Despite all the uncertainty throughout the year, 2023 turned out to be fairly steady for the automotive aftermarket as marked by steady retail growth and stable vehicle miles traveled (VMT). While there has been a considerable amount of variation (inflation, interest rates) in the broader economy, the pendulum seems to have stabilized a bit as the industry has adjusted to the uncertainties of the pandemic and supply chain challenges over the past few years.

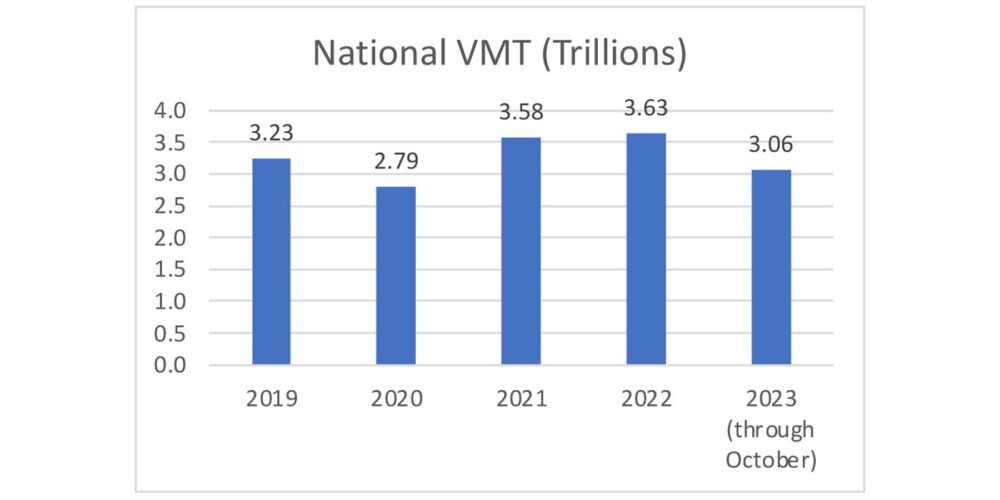

Let’s look at a few different topics spanning the aftermarket and broader economy, starting with the tried-and-true leading indicator of vehicle maintenance and aftermarket spend, total VMT.

VMT Trends

VMT for the first 10 months of 2023 nearly matches the same period for 2022 (Chart 1). We can reasonably expect total VMT for 2023 to slightly exceed that of 2022 (Chart 2).

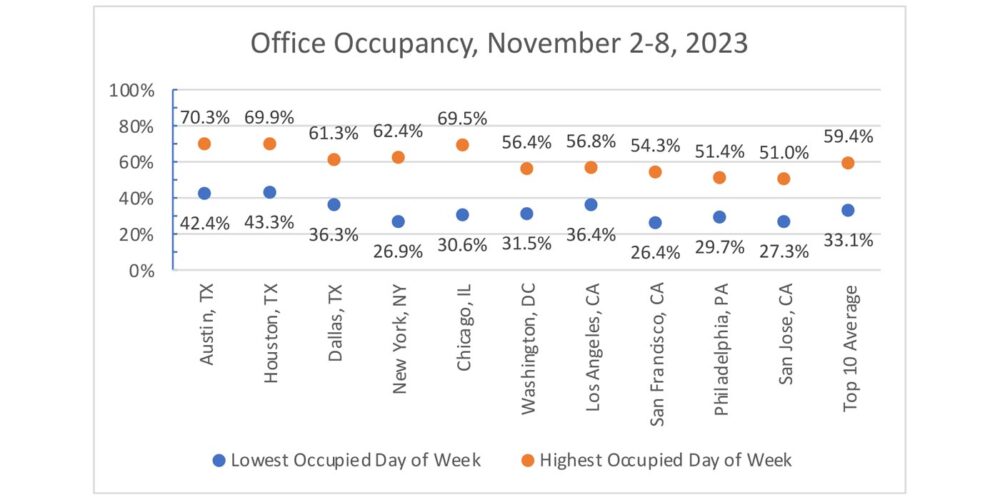

Interestingly, and likely relatedly, the percentage of office employees working remotely has stayed remarkably stable over the past year. According to Kastle, average office occupancy across 10 major U.S. cities was at 50.5% as of November 8.

This bodes well for tire replacement and service, particularly given the regular intervals associated with maintenance and replacement. When we look at overall retail performance, the storyline remains consistent – retail aftermarket spend has kept pace with driving habits.

