At this writing, summer break for students is halfway over, and it’s hard to believe that school will be in session before too long. Along with that, many organizations have been gearing up for return to the workplace, whether full-time or hybrid, around Labor Day. And, while the delta variant of COVID-19 has become more widespread, the state of the automotive aftermarket continues to be strong, even through tumultuous times.

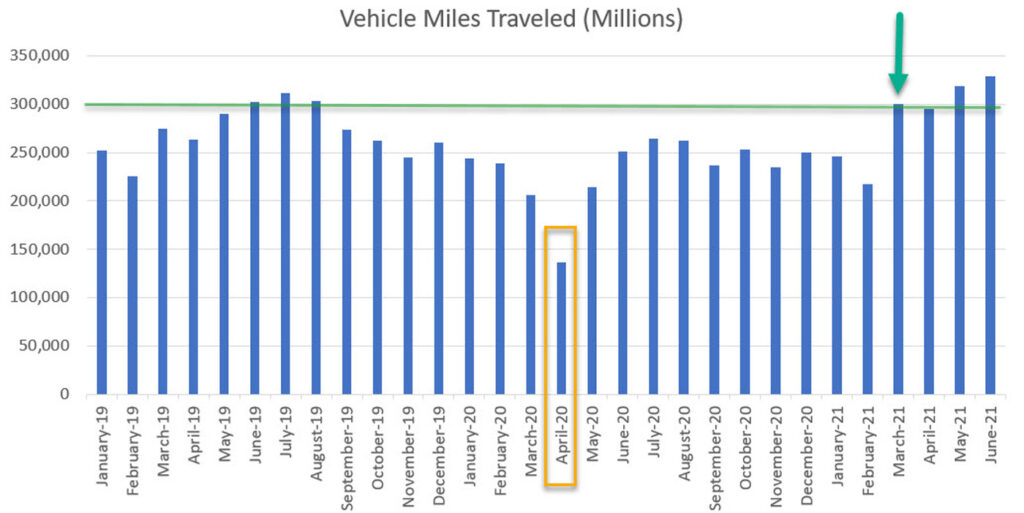

The economy has effectively rebooted, which I witnessed firsthand during a family vacation to the beach in early July where the area was back in action. This economic recovery has been in the works since spring break – where we saw vehicle miles traveled (VMT) rebound beginning in March as families traveled for pleasure, as you’ll see in Figure 1.

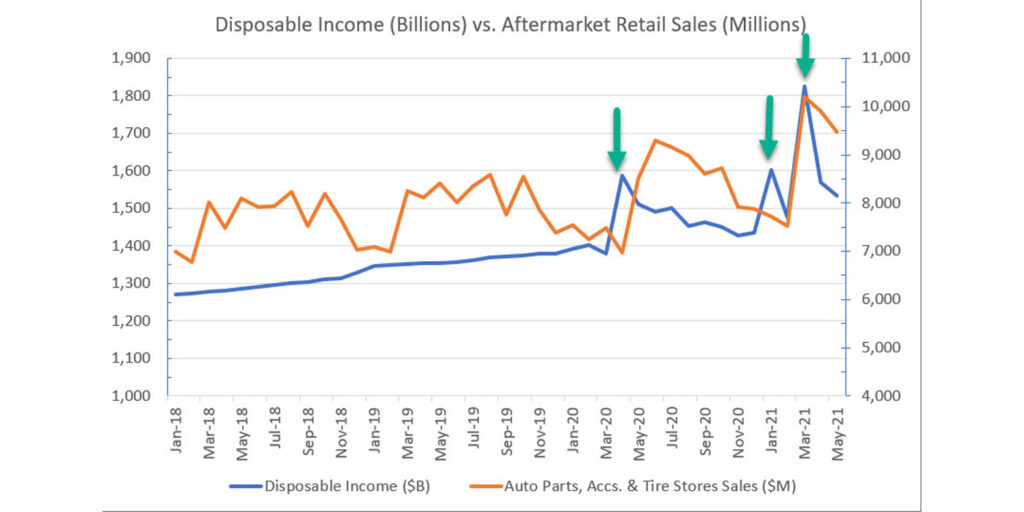

Interestingly, aftermarket retail sales have performed well despite the decrease in VMT. As pictured in Figure 2, disposable income has steadily increased over the past several years, and when consumers have received cash infusions (stimulus check distribution is marked by green arrows), they have used the money to pay bills, add to savings and care for their vehicles.

