Odd that it takes the judicial system to unlock the deepest of facts. Or at least recollections.

When it comes to corporate goings on, so much is done behind the scenes that what you see ultimately is not what you get. Last week, testimony in Cooper Tire & Rubber Co.’s suit against Apollo Tyre pulled back the curtain, giving one and all an inside look at a deal that started unraveling even as it was being announced.

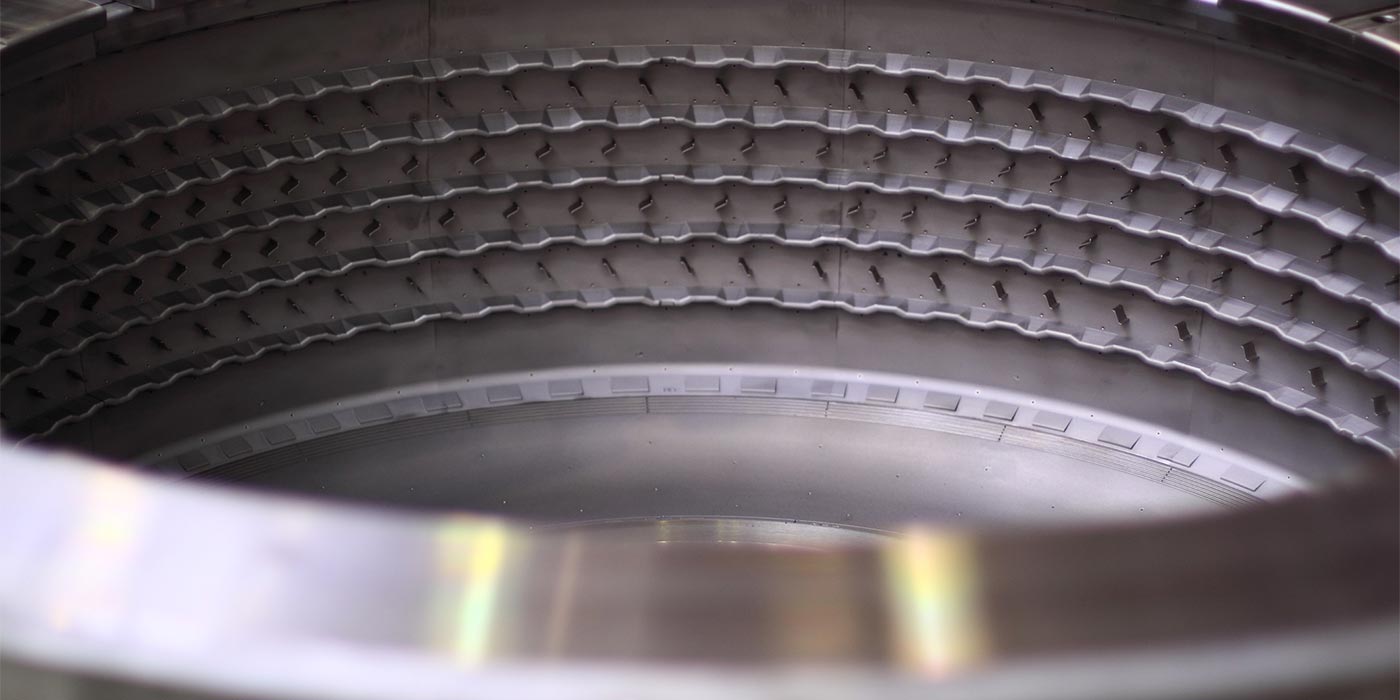

The Financial Times reported today that events were apparently set in motion more than a month before Apollo announced its $2.5 billion play for all of Cooper on June 12. According to FT, Apollo vice chairman and managing director Neeraj Kanwar met Che Hongzhi, a former Chinese government official who is not chairman of Chengshan Group, the 35% shareholder in Cooper Chengshan Tire Co. in Rongcheng City, Shandong Province. The plant, built in 1976 and refurbished since, turns out at least 35,000 tires per day; for Cooper it is a key source of consumer and medium truck tires and a large part of its overall business.

According to FT, the younger Kanwar testified that Che (as he likes to be called) “kept saying, ‘I’ve been a good son and the father is good. Now the father is divorcing me and the stepfather is coming in.’ He was trying to say something to us that we really didn’t understand.’”

That May 15 meeting in Beijing left Kanwar puzzled, he said.

A communications and interpretation problem, indeed, it turned out as Che, described by FT as fiery and bitter, felt jilted enough to order his 5,000 employees to strike the plant in a very public display. Later, Che and company pushed out Cooper officials, stopped producing any Cooper-related tires, and has withheld financial data required to consummate any sale. Informed reports say that Cooper officials haven’t been in the China plant since August.

Turns out, as we learned from last week’s testimony, Apollo went back to meet Che and offered some $170 million for his share of the joint venture plant, Che, who stood to gain nary a dime in the acquisition deal, stood firm at wanting a now reported $400 million. When it seemed he would get nary a dime, Che pulled the trigger on the strike and held the plant hostage.

Read the entire FT story here.

Meanwhile, Apollo’s approach to negotiating a successorship contract with the USW was apparently also misinterpreted. When it came to those required talks, “While the Americans prioritized speed and protection of shareholder value, the Indians focused on building strong relationships,” FT reported. Apollo came without concrete proposals on pensions, job security or any issue. In his testimony last week, Kanwar “indignantly insisted that he had used the meeting to learn more from Stan Johnson, the USW’s negotiator, about the union’s demands.

‘We wanted to understand his perspective on how we were going to deal with this issue. The meeting agenda was about relationship building.’”

He insists that was misread as “foot-dragging,” a claim Cooper made in its Oct. 4 suit to force closing on the sale deal.

As of the very moment I am writing this blog post, Judge Sam Glasscock III has yet to issue the rest of his ruling on the case. Last Friday, Glasscock ruled that Apollo did not breach terms of its $2.5 billion deal to buy Cooper, and rejected Cooper’s “buyer’s remorse” claims and insistence that Apollo was dragging its feet on closing the deal.

It appears Judge Glasscock won’t finish his ruling until Wednesday this week at the earliest, and a trip to the Delaware Supreme Court will probably be the next step; someone is bound to appeal, right?

Meanwhile, an investment expert friend of mine said it would take a miracle for Cooper to pull together all of the required financial and compliance reports necessary to complete the acquisition deal before Glasscock rules, let alone meet its obligations to issue a full and complete third quarter financial report. Cooper has until Nov. 14 to provide its third quarter data to the Securities and Exchange Commission.

This deal is far from over, some experts suggest. It may not be with the original line-up, certainly not for the original $35 per share. If a deal doesn’t get done, it will be interesting to see what happens to all of the key players. Unhappy shareholders – especially those being denied huge paydays – tend to punish those who failed to deliver. And two major tire companies’ futures hang in the balance.