In a landscape where competition is fierce and profit margins are slim, the tried-and-true ways of running a tire dealership likely aren’t the only things that will keep your shop afloat, much less ensure a vibrant, growing business.

Read on for opportunities to find riches in niches – areas of specialization to help you grow. In the pages that follow, we offer a series of ideas and examples of services and opportunities to help you find your own riches in niches. We uncovered some unique potential profit centers – add-ons to help boost your business – as well as some well-known services that deserve a closer look with your bottom line in mind.

No-Credit Financing

According to a 2017 Federal Reserve report, 46% of U.S. consumers can’t afford tires or needed repairs that are unplanned. (Aren’t they always unplanned?) While credit card financing is widespread in the industry and offered by many tire manufacturers, marketing groups and distributors, the truth is that primary finance approvals based on credit ratings often are as low as 25% of customers, depending on demographics around a dealer’s location, notes Cary Ladd, marketing manager for EasyPay Finance.

“A good alternative financing partner can approve a significant number of primary declines, resulting in game-changing revenues of up to $30,000 per month, as well as significant increases in the size of tickets and average repair orders,” Ladd says. “By offering an alternative payment solution, you are helping your customers when they need it most while also giving your business an important tool to increase revenue.”

Ryan Slobodian, executive vice president of Snap Finance, estimates that 35% of American consumers have a FICO credit score that doesn’t qualify them for prime financing. The company, which offers low credit financing as well as no-credit rent-to-own financing, uses the language “No credit needed,” so the credit-challenged consumer who understands they have a credit score that wouldn’t qualify for a primary offering knows there’s an opportunity at that store.

Both companies have a similar application and approval process: consumers can apply online via any device – in the store, the counterperson can even text them a link to the application – and after providing basic information, they can be qualified in a matter of minutes. EasyPay and Snap also each offer an online locator of retailers who offer their services and require no fee for merchant enrollment.

“It’s ‘crisis moment’ meets the need for financing,” Slobodian says. “Bringing that to the point of sale at a tire store versus that consumer having to go somewhere else to get the money to get the tires is a win for tire retailers… and the consumers get the convenience of taking care of it right there at the tire dealership.

“There are a lot of variables – volume, geographic location, etc. – but a 10% to 25% increase in sales is definitely possible,” he adds. “We’ve seen some stores do up to 50% of their business in RTO financing.”

Alternative Credit Card Processing

Offering payment by credit card is practically a requirement of doing business in this century. But it does come at a price – literally. Card issuers charge set interchange (wholesale) rates and per item fees to credit card processing companies, which pass those costs on to their retailer clients. On top of that, traditional credit card processors also tack on a rate mark-up (usually in the form of a percentage of each transaction), as well as their own per-item fee and monthly administrative fees.

While card issuer fees are set and cannot be avoided, processor fees vary by company – and can add up to a significant cost for tire and automotive service retailers with larger transaction amounts, according to Craig Roll, managing partner for Tire Dealer Processing, which operates solely in the tire and auto repair market.

Prior to 2015, the company operated under its corporate name, IntraFirst Corp, and marketed to any merchant. It was during that time, while conducting an educational session for the Georgia Tire Dealers and Retreaders Association, that Roll “was struck as to how much the average credit card processing transaction was costing these tire dealers due to the credit card processor’s markup over wholesale.”

He explains that because “their average transaction was more than $200, a credit card processor’s markup (which could range from 0.20% to well over 1%) was costing them a boat load of money. When I saw that a single set of tires that sold for $800 was costing the average tire dealer $4 to $8 in mark-up, I knew that there was a better way to do business.”

Through working with multiple tire dealers, Tire Dealer Processing designed a pricing strategy that eliminated the normal rate mark-up by implementing a nominal monthly fee (usually $25), plus 10 cents per transaction.

“This straightforward pricing strategy has proven to provide a huge cost savings to our dealers,” Roll says. “In saving our tire dealer customers as much as we do by having a 0% rate mark-up, we have guaranteed that our customer retention rate is better than 98%. It’s true that we don’t make as much off each tire dealer as our competitors, but we make our profits off volume.”