Driving Habits Have Changed

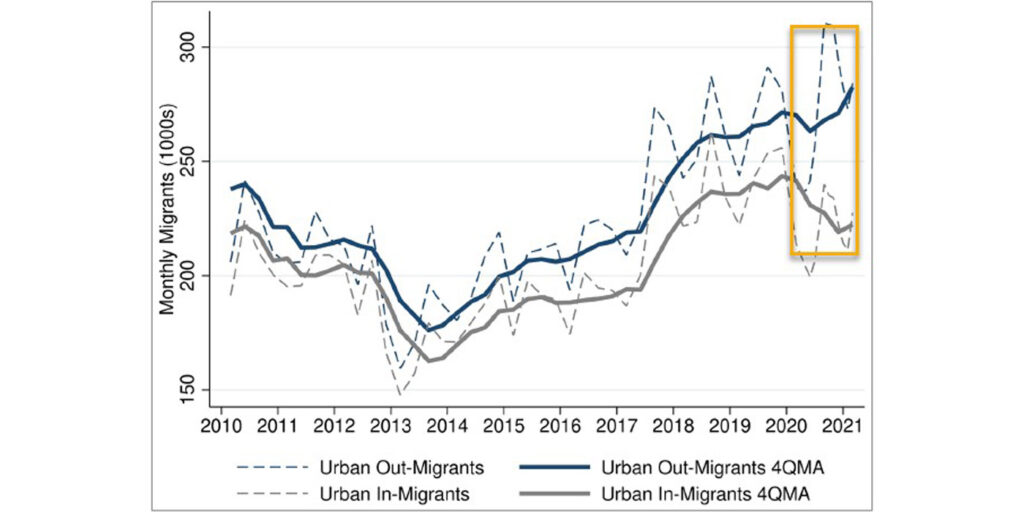

Americans have been moving out of cities at a faster rate than they have moved into cities. The chart in Figure 3 on page 22 shows the net migration of individuals moving away from (blue) and into (gray) urban areas. The solid lines represent the four-quarter moving average – notice the divergence in the boxed call-out.

If workers are more likely to work from home more frequently, what impact will that have on VMT and aftermarket sales? Companies are generally staging for a return to office around Labor Day. Global Workplace Analytics, a research-based consulting firm, estimates “we will see 25-30% of the workforce working at home on a multiple-days-a-week basis by the end of 2021. Based on a survey of 2,500 full-time workers, the firm concluded that “69% of U.S. employees worked from home at the peak of the pandemic.”

