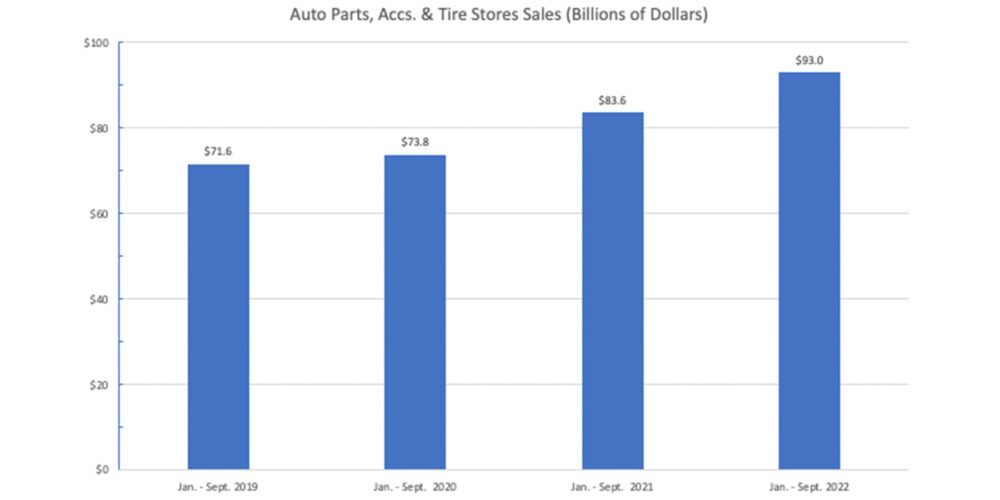

Overall, the automotive aftermarket continues to perform well. Chart 5 on pg. 18 illustrates the sales at automotive, accessory and tire stores for the first nine months of each year from 2019 to 2022. While inflation has certainly impacted retail prices, it is encouraging that the incremental sales from 2021 to 2022 exceeded 10%, and sales continue to exceed pre-pandemic levels.

Earlier this year, S&P Global forecasted aftermarket growth for light vehicles to grow by 8.5% in 2022. This follows 14.8% growth in 2021. While we still have some time to round out the year, it is encouraging to see retail sales performing well as market conditions stabilize.

That said, uncertainties still abound – “supply chain” is still a major headline, although perhaps not as dominant as it was earlier in the year. Data suggest that supply chain challenges have abated somewhat. The Federal Reserve of New York introduced the Global Supply Chain Pressure Index (GSCPI), which is a metric that incorporates global transportation costs, air freight costs, supply chain-related components from the Purchasing Managers’ Index and other data points to measure the state of the global supply chain.

We are a long way off from the massive supply chain headaches we had a year ago when the GSCPI was more than four standard deviations higher than normal. To put this in perspective – the average height of an American adult male is 5 feet, 10-in. with a standard deviation of 3.15-in. Someone who is four standard deviations above normal is nearly 6-foot-11 – in the last quarter of 2021, it was like being surrounded by men who were nearly seven feet tall!

To be sure, supply chain challenges continue to persist, and we don’t know what we might see in the news, but the stabilization of contributing factors like freight rates and materials availability should smooth out some of the uncertainties and challenges that the automotive aftermarket has weathered over the past several years.