Roll estimates Tire Dealer Processing’s customers save an average of $227 per month in a head-to-head comparison with their old processor (the company’s website also offers a price comparison tool).

Headlight Restoration

While today’s polycarbonate headlights offer durability and give automakers more options when it comes to design, there is one drawback compared to traditional glass headlights: oxidation, one of the major causes of yellowing in headlights. Many factors can cause oxidation, including excessive heat, pollution, harsh detergents, UV exposure from the sun, and chemicals such as road salt and deicing agents.

Tire dealers in both warm, sunny locales and winter-snow regions may want to consider offering headlight restoration, which removes oxidation from headlights and preserves the lenses by re-applying a protective UV-resistant coating.

The service is a profitable one, according to Korey Gobin, sales manager for Delta Kits, who says the average supply cost per restoration is $6.58, while the average charge to customers is $80 and the service takes roughly an hour, including dry time.

Selling points for customers include increased nighttime visibility, higher vehicle resale value and cost savings compared to headlight replacement. Instead of telling customers how valuable the service can be, Gobin recommends dealers show them.

“Get a discolored headlight from the junkyard and tape it down the middle; restore one side of the headlight so you will have a before and after, then place the headlight on the service counter,” he says. “Also, take before and after photos of every job you do and put pictures in the waiting area or play images via a slideshow on TVs.”

Replacement Keys

While today’s technology-laden vehicle smart keys offer added convenience and security for drivers, they also come at a much higher cost to replace – upwards of $200 to $400, depending on the make and model – if lost or stolen compared to the traditional keys of decades past.

“The rise in key technology has driven up their cost, complexity and variety, driving retailers out of the market,” says Kelly Papp, director of marketing communications for Car Keys Express NOW. “Because of the number of SKUs, investment in tools, staff training and support required to replace today’s keys, carmakers have had a virtual monopoly on the replacement key and remote consumer market for decades. That changes now.”

The Car Keys Express NOW turn-key program allows retailers to sell high-profit key replacement for modern vehicles using comprehensive training, field support, a workstation and universal keys, according to Papp.

“Our universal products combine the capabilities of over 600 OEM devices into two dozen keys, providing coverage for 95% of vehicles on the road today,” she says. “The innovative service saves customers the time, expense and hassle of a dealership appointment.”

Papp says the company recommends that retailers create awareness inside their showroom or waiting area and tell consumers they now offer key replacement service, in addition to listing the new service on their website, social media and in digital marketing.

“Consumers are searching online for alternatives to the dealership to replace their keys,” she notes. “The opportunity to break a monopoly doesn’t happen often. There’s significant consumer demand and very few companies offering a compelling or holistic solution. The retailers who are early movers will have the advantage.”

One tire dealer had just that in mind when he recently decided to add key replacement service to his shop, inspired by a unique opportunity that presented itself.

“We have one big customer that is responsible for maintaining or repairing cars when they’re transported from the manufacturing plant to the final destination. When they get here, sometimes the keys are lost and they need keys to get them off the railroad cars,” explains Bud Luppino, owner of Bud’s Tire Pros, with three Southern California locations.

“Last November, when the new model year cars were coming, there were 89 Mustangs that came in on the railroad cars, and when they had been loaded, the keys were thrown away. Ford has to pay $3,000 a day for each day the railroad car sits there. So it’s really important that they get those cars off as soon as possible.

“They needed 89 keys, and I thought if it happened once, it’s going to happen again,” he continued. “They’d been using another company for replacement keys and I thought, ‘If they can do them, we can do them.’ I figured with enough keys, it will pay for my equipment.”

Rather than use a turn-key vendor, Luppino researched and pieced together the supplies and equipment needed for his clientele, which includes luxury car owners.

“Because our needs were a little more sophisticated, we pieced everything together from five or six companies in order to get everything we wanted. Being a licensed locksmith, we were able to buy it at a lower cost.”

