The tire industry is more competitive than ever, with independent dealers facing challenges from big chains, box stores and online sellers. But who do tire dealers see as their toughest competition, and how is the landscape changing?

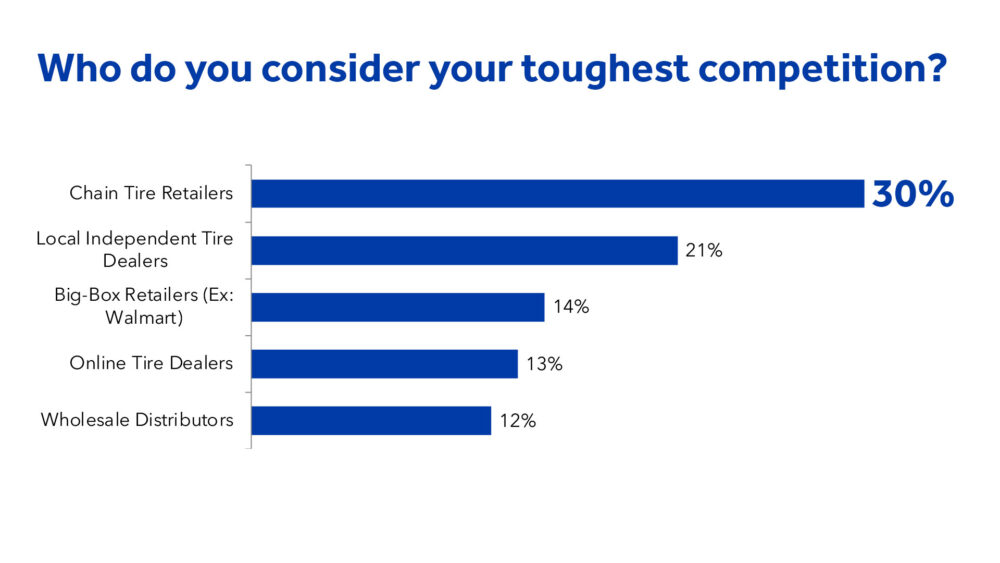

When asked who their toughest competitor is, 30% of independent tire dealers pointed to national tire retail chains, followed by other local independent dealers at 21%. Dealers are also feeling competition from big box retailers, with 14% citing them as the top competitor. Online tire retailers and wholesale distributors took 13% and 12% of votes, respectively.

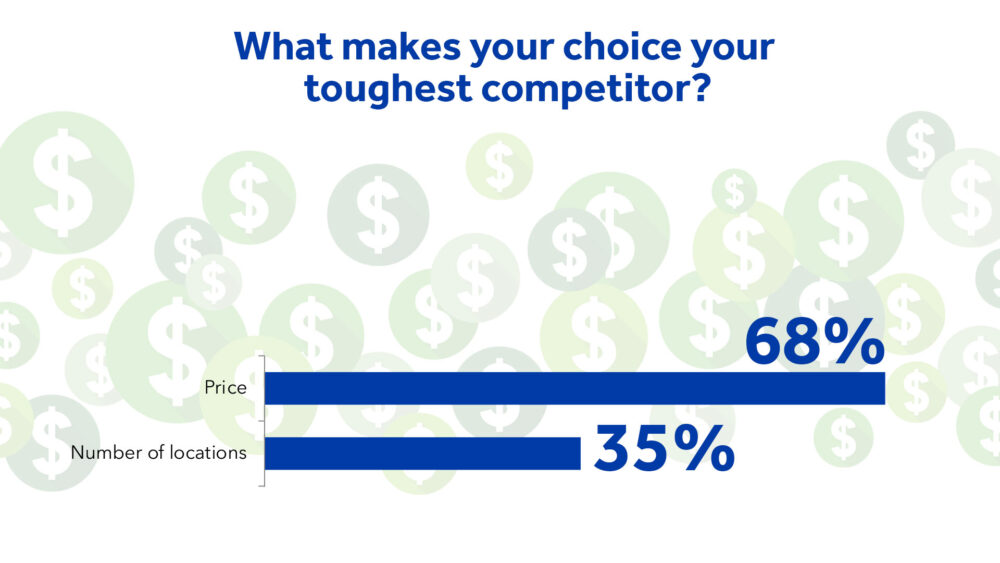

It’s no surprise the big chains are seen as the top threat – with hundreds of locations and deep pockets. But what makes these competitors so tough? The number one factor cited in our data was lower pricing, with 68% of respondents saying as much. Meanwhile, 35% say the fact that big chains have a large number of locations affects competition. Because of their inventory volume and amount of locations, chain retailers often can leverage that to offer reduced prices that independents struggle to match.

Other advantages of the bigger chains and competition, in general, are bigger marketing budgets and convenience factors.

