One of the words often used in the tire industry is “tier.” Companies and product lines are often categorized as Tier One, Tier Two, Tier Three, etc. in conversation. The concept has historically helped to describe where different tire brands might fall across a broad marketplace spectrum. But when you dig further into what determines a brand by tier ranking, you find conflicting criteria. In fact, we found no standardized industry definition of what a tier actually is nor consistent, universally accepted details on what a specific tier ranking might take into account. This means that depending on who you’re talking to and what motivates them, different criteria might be used in the assessment of whether or not a brand is Tier One, Two, Three or Four.

Needless to say, the lack of a consistent definition and agreed-upon criteria is concerning for something so widely used as an industry qualifier.

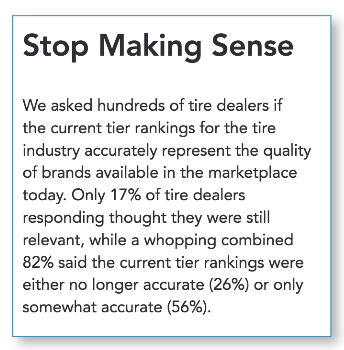

With the lack of clarity regarding this oft-used industry concept, Tire Review surveyed those from across the industry on the topic of tiers. How do they define a tier? Are they relevant? Does the concept even make sense in today’s competitive marketplace? Should it be based on a historic view or on who’s bigger globally, or should it be based on the quality of the overall offering, or the ability to deliver within specific product categories? What about dealer programs and warranties? What about OE?

The article that follows explores the concept of tiers from different perspectives across the industry, including the results of an independent survey on the topic.

See the results: Where did the tire brands you carry stack up? Take a look!

A Historical Approach

While the definition of tier may vary from one person to the next, the concept is useful when it comes to making sense of the variety of offerings within the replacement tire space. For tire dealers, understanding where a tire brand falls within the spectrum can help support product mix, positioning and sales strategy, especially as it pertains to good-better-best decisions. For tiremakers, it serves as a type of benchmark against which they might compare themselves to others. For brands newer to the North American marketplace, go-to-market goals are often driven by the tier concept — those that view their product as Tier Three push to be considered Tier Two. Others focus on being the very best within in their current tier to more fully “bloom where they’re planted,” embracing their current market position and building their business around it.

Throughout 2018, we interviewed veterans across the tire industry, including company presidents, brand managers and marketing/sales leaders within the manufacturing space, asking their opinion: “How do you define the tiers, and how do you determine which brands fall into each?” It was interesting to see how widely their responses varied. While most agree on the qualities of a Tier One tiremaker with some clarity, the rules that separate a brand within Tiers Two, Three and Four begin to blur.

In speaking with industry leaders, Tier One is most often defined as brands with the largest market share, the largest global footprint, that can sell for the highest price and spends the most in consumer advertising for high awareness. In other words, they’re the names that are top of mind when you ask the average U.S. consumer to name a tire company. While a brand’s level of OE penetration might also be part of that criteria, the influx of non-Tier-One brands scoring OE contracts made that less of a factor. Other Tier One considerations include market coverage and depth of product line (including types of products and sizes available).

When talking about the criteria to support a Tier Two brand as compared to a Tier Three, the consensus seems to be that they have many of but not all of the qualities of a Tier One brand. For instance, they may offer great quality in some but not all product categories, lack certain dealer programs or may not have the same level of brand recognition of those few top-tier tiremakers.

Tier Three versus Tier Four descriptions also varied. Some described Tier Four brands as value-priced, ordered by the container load, often imported from China/Asia and typically fall outside traditional regional distribution.

The most concise definition on tiers came from Tarang Srivastava, general manager of CEAT Specialty Tires, an emerging agricultural tire brand in the United States based in India. Consultants engaged with the global tiremaker delved into the concept of tiers to support the overall positioning strategy as CEAT entered the North American marketplace.

“When we were looking at establishing our business, we were looking at this question in the U.S. market as well as the European market. We had some of the big consulting companies work on it, so they [provided their version of] a tier system,” explains Srivastava of CEAT. “Tier One is like Bridgestone and Michelin, based on big brands, big price and big presence. The bottom tier, the third tier, is no brand, a rock bottom price and no support—basically just [sold on] price. Then the middle tier is the value tier, which has very good value from a quality point of view, very good pricing, warranty support and some brand visibility.”

But for some leaders in the mid-spectrum, the idea of tiers is interesting yet irrelevant to what they do. One North America president and CEO of a Tier Two brand (who asked not to be named) rejected the concept of tiers entirely, instead encouraging his team to focus on developing the very best products in the markets they serve to focus on the customer instead of the competition. While they continue to work on growing their brand’s market coverage, distribution and household name recognition, he places equal importance on their efforts to stay top of mind for the niche/enthusiast markets they serve.