Industry Performance and Outlook

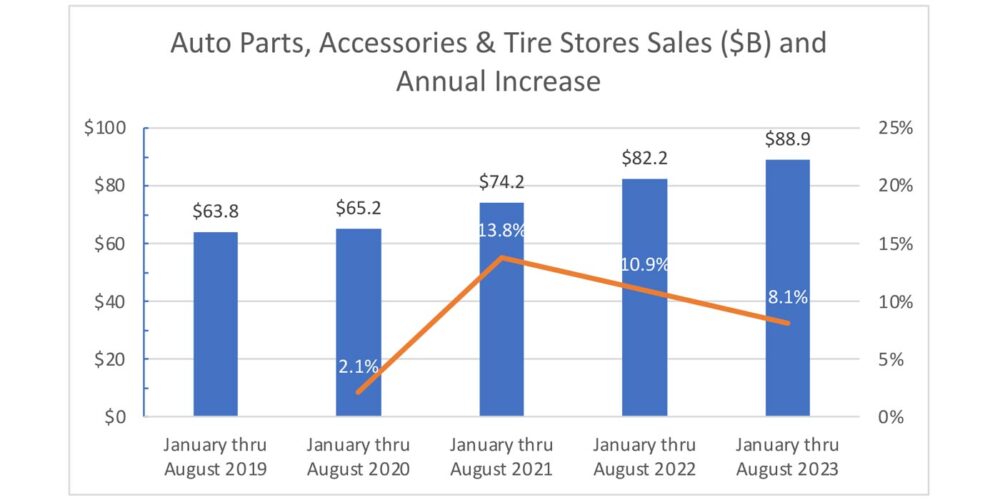

Retail sales in the automotive aftermarket continue to climb. Chart 4 below illustrates the sales at automotive, accessory, and tire stores for the first eight months of each year from 2019 to 2023.

As with last year, inflation has contributed to retail prices. Despite that, sales from 2022 to 2023 increased by more than 8%, higher than the average inflation rate throughout 2023.

In this year’s Joint Channel Forecast Model, published in June 2023 as part of the Auto Care Factbook, S&P Global forecasted aftermarket growth for light vehicles to grow by 8.1% in 2023 after 9.7% growth in 2022. As with last year, retail sales of aftermarket parts and accessories continue to show promise for a strong year. Now, let’s look at consumer sentiment to gauge potential future spend.

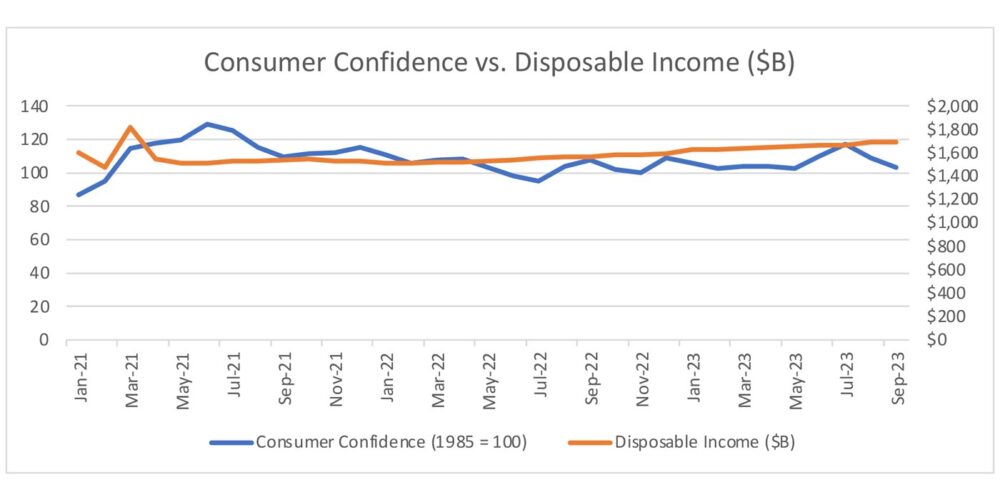

Consumer Considerations

Consumer confidence and disposable income have stayed fairly flat throughout the past year, although inflation has both dampened confidence and impacted consumers’ real purchasing power. Recently, consumers have expressed concerns of staples: food and grocery items, as well as gas and fuel (more commentary available in the October 2023 University of Michigan’s “surveys of consumers” series here). As these products apply to all consumer groups, reduced aftermarket spend and/or delayed maintenance are certainly possible.