The process involved applying for a VSP Registry license from the National Automotive Service Task Force, then being placed on the LSID Registry for security professionals, which involved a security/background check. After a couple months’ wait, the dealership received its security clearance and was able to buy the necessary equipment without any restrictions. The total investment of $20,000 included the most vital piece of equipment, a programmer ordered from Italy, which added another few months of wait time before Bud’s Tire Pros could begin offering the service.

One month into service, Luppino says three employees have been trained and he sees promise in the equipment’s ease of use and versatility – its small size means it can be operated in the shop or on a mobile unit. The service is quick to learn and perform, and while he opted not to discuss specifics, he did say the company offers the service at a “slightly more competitive” price than car dealerships in the area.

“I believe it will be a good profit center,” Luppino adds. “Compared to what our customers are currently paying – whether it’s the wholesale customer that does all the keys on the trains, or regular customers who need a key replacement from a dealership – I know what the dealerships are charging and the profit margin is substantial.”

Specialty Trailer Tire Market

When a customer’s vehicle has a hitch on the back, it opens up the opportunity for a conversation about specialty trailer (ST) tires.

It’s not new and it’s not the most exciting product your customers want to talk about, but the specialty trailer tire market is a segment with staying power. It also covers products that many of your existing customers have and would welcome the convenient opportunity to purchase in the same location as their vehicle tires and service.

“Traditionally the profit margin on trailer tires is a few points higher than passenger and light truck tires,” says Randy Tsai, senior vice president of Greenball. “This has been changing as of late with a lot more competition, especially in the ST radial market, entering the segment. However, the fact of the matter is that trailer tire sales are still added unit sales.”

The most popular sizes overall are ST225/75R15, ST205/75R15 and ST205/75R14, though this changes depending on the particular trailer segment in question, Tsai notes. Depending on their market, tire dealers will want to focus on those sizes for the types of trailers they will encounter most in their area: RV travel trailers, fifth wheel car carrier trailers, flatbed utility, boat or powersports trailers, for example.

With little up-front investment – after all, the equipment to install these tires is the same as that used for passenger and light truck tires – dealers who focus on the particular trailer market that is most prevalent in their area also can limit the amount of inventory needed to keep on hand, Tsai adds.

When you enter into that conversation about what they tow and trailer maintenance, earn your customers’ trust by sharing your expertise on trailer tires. Have your staff educate them on how an ST tire is built, designed specifically for the application of towing.

Tsai says the universal specialty-trailer-tire attributes worth mentioning include:

- Designed to carry a heavier load for their size.

- Built for stability and tracking the tow vehicle.

- Most are made with rubber compounds specifically formulated for heavy loads and heat/UV resistance.

“Let consumers know that trailer tires are available in (your) location,” he adds. “Have a display in the showroom, or specifically target customers who may have trailers, for example, by asking any customer that has a trailer hitch and trailer ball attached what type of trailer they tow and when the last time they checked their tires was.

“Most trailer owners neglect trailer tire maintenance,” Tsai continues. “So asking them when they are in for their car/light truck tire service is an opportunity to bring this to the top of their mind. This is especially important in the prime trailer tire selling season, which is typically spring.”

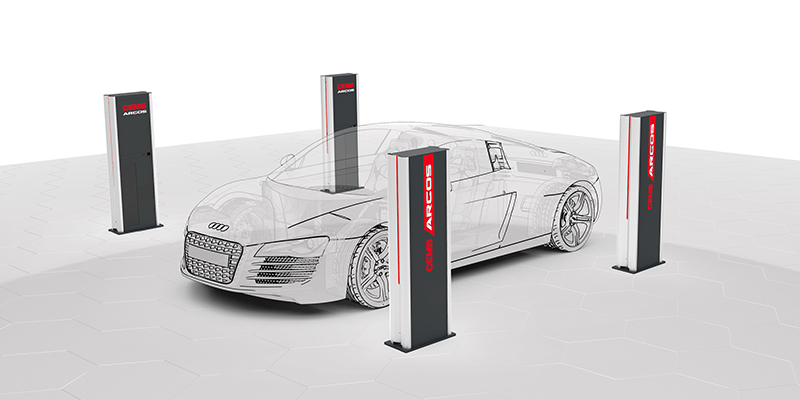

Vehicle Alignments

Alignments – though they are quick and easy to perform with the latest technology – are one of the highest profit margin services a dealer can offer, according to Kaleb Silver, director of product management, systems technology, for Hunter Engineering Co.

