If a business owner could get a crystal clear picture of the future, it certainly would make things much easier.

While that likely will never be possible, tire dealers are fortunate to have access to many pieces that, when put together, can offer a detailed patchwork of what’s coming down the road, so to speak.

From aftermarket and economic trends to commercial shipping numbers, many factors impact the tire industry. Perhaps the most direct indicators when it comes to the vehicles that will need service – and tires – in the next few years are the new and used car markets.

For this section of the State of the Industry, National Automobile Dealers Association (NADA) chief economist Steven Szakaly offers insight regarding the cars, pickups and SUV/CUVs that will be rolling into your service bays through 2019.

Vehicle Sales Forecast

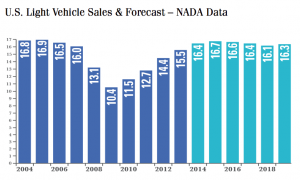

Since 2009, sales of new light vehicles (which NADA defines as Classes 1 through 4) have been on a steep upward climb, from a Great Recession low of 10.4 million units in 2009 to 15.5 million in 2013.

The forecast for this year is even higher – 16.4 million units – and that level is expected to hold relatively steady through 2019, according to Szakaly (see accompanying chart for more details).

“We’re effectively forecasting a return to 16 million units, which has been the ‘holy grail’ of the growth level,” he says, adding, “A sales figure of 16 million is back to pre-recession levels.”

Even with a slight dip projected for 2018 (to 16.1 million units), Szakaly says sales growth is still very strong.

“We had pent-up demand during the recession,” he adds. “There were a lot of people who delayed vehicle purchases, who extended the life of their cars, and who are now coming back into the market because they’ve paid down their debt, their houses are worth something again, and the employment situation has improved. In short, people are starting to think about making these larger purchases.”

Another factor driving increased vehicle sales is that the U.S. still has “net positive household formation,” meaning the population is growing. “Though it’s slower than it has been historically, our households are growing and that, of course, means those people will eventually need cars to drive,” Szakaly notes.

Trends by Segment

Because these new vehicles will eventually end up at your shop for service and tires, it’s important to keep tabs on sales trends by segment and brand.

With recent gasoline prices remaining somewhat stable – and more affordable – than a few years ago, Americans are trending back toward larger vehicles, according to Szakaly, who adds, “prices are still high compared to what they were before the recession, but we’re not seeing spikes and uncertainty in the market.”

With level prices, it’s easier for drivers to plan on stable operating costs for their vehicles. “That certainly drives demand for SUVs,” he explains. “We’re also going to see a lot of growth in pickups – we already have this year – which is related to the positive housing market and construction outlook.”

Regarding vehicles by manufacturer, expect domestic brands to continue to make up the majority of customer vehicles needing service. According to NADA data, the highest average new vehicle marketshares during the last 10 years (through 2013) were General Motors (22.3%), Ford (16.6%) and Chrysler (11.8%). The highest import brand was Toyota, at 14.7% (see accompanying chart for more details).

Impact of Used Vehicles

Though new vehicle sales are up, the used vehicle market is expected to strengthen as well, according to Szakaly.

“I expect used vehicle sales to be up, but pricing will actually soften in the used vehicle market because we’re going to see a lot more inventory start to roll in,” he explains. “Because of the low number of new car sales years we had in 2009-12, the supply of used vehicles has been very constrained. The last few years we haven’t had quite the number of used cars in the market that we normally would.”

Szakaly estimates used vehicle prices will soften beginning in late 2015 and heading into 2016.

Increased used vehicle sales, in addition to the average age of vehicles on the road (roughly 11 years), are currently at an all-time high, which means added service work for tire dealers.

“In all likelihood, a four-year-old used vehicle still has seven years more life left in it,” Szakaly says. “People are holding onto these cars, which means they’re going to need more maintenance and more tires. And while cars themselves are lasting longer because the quality is up, people are still going to need tires.”

Other Factors

Over the next few years, while the rate of increase may be slower, the age and mileage of vehicles on the road will continue to climb, Szakaly says, adding, “as we see interest rates rise and new vehicles become more difficult to afford as loan terms stretch out, the average vehicle age will keep going up. Extended loan terms mean people will take longer to cycle in and out of the market.”

These higher interest rates – which Szakaly predicts will begin to climb during the second quarter of 2015 and add a full percentage point throughout the course of that year – could have a large effect on new vehicle sales, pricing and affordability in general.

“Most vehicles are financed whether new or used, and it’s a very large purchase so those finance terms are important,” he explains. “We’re basically at the lowest point for interest – zero, essentially – and we’ve been there since 2008-09, so there’s nowhere to go but up.

Generally speaking, the next several years look to be favorable for consumers and businesses. “The general economic trends are good,” Szakaly adds. “Certainly we’re seeing overall improvement and I think we’ll continue to see growth in the economy.”

If you’re reading this, that means your tire dealership has weathered the storm of the recession – which is no small feat. As you work to either regain lost ground or keep the added profits you’ve managed to attain, keep tabs on industry forecasts in order to stay ahead of the curve.

For more details on the new and used vehicle market, as well as automobile dealership trends, visit nada.org.