Shades of Grey

With slow year-over-year growth in the replacement tire market and more global brands seeking a foothold in North America, the fastest way to grow market share for those in Tier Two and Tier Three is to steal it from somebody else.

Rick Brennan of Sumitomo Rubber North America’s Falken Tire division once described the battle for share and unit sales in the middle tier as a “bloodbath” as brands fight it out for unit sales and awareness. Even the smallest percentage of gain is viewed as a big win, especially as global brands are growing their investment in U.S. manufacturing and developing products uniquely designed for North American consumers.

Regarding brand strategy within Tier Two, one long-time tire industry veteran with deep roots in product, sales and marketing leadership explained that when you dissect the tire marketplace, there are four common factors or themes that can help shift brands higher or lower within the middle tiers.

“I would look at the Tier One companies, and I would say ‘how am I going to move the brand up?’ What are the common themes between those at the top?’” the industry veteran said. “Like others, I often describe it as four legs to a chair – marketing (spending as much as possible to build brand awareness), logistics (the ability to produce product), OE (which carries with it a certain R&D aspect that moves the product development forward) and finally its dealer support, which equates to the ease of doing business. In my experience, it’s that ease-of-doing-business leg that is the most dysfunctional part within the market. Even the Tier One companies are working hard to improve on this, so no one is getting all four right. But I know that we need to do our best to make improvements below the line because as a Tier Two, we can’t compete above the line. It’s too easy for them to outspend us.”

When brands based in South Korea, Japan, India, China and other parts of the globe were faced with the challenges of building a reputation in the U.S. market, one strategy that appears to be working is this – make better tires.

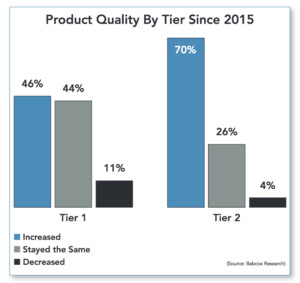

The 2018 Tire Review Tier Study found that 70% of dealers surveyed believed the quality of Tier Two brands has increased over the past three years, while just 46% said Tier One brand quality has increased. With that, 4% said Tier Two products had decreased in quality as compared to 11% perceiving a decrease in the quality of Tier One product. Forty-four percent said the quality of Tier One had stayed the same in those same three years.

As many brands in the middle have made focused efforts to increase the quality or their products to stay competitive, Kenda Tire is among those to leverage the strategy as a point of differentiation.

“Tier One, as I see it, are the brands that are OE brands that have at least 5% market share, or closer to 10% in replacement market share,” explains Brandon Stotsenburg, vice president of automotive products at America Kenda Rubber. “The Tier Two are lower level aftermarket share brands that are also OE but are essentially the second brand within those Tier One brands, like Firestone, BFGoodrich and those companies, plus Pirelli and Hankook. Then it shades [into grey areas] relative to Tier Two. In the lower level of Tier Two, you have brands that are OE brands for those times the OEs are going for value, like Kumho, General, etc.,…so if you’re not in OE, you’re either Tier Three or Tier Four. But from a performance perspective and how products actually perform, it breaks out differently. There are definitely brands that have a higher level of performance, and the aftermarket channels recognize that and can reflect that back, like in light truck and CUV categories. Dealers and consumers will definitely see different performance characteristics with some of those brands. From my perspective, when I tell you that Kenda across all of its products offers a Tier One performance level at a Tier Three value price, it’s reflecting that second definition.”

He adds that with the strong research and development – including extensive comparative product testing – he’s confident in Kenda’s quality-at-a-value positioning to be a strong differentiator for the brand.

Indeed, Tire Review research conducted by the Babcox Research team shows that Tier Two brands have shown strong gains in perceived quality in the past three years.

CEAT’s Srivastava confirmed the findings of our survey with their own internal research: “When we blocked out all of the companies, and we looked at the trend over the past 20 years, Tier Two (or the middle tier) has expanded at the cost of Tier One and Tier Three. And that is where we want to be. We know we are competitively priced. We cannot be, from day one, a Bridgestone. At the same time, you want brand recognition. You want to support your product with a warranty, with technical support and you want to build a world-class product. So that is where we are and that is the segment that is growing fastest, even at the cost of Tier One.”

At the same time, Tier Three and some in Tier Four have U.S. teams hard at work to introduce and enhance their brands and overall product offering as more competitive. Andrew Hoit, vice president of sales and marketing with Tireco, producers of Milestar, Nankang and Westlake brands, has spent the past two years executing a clear strategy for growing the market positioning of the Tireco products in the United States. Hoit, along with James Yim of marketing agency Garbage Dream, have built a solid foundation with the goal of solidifying Tireco brands’ place as the best of the Tier Three options. Efforts include creating new websites, developing social media strategies to include a lifestyle blog and creating polished point-of-sale materials for dealers while expanding the depth and breadth of the product offering.