“More than 60% of the vehicles in operation today are out of alignment, creating a great market need that dealers can address,” he says. “Many times, alignments can also lead to other service opportunities, such as steering and suspension parts replacement.”

Many models of modern alignment equipment allow a tech to check alignments in less than two minutes, helping to identify which vehicles need to be aligned quickly, Silver explains, adding that this also can allow the dealer to provide good news and peace of mind to the customer if their vehicle is in alignment.

“Needed steering and suspension repairs are also commonly overlooked by shops today,” he says. “An estimated 30% of vehicles on the road need some steering or suspension part service/replacement performed. Last but not least is the need to reset electronic sensors on modern vehicles after a wheel alignment. Sensors – like the steering angle sensor, forward detection radar, and forward recognition cameras – require reset after a wheel alignment for some manufacturers.”

When it comes to convincing customers of the importance of alignments, Ron Racine, training manager for North and Latin America for Snap-on Undercar Division, says customer education helps to bridge the technology gap between what is commonly known and what should be known: that the tires are the only part of the vehicle in contact with the ground, so they have to provide a comfortable ride with low noise, good road adhesion under acceleration and braking, and stick to the road when turning. Bad wheel alignment will result in a higher operating cost for the customer in both higher fuel consumption and faster tire wear.

“Visual aids in the shop can also elevate customer awareness of the underlying conditions relative to their tires,” Racine adds. “In the past, marketing of wheel alignment was done using two-wheel, thrust line, or four-wheel alignment. Today it’s simply called ‘wheel alignment’ and because of the pre-alignment and post wheel alignment requirements, tire dealers should review how they present wheel alignment services and charge accordingly.”

TPMS Service

TPMS service is not new, and your techs likely have this one under control – but here the profit opportunity lies within customer education. Teach your customers to think beyond “that dashboard light is on again” to build trust and credibility.

“Most drivers have not grown up with the knowledge of what TPMS is, so your customer may not understand why TPMS service is necessary,” says Sheila Stevens, marketing coordinator for ATEQ. “Let them know the many benefits… of having a properly working TPMS system, such as improved fuel economy, road safety and decreased tire wear.”

She recommends the “show it and sell it” approach: “The customer most likely does not know what a TPMS sensor looks like since it is hidden within the tire. Go further with educating a customer by showing them a TPMS sensor and show them how it communicates with the vehicle to keep them safe on the road. If there is a damaged sensor, it is best to show the sensor with a dead battery or a damaged grommet, so they understand what they are paying for.”

Another way to “show and sell” is by putting sensor and tool information at the counters or in the lobby.

“While they wait for the diagnosis of their vehicle services, they are able to read and understand TPMS a little better, so when it comes time for the technician to talk to the customer, they already have the information embedded in their mind,” Stevens says.

“On another note, it is always good to have more than one aftermarket sensor brand in the shop and have a tool that supports multiple aftermarket sensor brands,” she adds. “Different brands carry different coverage, and not all aftermarket sensor coverage is 100%, so if shops carry more than one brand, they are guaranteed to be able to work on (every) vehicle; thus, making sure not to turn customers away.”

Detailing

Detailing done right is a business in itself, but it also could be a profit opportunity for tire dealers willing to invest in the proper training and equipment. Offering a light detail service can also be a differentiator in the level of “white-glove care” your shop provides. But be aware that different types of customers will have different needs and expectations so a tiered approach to detail-service offerings may be the best way to go.

