At this year’s Point S Annual Meeting, tire dealers walked into the meeting room to Kanye West’s “All of the Lights” blasting over the loudspeakers. It didn’t take long to discover how fitting the song choice was, as Point S executives shared some of the ways the company shined brightest in 2023, such as a record amount of store additions, new marketing initiatives and member incentives.

Point S has remained consistent throughout the years and hasn’t shown signs of letting short-term success stop it from growing. But, how does the company plan to follow up a record year in 2023?

To find out, Walter Lybeck, Point S CEO and Clint Young, Point S president and COO, gave Tire Review some insight into the company’s goals this year to learn more about what the company is doing behind the scenes to help its dealer base see all of the lights in 2024 and beyond.

Christian Hinton, Tire Review Associate Editor: Point S introduced the goal of having 500 stores in 50 states within 5 years at last year’s conference. How is that going?

Walter Lybeck: We added 69 locations last year, bringing the total number to 336 stores across 31 different states. We had 275 total stores the year, although the math is a little weird because we have members come and go. The 500 stores in 50 states within 5 years plan is an extension of the strategy that we set in place. We’ve always had growth as a strategy. It’s a basic strategy, but Clint and I and our management team worked with our board the summer before developing a profound growth plan, which involved a lot of the components of 500, 50, 5, which then evolved into that initiative. It was intentional that we were going to grow fast, but we knew we needed to grow faster, we knew we needed to be bigger. We built it on purpose that way.

Last year, you spoke with Tire Review about All-Trac online scheduling and digital inspections. How has the integration of this technology worked over the past year? What has the dealer adoption and feedback been like?

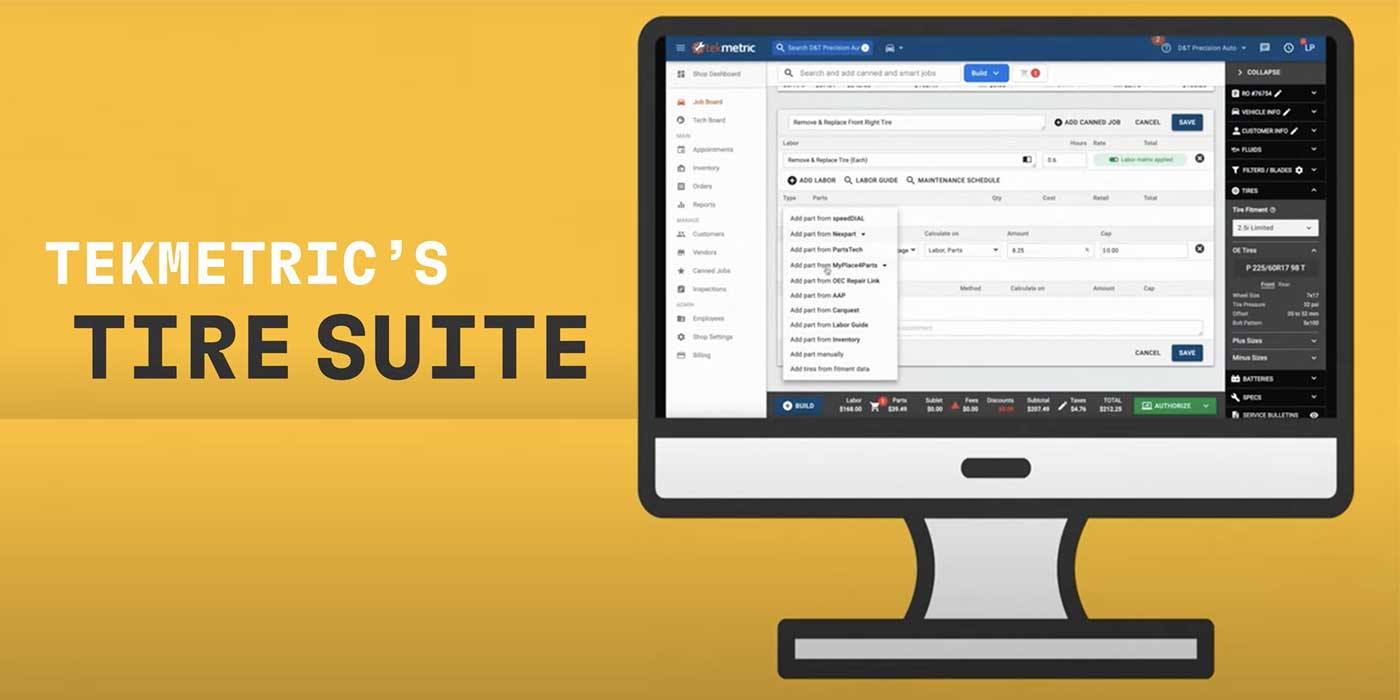

Clint Young: There are several pillars to your question there. Not only are we releasing a new website, but our All-Trac program benefits our membership, t all are different services. If we’re talking about digital inspections, that is an element of our All-Trac program – adoption’s been great since last year. It does bolt onto our POS system and about half of our members have our POS system. I think we have reached a ceiling with adoption there. Because the IT team’s been focused on our website development, we haven’t furthered the development of the POS connection and that’s probably something that’ll come in the future.