With the variety of ways to determine tiers, some in the industry simply default to price as the main criteria.

“Part of it is price driven,” says Tireco’s Hoit. “I have always defaulted to tiering by market price because that is the most black-and-white definition that you have.”

For dealers that sell on price as the number-one factor in securing the sale, having a number of quality “value brands” in the product mix is increasingly important to their business.

When asked where Kumho fits in the market, Shawn Denlein, executive vice president of sales and marketing for Kumho Tire USA, sees the brand as a lower Tier Two.

“I think the market understands tiers, but the dealer uses it differently,” says Denlein. “The market understands it as whether it’s an entry-level or a high-value brand of tire, or maybe it’s a brand that I’ve heard of but I’m not as familiar with, or it’s a household brand. But it’s so debatable. Everybody has a different approach.”

When it comes to how the tire tiers should be structured – by overall brand or by individual product category, Tireco’s Hoit agrees about the topic being a good one for discussion.

“It would be extremely fun to get a bunch of people in a room to debate this,” says Hoit when asked about whether tiers should be based on overall brand or by product category. “If you look at it like that from a product perspective, you can use Milestar as an example. We’re pegged into a Tier Three brand, but not based on performance or quality. It’s the same thing you can say about the Nokian line. Nokian, from a quality standpoint, they build an outstanding product. We sell them on our wholesale side, and we know the quality. But the brand isn’t well recognized in the U.S. so they need to buy and build that brand awareness.”

Wes Boling is the marketing communications manager with Nokian Tyres. He says that the focus should be based on providing dealers with quality products that perform well, so they can build relationships and loyalty with their customers in return, and not on the “rat race” of rankings.

“With all respect to any other company out there, I think it is easy to get caught up in the rat race of have rankings or maybe subjective classifications,” Boling says. “But ultimately those things aren’t always speaking to the quality of the driver experience and to the service that we’re providing dealers. It’s easy to get lost in some of those other things and forget that what we’re really trying to do here.”

He said that while the concept of tiers is a good one, it comes down to helping dealers make money selling tires – tires that perform well and make the customer happy.

The increasing quality and value of Tier Two and Tier Three products is expected to place even more pressure on Tier One brands. While some industry veterans point to history and global reach, tire dealers share a different view on how the tire tiers should be defined.

A New Look at Tier Criteria

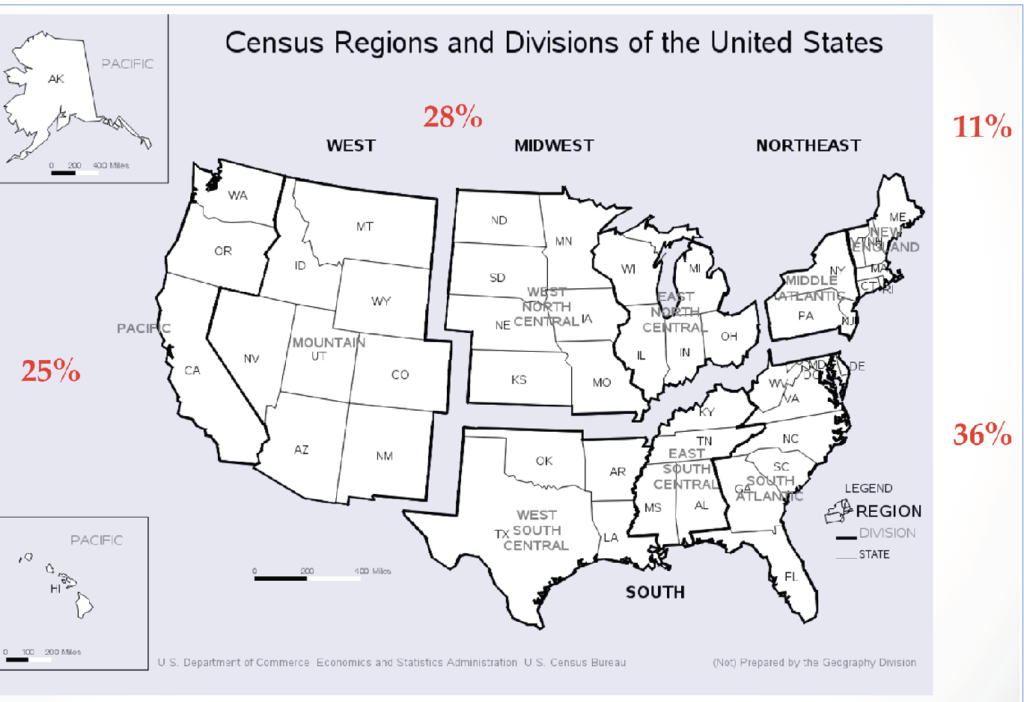

With so much diversity of opinion and a lack of a uniform definition, we took the question of tire tier criteria to independent tire dealers across the United States. Considering the fact that more than 60% of all replacement tires are sold to consumers through independently owned tire businesses, we were curious as to how tire dealers would define the tier spectrum, especially based on their expertise and critical role within the replacement tire marketplace.