According to the article, “The Secrets to Successful Detailing,” written by Charles Bonfiglio and published in the August 2018 issue of Professional Carwashing & Detailing, a sister publication to Tire Review: “It’s largely predictable based on the type of cars they bring in for service. Car fanatics might want the gamut of offerings, including a sparkling interior, undercarriage wash, trunk detailing and degreasing. Others just want a spiffy ride. The former wants a supreme package that includes waxes or protective coatings along with all other typical detail services. The latter is content with an economy package that includes a good interior cleaning and window washing.”

Like most auto-related services, adding a new profit center to your business requires an investment in training, products and equipment. Additional sales training can help ensure it gets off to a strong start.

While detailing and surface-protection services may not seem complicated, knowing what to use, when, and how to sell it can be the difference between success and failure.

Nick Vacco, founder and CEO of Detail King, an auto detailing training institute, was interviewed by Annie Pilon for an article on starting a car detailing business for the online news magazine SmallBizTrends.com. He provided the following tips for new detailing operations.

- Get training: While detailing doesn’t require a degree or a certification, like any other profession, you need the schooling to understand the proper techniques and the business aspect.

- Invest in the right tools: If you plan on starting a mobile detailing business and already have a truck or van, you can expect to spend anywhere from $3,000 to $10,000 on equipment, such as a pressure washer, hot water extractor, buffer, towels, buckets, sponges, etc. Larger operations will naturally cost more, but overall, the niche offering does not require gross amounts of capital to break into.

- Practice your upselling skills: While selling is important in any business, upselling and cross-selling are vital. According to Vacco, when you already have a paying customer, you might be able to entice them into purchasing more in order to boost your profit margins.

Treat this segment of your business the same as your tire and service customers – offer a clean, well-stocked waiting area, courtesy shuttles for jobs that will take a significant amount of time, and go over the finished job with the customer.

“Stop at nothing short of full satisfaction, even if it means diluting the value of the job for your bottom line,” Bonfiglio says.

Commercial Wheel Polishing

If your shop offers a cradle-to-grave approach for fleet customers, commercial wheel polishing could be a natural extension of that portfolio. An all-in-one unit, like the one offered by Vehicle Inspection Systems (VIS), makes the process fast and easy for your staff to perform the service.

An automated wheel polishing system restores aluminum truck and bus wheel rims to a mirror-like finish. To add the service to their business, tire dealers don’t need to make an up-front investment in equipment; rather, the company charges a small set-up fee and has a “pay-per-cycle” program, according to Mark Keegans, vice president of sales and marketing.

“Rather than have to invest thousands of dollars, this allows qualified tire dealers the ability to provide a new service at a very modest start-up cost,” he says. “The program is all-inclusive, which includes on-site training and commissioning, technical support, remote site access, all consumables used in the wheel process, the prep tools and equipment required…and the unit is under full warranty and maintenance for the life of the contract.”

Dealers typically charge their customers between $65 to $85 per wheel for the service and often offer a volume discount for large fleet clients. Depending on the condition of the wheel and the quality of finish the end user desires, the length of time it takes to polish a wheel ranges from about 20-30 minutes, Keegans notes, adding that there is no heavy lifting involved no exposed moving parts.

Because the company does not want end-user fleets to know pricing information, Keegans declined to specify what the pay-per-cycle fee is, but he did stress that this is a substantial profit opportunity for tire dealers.

“More and more fleets are now requesting this service as part of a total wheel end management program,” Keegans says. “The need for cleaning from a safety consideration only continues to grow. How does a driver do a proper pre-trip inspection if they cannot see the wheel? Looking for cracks or wallowed out bolt holes, to name a couple of safety items, is much easier to detect when wheels are cleaned. In selling used trucks, clean and shiny wheels generally get an uplift in selling price.”

VIS offers marketing support through brochures, postcards, banners and on-site customer joint sales calls with end users.

In addition, Keegans says other promotional strategies used by tire dealers are: including the service on bids where they are going after a fleet’s wheel and tire maintenance program; setting up displays in the showroom showing a before and after wheel in order to get a true visual of what the process looks like; and getting brochures for salespeople and even road service trucks, which then hand them out on roadside calls.