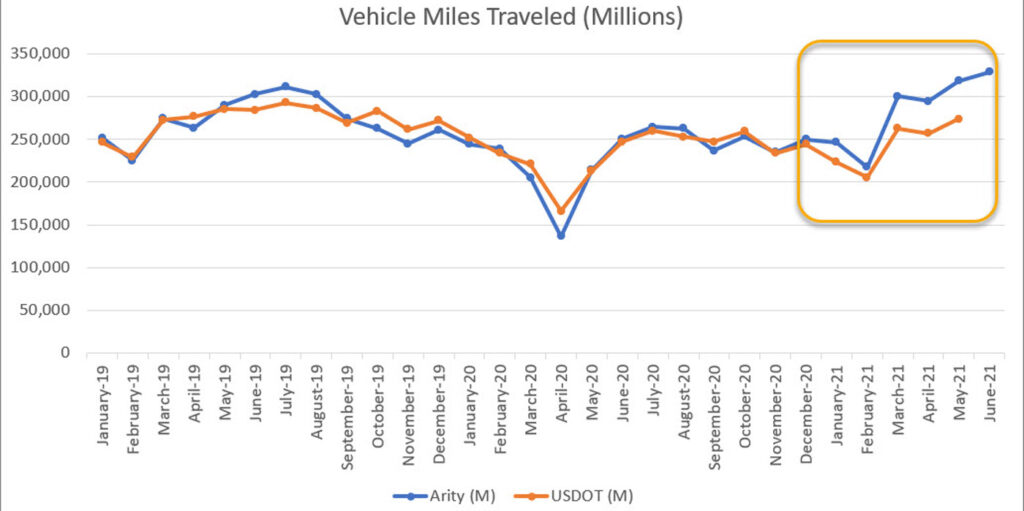

Further, Americans have been driving more locally this year. In Figure 4 on page 24, we display VMT from two sources: Arity (blue), a wholly owned subsidiary of The Allstate Corporation, and U.S. Department of Transportation (orange). Note the area in the gold box, where Arity’s VMT estimate exceeds the USDOT’s. Why do these lines have a greater divergence than in previous seasons?

USDOT uses continuous and temporary traffic counting stations nationwide to derive miles traveled data, with many counting stations distributed on highways. On the other hand, Arity’s mileage number is calculated based on data collected from 23 million active connections from multiple third-party anonymized and aggregated sources, including consumer apps, insurance telematics mobile and device programs. Of the approximately 660 million daily miles captured by Arity via telematics data in recent months, more than two-thirds is from driving on arterial roads. Given the more “localized” driving patterns by Americans throughout the pandemic (e.g., far less highway commuting, far more local errands and local trips on residential/commercial thoroughfares, but not interstate/U.S. highways), we expect Arity’s data to accurately reflect changes in driving habits—that is, people have driven using more local roads as opposed to major highways (in addition to varying the time of day for trips, resulting in lower traffic volume during peak rush hour).

The USDOT monitoring system is static and relies on highway traffic to be a good proxy for overall VMT; as such, USDOT estimates also rely on a stable mix of highway vs. arterial road traffic. If local driving declines disproportionately, like we had at the onset of the COVID-19 pandemic in Spring 2020, DOT data will likely overestimate the true/actual VMT. Likewise, if local traffic disproportionately increases, as it has over the last few months, then we expect DOT data to underestimate the true/actual VMT.

Steadier Adoption of Electric Vehicles

Adoption of alternative powertrain vehicles has continued to increase. In 2020, battery electric vehicles, hybrid electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles accounted for 4.9% of registrations for new passenger cars and light vehicles. This proportion has increased steadily from 2.9% in 2016 and is poised to continue its ascent, particularly as vehicle manufacturers commit to electric vehicles, incentives continue to be available for consumers, and as technology improves (e.g., range) and becomes more available (e.g., charging stations).

While EVs are not expected to reach global parity with internal combustion engines as part of the overall car parc for several decades, they present interesting opportunities and questions for the industry – for example, those related to expected maintenance and repair potential for service providers. Additionally, consumer adoption for used EVs will be telling. While purchasers of lower-priced used ICE vehicles are frequently the fourth or fifth owner of that vehicle, whether or not this demographic will be willing to be the fourth or fifth owner of a used EV is uncertain—after all, accessibility to charging infrastructure is a common hurdle for prospective EV customers.

Hiring Challenges

The industry has seen a number of shocks to the supply chain throughout the pandemic. As supply chains have restabilized, distributors have been working to replenish their inventory levels. Thomas Beer, CEO of SSF Imported Auto Parts, a supplier of European auto parts to independent repair and collision specialists, indicated that recruiting and onboarding new employees has been more challenging in 2021. Fluctuations in shipment arrivals have exacerbated staff scheduling for shipment receipt, leading to sales team members, executives and warehouse employees to work together on the warehouse floor. And, with more variability in shipment schedules, overtime is more frequent, driving up costs and the potential for error.