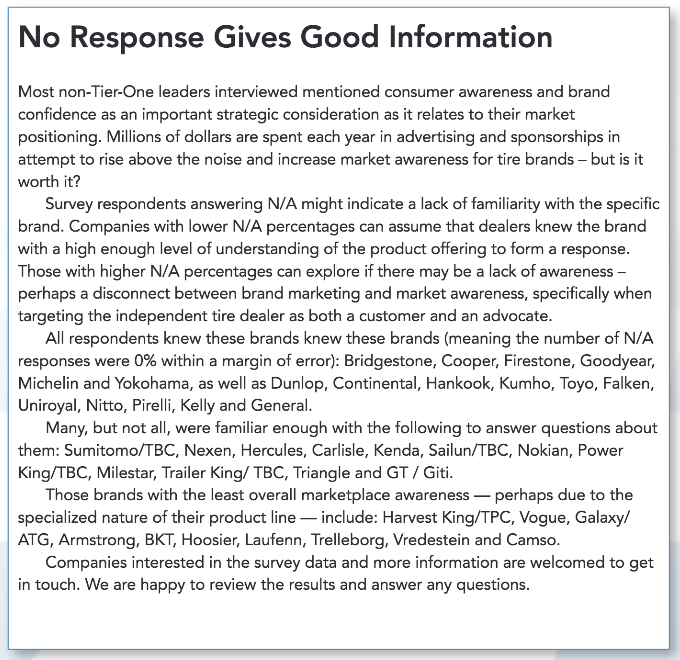

We asked independent tire dealers for their perspective on the criteria they believe matters most and how specific brands might be sorted into tiers based on that ideal criteria. Note that the survey was ambitious and took up to 30 minutes to complete, yet the number of responses at 241 exceeded our internal expectations and represents a meaningful sample for the purposes of this study.

If we were to start from scratch and establish a tier system for the tire industry today, what might that look like? We put that question to hundreds of tire dealers worded as this:

“Basically, we’re curious about why some tire brands are considered Tier One, Tier Two, etc. and others are not – especially as companies today are investing more in creating higher quality products and spending more to increase consumer awareness. So do the old Tier stereotypes still apply today? And should they? We want to know what you think.”

Here’s what they had to say.

Redefining a Tier

We began our survey with a question about the factors independent tire dealers see as most important in defining a tier.

“In your opinion, what are the key determinants in defining a tier? Please sort the following qualities, with the most important at the top of the list, and the least important at the bottom.”

When we spoke with tire manufacturers, many cited global volume, unit sales and history when asked what makes a Tier One brand. In contrast, it’s interesting that tire dealers ranked “history” and “volume sold” at the bottom of their list of importance. The data indicates that dealers are far more interested in quality, engineering and performance as the most important criteria of tire brand ranking. Reputation of the brand (which might include OE, consumer awareness and brand marketing) is a distant second, followed by price, profit, depth of product line and the reliability of distribution tied for third. In other words, getting it soon, in the right size and at the best price are important criteria to dealers but not nearly as important as having a quality product to sell that will perform well—a brand they can trust.

Tackling Tiers by Type

The current tier structure is based on the overall placement of specific tire brands and manufacturers. But as product lines evolve and tire technology becomes more advanced and highly specialized, we were curious as to whether or not tier rankings should be based on specific product categories instead of on broad product lines. For instance, Nokian might be seen as a Tier Three brand overall, yet some might consider them to be Tier One in the category of winter tires. With that, we asked how brands would stack up based on the priorities of each individual respondent by product category.

Here’s how we worded it:

“If we leave our old biases aside, and we’re starting fresh today, how does the tire product landscape take shape? What do you think about tiers and where certain brands fall – both overall and based on product types? Histories aside, based on the criteria and determining factors you just provided, please select the tiers in which you think the following companies belong.”

The results sorted into tiers are on page 21. It’s interesting to see the shifts in rankings based on the niche product categories some tiremakers are best known for.

Again, you’re invited to email me at [email protected] with any comments, feedback or questions. We look forward to continuing the conversation in the year ahead.