The spread of COVID-19 in 2020 will suppress mobility and economic activity as well as change the landscapes for industry and transportation. The pandemic has affected the global economy, collapsing vehicle and equipment production sales, usage, as well as tire production and trade.

As financial reports are released by tiremakers, the following trends are emerging and will have an impact on the industry for the next several years:

- The industry is experiencing its largest volume declines in decades and conditions have been characterized as “exceptionally soft.”

- Recovery is expected to be slow with lagging global resolution to the virus.

- The weakened economy, lack of consumer confidence and high global unemployment rates have resulted in a plunge in auto sales and aftermarket tire sales.

- In the supply chain, consumption of tire materials has dropped in line with tire manufacturing, creating declining prices for natural and synthetic rubber and other key commodities.

- R&D budgets and investments in new technologies are being curtailed to shore up other critical business functions.

- Changing consumer patterns, such as working from home and e-commerce, are likely to have a lasting effect on tire industry practices.

- Industry production levels will be impacted for the long-term with implications for global supply chains.

Global Tires Market

In late 2019, Smithers published the Future of Global Tires to 2024 report, which sized the tire market at over 2.36 billion units in 2019, with topline volume growth expected to continue at a 3.1% compound annual rate from 2019 through 2024. In 2024, total global industry tire volume was expected to reach 2.75 billion units. The 2019 market value of $239 billion was expected rise to $280 billion in 2024, for a 3.2% compound annual growth rate. Considering the impact of COVID-19 on the global tires market, Smithers sees little recovery in 2020-2021, with real recovery starting in 2022 and 2019 tire volume not being reached again until 2023.

As part of its Global Tires report refresh that accounts for the impact of COVID-19 on the industry, Smithers estimates volume growth over the next couple of years will fall significantly with market conditions prolonging the status quo in technology. The market adjustment will slow the adoption of electric vehicles and delay ride sharing, as well as drive supply chain consolidation and other disruptions.

Signs of Recovery in Asia

Asia was the first economy to emerge from the shutdown related to the coronavirus. Despite short-term setbacks, ongoing industrialization and economic expansion is increasing personal income levels in Asia, which has led to higher motor vehicle ownership. This trend is creating dynamic opportunities for tire sales in the market as detailed in The Future of Tire in Asia to 2025 market report from Smithers.

Three of the world’s four largest tire markets are located in Asia: China, India and Japan. These three markets make up 70% of the 2020 Asia tire market, which is estimated at 1.3 billion tires at a value of U.S. $97.4 billion.

As a result of increased vehicle ownership rates, the tire replacement market in Asia will continue to grow. Over the forecast period of this report, Asia will be responsible for over two-thirds of global tire demand gains. Although COVID-19 will significantly impact 2020 tire sales, the tire market in Asia is forecast to pick up and grow on average by 3.6% until 2025.

The Asia tire market is highly diverse, with a dominance of passenger car and light goods vehicle tires. Significant markets are also present for medium- and heavy-duty trucks, buses and specialty applications such as motorcycles, OTR equipment and aviation tires.

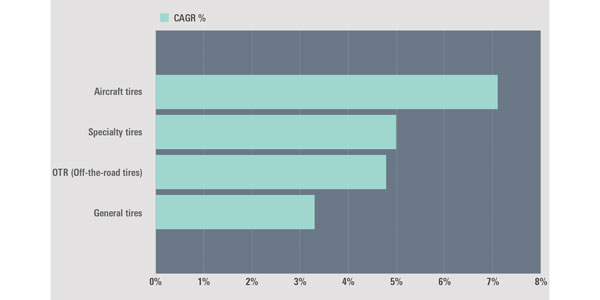

General tires will continue to make up the majority (84.2% share) of the total Asia tires market by 2025, but significant stronger growth is forecasted in aircraft, specialty and OTR tires (see Figure E.2).

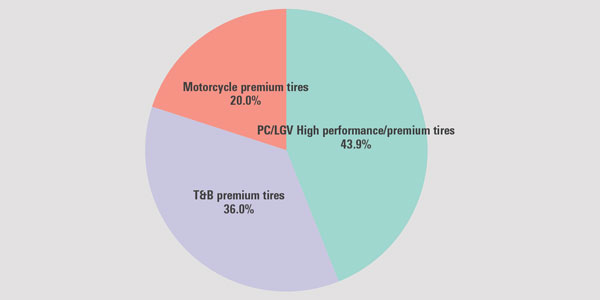

The high-performance passenger car/light goods vehicle segment is the largest in volume and value for specialty tires and is growing rapidly, driven by the growth of CUV, SUV and pickup truck segments in Asia. Trucks and buses face somewhat more subdued dynamics, where the drivers are more related to fuel efficiency. This is forecast to still be the case by 2025 (see Figure E.4). The premium motorcycle tires market shows the highest growth rate, both in value (6.8% CAGR) and volume (6.0% CAGR) among specialty tires for 2020–2025. The premium motorcycle tires market is still at an early stage in Asia, where the main use of these vehicles is commuting.

Tire and Transportation Technology

Current tire technology in China is focused on low rolling resistance (LRR) tires, driven by pressure from the government to reduce CO2 emissions and the establishment of the China Rubber Industry Association (CRIA) tire labeling system. In addition, exporting tire manufacturers must meet the tire labeling requirements of their export markets. There is also an increased focus on R&D for tires adapted to electric and autonomous vehicles.

China is, and will continue to be, the biggest EV market, and its progress in the segment will influence the rest of the world. This is due to government policies designed to reduce pollution in cities and dependence on imported oil. The government also desires to dominate this growth industry. In Asia, the electric bus market is expected to be dominated by China and India in size and to be predominantly BEVs (Battery Electric Vehicles). Japan and South Korea will also invest significantly in electric buses, as will the Southeast Asia region led by Singapore.

Janine Young is a commissioning editor for Smithers’ reports and consultancy business which publishes market research on key market segments, including tires, non-tire rubber, elastomers and plastics, among others. She is editor of the Smithers Report, a subscription news service that focuses on tire and rubber market trends and technology. A career B2B communications professional with a specialization in the automotive and tire industries, Janine has developed her industry expertise through positions in trade journalism, corporate communications and public relations.