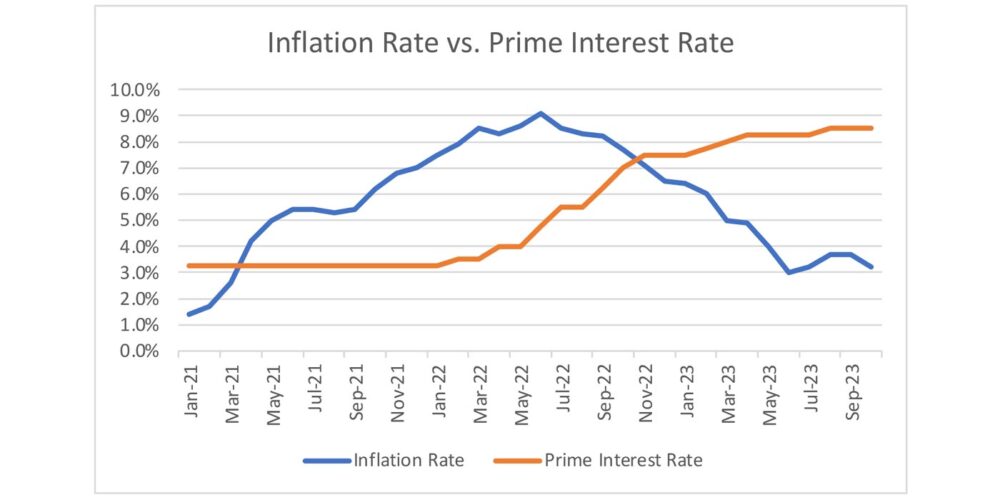

As illustrated nearby, inflation peaked at 9.1% in June 2022 but has since receded to 3.2% in October 2023, largely due to the Federal Reserve’s actions to increase interest rates – the prime interest rate is 8.5% as of October 2023. This has been a double-edged sword of sorts – with mortgage rates at their highest since the early 2000s, homeowners are less likely to sell their homes and first-time homebuyers are more likely to sit on the sidelines. Black Knight reports that home affordability is at a 39-year low and purchase-mortgage applications are at their weakest levels since interest rates started rising. As a result, some would-be homebuyers are spending less on real estate and more on investments and experiences, as reported in The Wall Street Journal.

Will they spend on their vehicles? Perhaps. As reported in the Factbook, the value of DIFM delayed maintenance increased from 2021 to 2022 by 30%. The time frame for that delayed service or repair reduced from 2021 (71.6% within 3 months) to 2022 (76.3% within three months, mostly within one month) so we will see if the trend changes for 2023.

Rising EV Adoption Appears Promising for the Tire Industry

Alternative powertrain vehicles (i.e., battery electric, hybrid electric, plug-in hybrid electric, and fuel cell) continued their ascent in 2022, accounting for 12.7% of new vehicle registrations in the United States, up from 9.6% in 2022 (Auto Care Association 2024 Factbook, based on S&P Global Mobility data). With average mileage of a little more than 12,000 miles per year, demand for tires will continue to grow as adoption increases.

This year’s update to the “Joint EV Trends and Outlook Forecast” produced by Auto Care Association and MEMA reported that more than one-third (35%) of U.S. light vehicle sales in 2030 are expected to be BEVs – based on registration of 16.1 million new vehicles, this translates to 5.6 million new vehicles. BEV penetration of the overall car parc is forecasted at 10% in 2030 before growing to 47% in 2045, when 86% of new U.S. light vehicles are forecast to be BEVs.

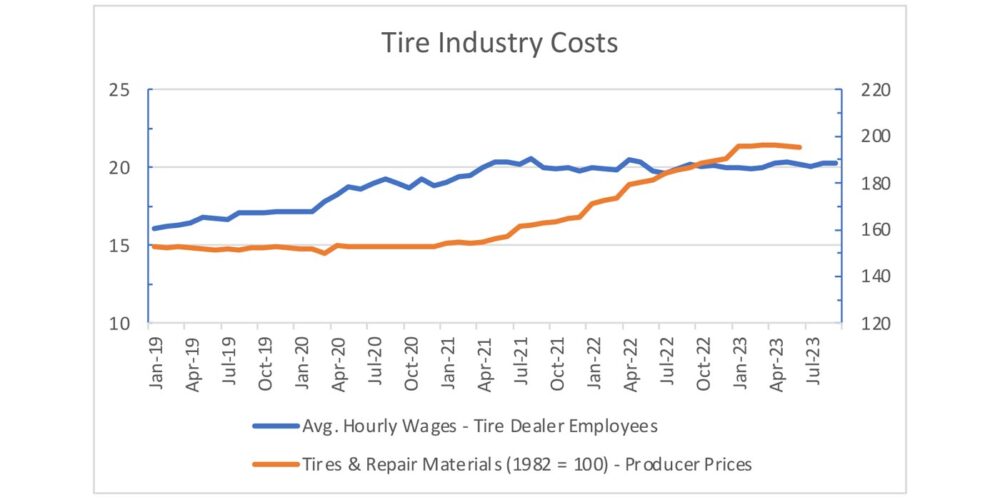

Steadily Increasing Materials Prices

The cost of doing business has increased for the tire industry. As charted below in Chart 7, the producer price of tire and repair materials (orange) has risen considerably over the past two years. Tire store managers appear to be holding labor costs flat (blue), though, to the detriment of customers and employees given the high inflation mentioned earlier

