Adapting to consumer demand has been mission-critical to the success of the consumer tire marketplace for decades. Shifting purchase behaviors and rapidly evolving technologies have long created the occasion for tire manufacturers to embrace innovation to help dealers sustain and capture new business. This approach has perhaps never been more important than in the present moment.

The COVID-19 pandemic continues to impact the tire industry, including the passenger and light truck segment, but with this unprecedented challenge comes a significant opportunity for tire manufacturers and dealers to work together to deliver a seamless customer journey. To accomplish this, we must work to understand the long-term impact of the pandemic on consumer behavior and invest in tire and mobility solutions that support the transforming consumer landscape.

Assessing the Impact

The global pandemic has impacted the tire industry in a myriad ways. While the consumer segment has faced sales declines largely because of its ties to the original equipment tire business, passenger and light truck replacement tire sales have remained more resilient due, in large part, to people who have been driving to provide essential services, including delivery drivers and first responders. Along these lines, the commercial replacement tire segment has remained stable, with fleets and transportation playing a critical role in keeping essential goods and services moving.

At Bridgestone, we remain optimistic about the future of passenger and light truck tire sales. For example, the loss of traditional miles driven is being countered by a number of different factors, including a pent-up demand for safe travel solutions and a preference for personal vehicle transportation. A national poll, conducted in June by market research firm Harris Insights & Analytics, found that personal vehicles are overwhelmingly viewed as the safest mode of transportation during the pandemic and are expected to remain so for the next three months. We anticipate this trend will continue for the foreseeable future. Now is the time for tire dealers to prepare for a strong post-crisis recovery by ensuring access to best-in-class passenger and light truck tires, services and solutions that meet emerging customer needs.

Identifying Key Opportunities

The COVID-19 pandemic has presented the tire industry with a unique moment to assess and prioritize opportunities to unlock growth for the future. Prior to the pandemic, online shopping and last-mile delivery had already been established as a major driver of sales growth for the passenger and light truck tire segment. On demand, same-day delivery and the increasing preference of shoppers to have goods delivered straight to their homes have resulted in a growing number of non-traditional fleets supporting the final step in the consumer purchase journey. Since March, as new types of businesses have been pressed to serve their customers through delivery and contact-free services, the expansion of last-mile delivery has only accelerated. As an industry, we need to create a seamless digital customer experience to meet this key, emerging opportunity.

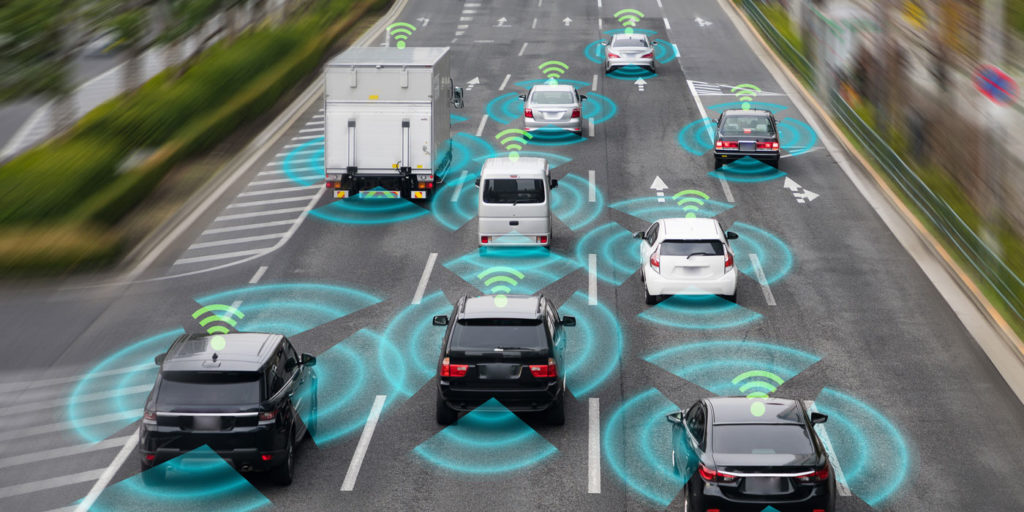

Leaning into telematics technologies that can assess tire health, optimize routes and track for efficiency and safety will be critical to capitalize on the expansion of the last-mile delivery segment. Beyond last mile delivery, dealers also have an opportunity to seize upon shifting consumer expectations by incorporating concierge and contact-free services into their long-term business strategies. Curbside drop-off and other frictionless offerings inspired by safety measures necessitated by the pandemic offer added convenience. We expect consumers will expect this same level of convenience and safety moving forward, even when the current crisis ends. Implementing convenience-focused customer solutions will be critical for tire and auto dealers looking to maintain and grow their business long-term

Responding with High-Technology Tire Solutions

Beyond the current environment, we continue to see the expansion of higher technology passenger and light truck tire solutions. Consumers today expect maximum tire performance with fewer trade-offs. As such, we anticipate seeing further adoption and demand for tires that offer all-weather performance and extended mobility. Dealers can look for tire manufacturers to continue to innovate to improve the wear life, ride comfort and fuel economy of all-weather tire offerings, going above and beyond to deliver best-in-class four-season tire performance.

We are also seeing major technological advancements in extended mobility tires, such as tires with run-flat and sealant technologies, making them more comparable to conventional tires in ride comfort and wear life. Original equipment manufacturers continue to opt for extended mobility tires in place of spare tires, allowing for the optimization of limited vehicle space while also providing an added safety benefit and convenience.

Additionally, as we look ahead to a future when vehicles are fully autonomous, we know autonomous vehicles are likely to be fleet owned, making downtime very costly and extended mobility tires an ideal solution.

While 2020 has been filled with uncertainty, the tire industry has an opportunity to rise to the occasion to meet the rapidly transforming needs of today’s drivers. At Bridgestone, we see this is as a pivot point for our company as we evolve beyond traditional tires and service to become a leader in sustainable mobility and advanced solutions. Continued investment in innovation and new technologies that deliver what customers are asking for will be critical to delivering a strong post-crisis recovery and positioning Bridgestone and our dealers for long-term success. As we look ahead, manufacturers and dealers must work together to lead with a consumer-centric approach that embraces the future of mobility.

Jeff Cook is the executive director of product strategy and portfolio planning for Bridgestone Americas. He is responsible for setting product strategy and delivering on strategic product development priorities across the consumer and commercial businesses in the U.S. and Canada. In this role, Cook leads a team focused on enhancements to the product portfolio to ensure the company is meeting the needs of the customer.