These dynamics are closely connected to hiring, onboarding and training of employees. With retail stores and restaurants ramping back into full operation, there has been more competition for qualified workers in the automotive aftermarket. Beer highlighted non-traditional/online retailers like Amazon and Walmart who sought warehouse employees as they moved to meet consumer demand online, and this has only added to the challenge. Getting people to “show up” for interviews, come to work and then stay on the job is nothing to take for granted.

Service shop owners also weigh in—and some have had better hiring outcomes than others. Kathleen Jarosik, owner of Xpertech Auto Repair in Englewood, Florida, said that hiring two staff members during the pandemic went smoothly. In one case, a technician reached out to her as he left a nearby dealership; in another case, she hired a customer service representative she knew from the retail industry.

A little further north, Doug Vidler, owner of Christian Brothers Automotive franchise store in Mooresville, North Carolina, has unfortunately had a tougher time finding qualified technicians at any level, indicating “there is a noticeable shift before and after the pandemic—applications for open positions have dropped off” and “the few who have responded have skillsets that are not as well-aligned” as before.

Vidler suspects that high-quality technicians have managed to stay employed and likely to be “satisfied with their current employer.” Dwayne Myers, co-owner and managing partner of Dynamic Automotive in Frederick, Maryland, has observed similarly: “I know other people have had issues finding help, and I think [stimulus checks, unemployment benefits, competing with other industries] have contributed” to the challenge. Both Vidler and Myers have seen their shops staying active and busy as well, particularly as the availability of new or used vehicles has been low, resulting in an overpriced used car market. This combined with high prices at a new car dealership “have made repairing and maintain your vehicle a priority,” according to Myers.

Tapering DIY and Delayed Maintenance Trends

Last summer, we saw DIY rates peak as vehicle owners stayed at home and took on various projects around the house. According to IMR Inc., while DIY intention rose to 32% in 2020, it has decreased to 28.7% in the first half of 2021. Bill Thompson, president of IMR Inc., says, “DIY installation rates [for parts/services/chemicals tracked by IMR Inc.] in the first quarter of 2021 have declined to pre-pre-pandemic levels while DIFM (do it for me) has increased at a good clip,” which has been encouraged by government stimulus checks.

We also saw delayed maintenance go up as vehicle owners drove fewer miles throughout the pandemic. Since then, delayed maintenance decreased a notch from 18.3% in 2019-2020 to 17.3% in 1H2021, according to IMR Inc.

Correspondingly, the market potential for delayed maintenance has increased by 13% from 2019 to 2020. Highlighting the main reasons for delaying maintenance —cost (34%) and time (21%)—Thompson advises repair shops to facilitate customers’ vehicle intake since many vehicle owners are likely to have less time available as they return to the workplace.

Industry Implications and Outlook

So, what does all of this mean for the aftermarket? While VMT is steadily recovering to pre-pandemic levels, driving patterns have changed for many—commuting fewer days each week, traveling at different times, taking a different vehicle, driving for more varied purposes. Service/repair and retail companies are taking notice and advising their customers accordingly as they find “the new normal.”

As noted, the state of the industry is strong—IHS Markit forecasts the aftermarket to rebound strongly this year. After losing 5.3% in 2020, the industry is projected to climb 11.2% in 2021, then by 4-5% per year from 2022-2024, according to the Auto Care Association and AASA Channel Forecast Model. The strong rebound is more pronounced for the automotive aftermarket than it is for the general economy. The Conference Board expects 6.6% year-over-year growth in U.S. GDP in 2021, and the Congressional Budget Office expects the economy to grow by 7.4% in 2021, then 3.1% in 2022, according to The Washington Post.

The automotive aftermarket demonstrated its resilience and adaptability since the onset of the pandemic. While challenges persist, confidence abounds that all aspects of the supply chain will continue to demonstrate their resolve, innovation and agility throughout the balance of the year and into 2023.