Industry Response

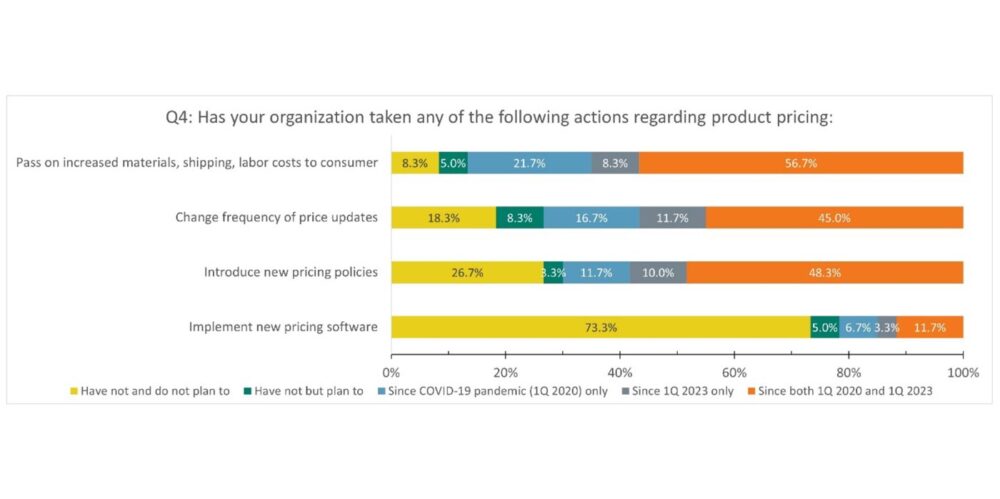

So, how have companies across the industry dealt with high inflation and interest rates this year? Based on a survey of Auto Care Association members, aftermarket companies have generally passed on higher materials, shipping and labor costs to their customers:

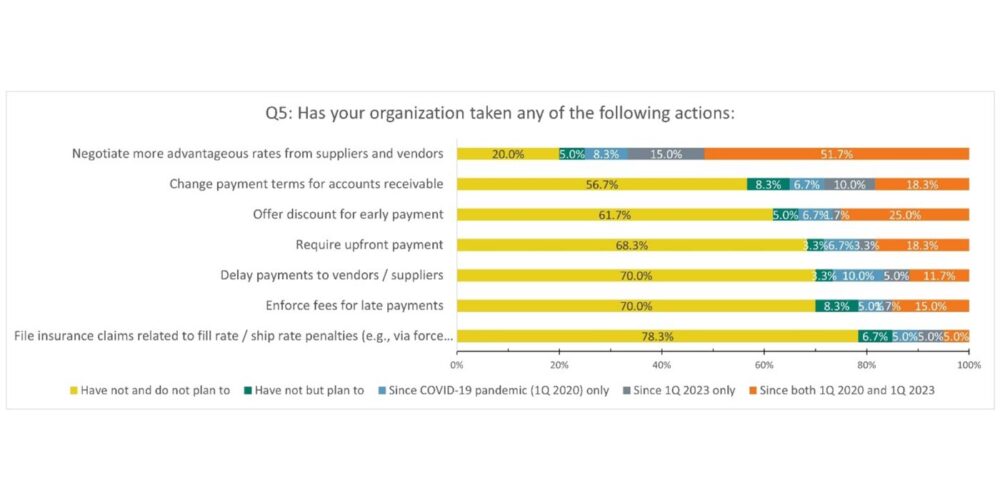

Not surprisingly, companies were most likely to negotiate with suppliers and vendors for more favorable rates, as well as incentivize early payment and modify payment terms:

Other tactics that companies have taken are to diversify supply sources, invest in facility space, review inventory levels more frequently, and increase inventory of critical final products. Check out additional stats here.

Mike Chung is senior director, market intelligence at Auto Care Association. With more than a dozen years of experience in market research, Chung provides the industry with timely information on key factors and trends influencing the health of the automotive aftermarket to help businesses throughout the supply chain make better business decisions. He can be reached at [email protected].