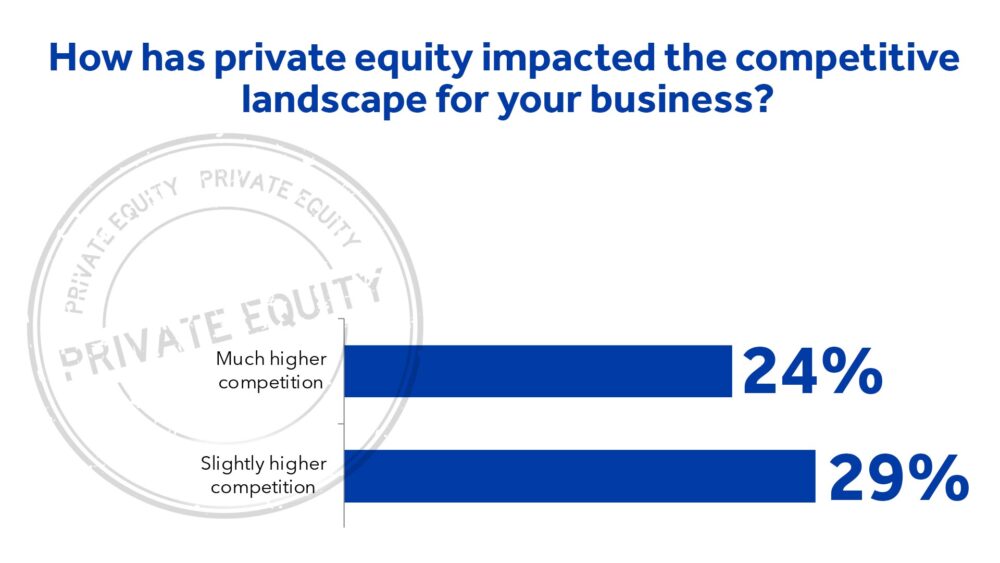

We also asked dealers how competition has changed with the rise of private equity investment in retail chains. Private equity firms consolidate chains under holding companies and provide capital to expand through acquisitions and new store openings. 24% of our respondents said private equity is driving much higher competition, while 29% said it’s moderately increased competition. This data tells us that over half of respondents say private equity investment has intensified competition by enabling retail chains to rapidly expand and modernize stores in ways most independent dealers can’t afford.

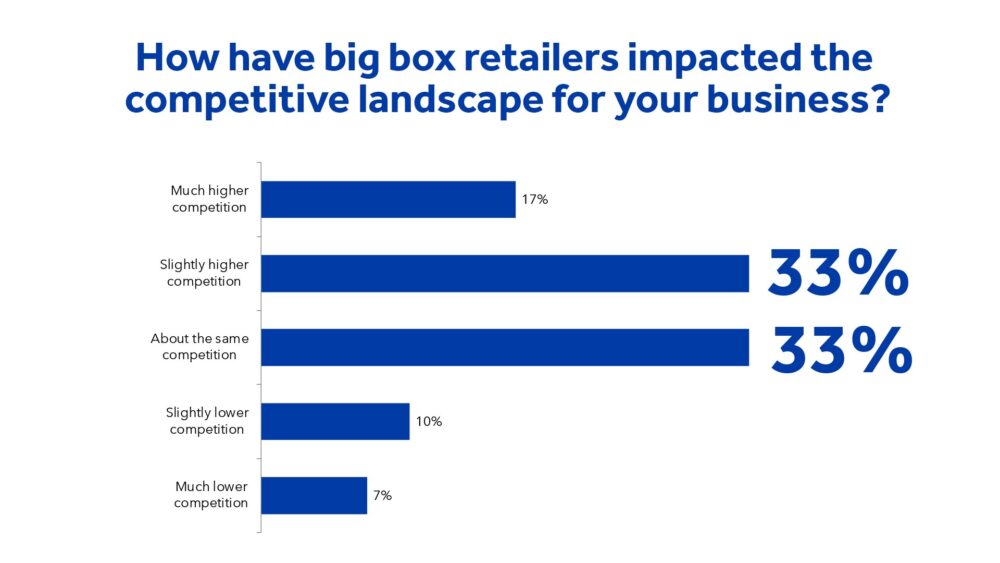

Finally, we looked at the impact of competition from big box retailers. 33% of respondents said big box retailers have only moderately increased competition and 33% said competition stayed the same. Meanwhile, 17% of dealers say big box retailers have increased competition substantially. Our data also showed that 50% of independent tire dealers estimate having one to four big box stores within 10 miles of their location. Additionally, 41% of respondents have to contend with five to ten stores in close proximity, meaning tire buyers have more options – potentially limiting revenue for independent retailers.

Due to all the options your customers have, you need to differentiate yourself. While the competitive environment is demanding, fear not independent dealers – you still maintain key advantages like your local expertise and longstanding community ties. However, understanding the competition will allow independents to tailor offerings and demonstrate their unique value to the community.

Take Tire Review’s 2022 Top Shop winner, Telle Tire & Auto Service, for example. What does Telle, an independent tire dealer, attribute its success over competition to? Continuous training and education for techs, a marketing strategy that builds brand consistency for all locations and providing excellent customer service – meaning clean lobbies, loaner cars, and technicians that treat customers like family.

Tire industry competition continues to get fierce…how are you dealing with the competitive pressures in your market?