“For those tire dealers that are proactive, it creates a competitive advantage for them,” Keegans adds. “They are offering a service that perhaps the competition does not offer.”

Breathalyzer Installation

Whether it’s court-ordered, desired for discounts on insurance premiums or chosen by a driver who simply wants to avoid a DUI, ignition interlock devices, or breathalyzers, are a potential profit center for tire dealers.

Drivers pay for installation, as well as a monthly lease charge through a company that offers ignition interlock devices. Intoxalock, the largest equipment provider, offers an installer locator on its website, sending potential customers right to a nearby shop. It also gives its installers exclusive territory, according to David Estes, owner and president of Denver-based Buchtel Motors.

“I was looking for out-of-the-box value adds that were relatively easy and marketable by word of mouth,” he says, estimating that each month his shop performs about 15 Intoxalock installations, which have a 50% profit margin.

“Once you learn the process, they’re pretty quick to install,” he says. “Then you also charge when the system needs to be removed and when you recalibrate the units, which Intoxalock requires every two months.”

A few different manufacturers offer breathalyzer devices, and often the brands allowed in a given area are based on state requirements. Certain states also have additional requirements (GPS, cameras, etc.) that must be placed in the vehicle along with the ignition interlock device, Estes notes.

“Customers are usually court ordered and required to install the device if they want to get their license back within a certain amount of time or if they need driving privileges to commute to or from work,” he says. “Some are voluntary for insurance rate discounts or a probation situation; we don’t ask the reasons due to respect for our customers’ privacy.”

Performing State Inspections

If we told you that adding a service to your business that wouldn’t really earn any money and would take up time and resources was a good idea, you might discount us as terribly uninformed. While becoming a provider of state safety or emissions inspections – if such an opportunity exists in your state – might resemble that scenario on the surface, the benefit of having an added touchpoint with a large number of vehicle owners in the immediate vicinity is enough to outweigh the cost.

Originally a service station dealer, Virginia Tire & Auto, now with 13 locations, has offered state safety/emissions inspections since its inception, and carried the trend over to its dedicated tire shops, the first of which opened in 1988, according to President Julie Holmes.

The process to become an inspection provider, which is detailed on the Virginia State Police website, covers operating hours, equipment, staff and facility requirements.

“We run inspections during our business hours, which are the same hours,” Holmes says, adding that the cost to drivers for an inspection is $16, and there are no subsidies from the state for providers. There have been attempts to increase the retail price of inspections, including one earlier this year for which the Virginia Automotive Association was very involved in speaking to legislators, but so far they have not been successful.

Even though shops aren’t earning much on the service itself, the real profit opportunity for tire dealers lies in the fact that if vehicles need repairs in order to pass the inspection, drivers are highly likely to have them done right then and there, according to Holmes.

“It is a great relationship builder with customers,” she says. “It’s an entry point to our business.”

Tire and Wheel Coverage

Shops are always looking for logical add-ons to a tire sale, which is where TW Protection comes in.

The company, founded by tire industry veteran Jared Kugel, wants to help tire dealers increase their profits by offering tire and wheel protection. Allstate Dealer Services partnered with TW Protection to allow independent tire dealers to sell tire and wheel coverage plans.

“TW Protection entered into this endeavor because we believe offering Allstate Tire & Wheel Protection helps tire dealers retain customers and gain a competitive edge against forces that are hurting independent tire retailers,” Kugel says.

According to TW Protection, selling this product to consumers, allows retailers to increase their revenue through product sales and service retention. As an authorized dealer, dealers can earn increased profits through product sales and service retention. Providers can also get paid for each coverage contract sold and reimbursed for tire and wheel repairs and replacements.

“People will instinctually return to the store or shop they bought the coverage from,” Kugel says. “This is a coverage consumers cannot buy from an online retailer, Amazon or a big box retail chain at this time.” TR