Why do only half of your members use the POS system? Do you want more members using it?

Clint Young: Yes and no. We work with independents, so they come to us with already-established systems in place a lot of the time. If they have a POS system that they might have paid to run for five years, we might not get an opportunity to integrate that for a little while. But, we are working and looking at connections to other POS systems.

Walter Lybeck: I would add that point-of-sale systems are a different flavor, meaning they’re all a little different. Every point-of-sale system has different advantages and disadvantages. Our point-of-sale system is very affordable, well-rounded and easy to use, but other programs might focus on other areas and be stronger in those that may cater to some of our independents more. We would never force a dealer into a system. Neither would we force a dealer into a business model that matched that system.

Clint, during this year’s Point S annual meeting you introduced the new style and branding guide for 2024, which includes a competition to encourage dealers to improve the look and branding of their stores. What other initiatives are available to dealers to improve staff, technology or training?

Clint Young: One new off the top of my head is that we have a new training platform called Today’s Class. It’s not new for us to have a platform like that; we’ve had a training platform for the past seven years, but it wasn’t industry-focused. This platform is specifically tire-industry focused. It has ASE-certified training, all kinds of inspection training and is technician and sales counter-focused. It gives the owner the ability to push and monitor technician training.

Walter Lybeck: Today’s Class is not a proprietary software. We pay for it on behalf of the members to ensure that they have access to it. There are certain things we feel are required. For example, we started putting digital TVs into stores and providing the content that goes on them. Those are all remote-controlled. We want our showrooms to feel modern. Then you’ve got digital inspections, online appointments and selling on the web – and we want to provide great service with all of these things. If we believe it’s critical to an organization, we’re going to do our best to fund it.

What are some challenges or threats that have emerged for independent tire dealers over the past year?

Walter Lybeck: One of the first concerns that I can think of is low-rolling resistance initiatives from some states. Washington and California already have some bills introduced, and I’m sure Oregon will follow. This is all new, so I haven’t checked on other states yet. A bill like House Bill 2262 in Washington State requires extremely low rolling resistance as part of the tire manufacturing requirement, which could completely disrupt the options available to consumers, especially as it relates to price point tires because tires that meet low rolling resistance qualifications are also way more expensive. I’m very concerned from a consumer perspective and from a supply perspective at this point. Bills like this potentially will have a massive impact and, while I think it’s based on good intentions, there’s also a total lack of understanding of the customer base.

Clint Young: Walter’s kind of looking over the hill, and I’m kind of looking more internally in my role. Our threats are everyday business threats, but something we’re focused on right now is keeping stores connected to us, even as store owners start to get close to retirement. So, we stay connected to second- and third generations if it’s there. If it’s not, we make ourselves relevant to that owner so that if they get to a point where they do want to sell, we have an opportunity to retain that store in the group. We pay out a pretty nice little fee if a store owner is looking at selling and they get us involved in the conversation and we retain that store.

What about EVs? How has Point S been approaching that space?

Walter Lybeck: If I talked in more depth about EVs during the conference, you would have seen people shaking their heads and the same amount of people nodding. But, you have to talk about it because it’s everywhere and it’s a legitimate trend. It’s happening. Our strategy is to make sure that our members have everything they need. Sometimes members don’t know what they need until they need it and we have to be ready to supply that. It’s not an environmental play, it’s an efficiency and dollar play for us. When it comes to EV tires, seeing that they are produced at a much greater level than even a year ago, we will have to stock enough EV inventory to meet our customer needs in all our major warehouses.

Clint Young: I think the other element to that is our level of communication with the membership. There’s a lot of head-scratching when you talk about EVs. People are worried that they don’t know how to address this need and don’t know exactly where it’s going. A lot of that is still on the drawing board for regions and states across the country, so we’ll have to be ahead of that and make sure that we’re helping our members.

What are Point S’s top goals and priorities for 2024?

Clint Young: Our goal is not to get distracted. We’re going to stay on the path that we are on which will probably require some additional staffing so that we can continue to reach out to new markets. We are very decentralized in how we have staff deployed in all of our different markets. We don’t all have an office out of our headquarters. We have salespeople that are on the West Coast, some of them in the mid-south, and we have a small sales team, so we want growth in that regard.

Walter Lybeck: I love the word focus. I’d say that’s our strategy this year. We’ve got a great website, the digital inspection tools and the All-Trac system. Now we need to create the depth and the connections to all the different platforms like Today’s Class, then integrate that into our system and look at the tools that are great for independents that we can use collectively to get better rates – essentially co-op with better software. I’m excited about the opportunities to refocus on the inside part of our organization this year.