The most dependable way to predict the future is to understand the present. In this article, we’ll diagnose the health of the end-markets today and provide some directional guidance on tire demand going forward.

The tire industry is highly correlated to GDP growth which has been growing in the low to mid-2% range recently versus total tire industry growth of ~1% in the first half of 2015, with replacement up 0.1% and OE up 5.4%.

Forecasts in the mid to high 2% range, annually over the next several years, are supportive of improved demand going forward. As GDP is not an independent driver or an exclusive guide to tire growth, other economic indicators to consider that support upward momentum to tire industry volume include:

a) unemployment in the low to mid 5% range,

b) ~3% increase in consumer spending;

c) positive personal income growth (albeit at a subdued pace)

Beginning with the new vehicle market, OE consumer tire volume was up 4.1% and OE commercial was up 18.1% through the first half of 2015. We continue to hold the bias that the OE channel will remain strong and our positive underlying outlook for new vehicle sales in the U.S. supports our positive longer-term outlook for consumer retail tire demand.

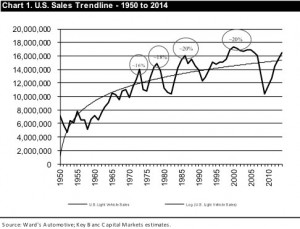

Our vehicle sales trendline analysis shown in Chart 1 (see next page) suggests peak U.S. seasonally adjusted annual rate (SAAR) atless than 18 million units driven by declining unemployment, increasing off-lease volumes, and improving financing availability.

Historically, new vehicle sales rebound to 15%-20% above trendline demand following a recessionary decline. The magnitude of the last pullback suggests a rebound at the high end of historic range, or ~20% above current trendline demand of ~15.5 million units, and suggests peak SAAR atless than 18.0 million units. As for 2015, we believe U.S. sales are likely to be ~17 million in 2015.

Regarding the replacement market, consumer replacement demand was down 0.3% year-to-date through June 15, with passenger tire volume down 0.2% and light truck volume down 1.1%. The weakness was directly correlated to the tariff activity with Chinese imports leveling off as dealers have reduced inventory. Domestic manufacturers or RMA members (Goodyear, Michelin, Continental, Cooper, etc.) were up 4% for passenger car and light truck replacement tires through the first half of this year.

Forward View

Looking ahead, we expect a robust tire market in the back half of 2015 set to accelerate from stagnant first half performance. The consumer tire headwind associated with the tariff (i.e. China imports down around 50% year-to-date) has essentially abated and import activity should begin to normalize.

Overall, the duties have insulated the U.S. tire industry from force-priced deflation as a result of lower raw material costs. Therefore, we continue to believe manufacturer margins in North America can be sustained at these record levels.

Additionally, our tire channel research has indicated inventory levels seem to be fairly normalized across both passenger car and light truck as well as commercial truck, with 70% and 80% of the KeyBanc Capital Markets tire survey respondents indicating inventory is “Just About Right” during the second quarter.

With RMA member growth strong at ~4% year-to-date and total industry tracking flattish while our survey shows demand up 6% at retail, carryover stock could actually be a bit on the low side, in our view. This could help to support demand through the remainder of the year and into next. Overall, we anticipate that industry shipment growth should mirror the underlying growth rate at retail.

The dichotomy of regional pricing dynamics in China versus the U.S. now is interesting, and the acrimonious reaction by the Chinese hasn’t been surprising given the magnitude of the loss of the tens of millions of units. The new duties are casting a long shadow on China’s tire manufacturing sector, exposing price vulnerabilities given the state of overcapacity.

Meanwhile in the U.S., manufacturers believe price/mix could be neutral next year suggesting some stability on the pricing front and the raw material environment continues to look favorable, potentially leading to a positive price/mix versus raw material spread. We are seeing distributors that have imported tires from China for a very long time change the sourcing for nearly their entire import product screen to Thailand, Vietnam, Indonesia and elsewhere. We saw this activity pick up significantly during the April-May timeframe successfully offsetting the weak import activity to the U.S. from China.

Overall, we expect the average sales price of tires in the U.S. to expand as a result, particularly in the Tier 3 and 4 categories as non-Chinese production cost is said to be ~12% higher, which will get passed along to the consumer. This will impact mix, likely driving higher volumes into the Tier 2 and 3 categories.

Overall, the duties have insulated the U.S. tire industry from force-priced deflation as a result of lower raw material costs. Therefore, we continue to believe manufacturer margins in North America can be sustained at these record levels.

Other Factors

Moving on from China, U.S. miles driven is at all-time high. This is welcome news to the industry, yet we caution to not get too bullish as the renewed strength in travel is owed mostly to lower gas prices. Put simply, if an average consumer is assumed to drive 15,000 miles annually and the average warranty of a tire is 50,000 miles, a 5% increase in miles driven puts 750 extra miles on a vehicle. That level of treadwear is incremental, but is certainly not an inflection point in terms of demand.

Rather, the state of the consumer is more important and as consumers save from lower gas prices at the pump, large retailers like Monro Muffler Brake share the view with us that the benefit is minimal as those savings are offset by higher healthcare costs.

Therefore, true underlying need for the product is what is driving demand, and in certain cases, we believe deferred replacement could be a potential catalyst over the coming quarters as retailers continue to see thinner than ever tread being replaced.

As it relates to commercial truck tire replacement demand, replacement volume is up 6.1% through June. Our proprietary survey has shown mid-single digit increases recently for sell-out at retail. When coupled with “Just About Right” inventory levels at 80% of surveyed dealers, we expect the replacement market to remain solidly positive for the foreseeable future.

Manufacturer capacity plans in North America give us confidence that the industry will continue to be in growth mode for the foreseeable future, as well. In addition to meeting demand, we believe the domestic manufacturers are likely to try to drive more share gains through these new capital investments.

Moreover, we also note that long-term demand will be supported by greater freight hauls with American Trucking Associations truck tonnage data showing growth in the low- to mid-single digit range consistently over the past year.

Manufacturer capacity plans in North America give us confidence that the industry will continue to be in growth mode for the foreseeable future, as well. In addition to meeting demand, we believe the domestic manufacturers are likely to try to drive more share gains through these new capital investments. For example, Goodyear’s capacity in North America is constrained but that is soon to be alleviated as the company is building a new $550 million plant in Central Mexico with annual capacity of six million units (10 million by 2019) that is expected to be operational by 2017.

Lastly, manufacturer volume outlooks give us reassurance that the industry will remain in positive territory. Goodyear has indicated that mature markets like the U.S. are expected to see annual growth around 1% over the long term and the current industry forecast for 2015 is flat given the import dynamic.

Additionally, Michelin expects 2015 to continue on an upward trend in mature markets like the US. Continental currently sees passenger car and light truck replacement tires down 2% in 2015, but this is likely to prove conservative given better than expected demand through the first half of 2015 and an abating import headwind.

Continental sees the commercial vehicle replacement market as growing by 3% in 2015. In terms of mix, manufacturer’s like Pirelli give us increased confidence the premium tire segment will continue to outgrow with forecasts of above industry growth in the mid to high single digit range.

Bottom line, sell-out at retail has been trending positive, economic indicators are positive and manufacturers are investing many hundreds of millions in new capacity in North America through decade end, which reaffirms our view that tire industry demand will continue to trend positively in the U.S. for the foreseeable future.