The off-the-road tire segment of the overall tire industry is, admittedly, a niche market. But, at roughly 10% of the global $170-plus billion tire industry, it is a sizeable niche and one that provides some interesting opportunities for all commercial tire dealers, whether they consider themselves OTR sellers or not.

Last year, a good friend and former colleague Shawn Rasey wrote an excellent article on the OTR industry for this publication. In it, he reminded us all that there are few segments of the industry as cyclical as OTR tires. Mining and construction, by their very dependence on macro-economic trends, are boom and bust activities. When mining, in particular, is booming, manufacturers cannot keep up with demand, supply is tight, shortages ensue and prices go up.

It makes sense, then, that this is the time when many producers decide to invest in plant expansions and new factories only to see their increased capacity come on board the very moment the market turns downward. That is what we are seeing today, and I’ll have more to say about this in a moment.

But first, let’s look more closely at the two main industries that drive OTR tire demand –mining and construction.

The Mining World

Few readers are involved in serving large, open-pit mining, which, at the moment, is just as well since mining is going through one of its classic downturns. Global demand for almost every major commodity mined today – gold, copper, silver, iron, even oil – is down. Lower demand leads to lower pricing and most mining companies today are in contraction mode instead of expansion.

There are exceptions, however. With metals pricing at or below cost of production, many of the global lower cost producers have actually increased production in an effort to drive smaller, higher-cost producers out of business. When the market recovers (and history shows that it always does), then these producers will be well positioned to profit handsomely.

As the strong get stronger and the weak either go out of business or get purchased by the stronger, further industry consolidation results, making for fewer customers with greater buying power.

Commodity prices most affecting North American mining companies (gold, copper, iron, coal, oil sands) are forecasted to stay low for the remainder of 2015 and into 2016 before seeing an uptick in 2017. As a result of weakening prices and production, heavy equipment maker Caterpillar forecasted 2015 sales to be down 9% versus last year.

Despite the “doom and gloom” surrounding global mining, there are some positives. First, while large open pit surface mining is what most of us think about when the word “mining” is mentioned, it is important to note that there is another form of “mining” that is much more prevalent and exists in many more parts of the country than does copper, coal, iron or gold.

I’m referring to the mining of aggregates – sand and gravel – most often dedicated to construction projects. Last year saw a huge rebound in production of aggregates and, after a brief pause in 2015, the aggregates market looks very promising for 2016, as well. This is all being led by a resurgence of construction in the U.S.

The other bit of good news for those serving the mining industry is that the current downturn is starting to change the attitude of mining companies toward their suppliers. Many have already taken severe cost-cutting measures to stay profitable. With continued weakening of commodity pricing, the smart companies are looking more and more to partner with their suppliers for sustainable advantage. Rick Carr, a principal with Deloitte Consulting, had this to say in a 2015 position paper on mining:

“Mining companies should also be mindful of their suppliers and contractors, whose situation is equally precarious. Rather than pressuring suppliers further by demanding deeper price discounts, mining companies can adopt several non-pricing mechanisms such as flexible contracting, inventory management, preventive inspections and mobile maintenance programs.

By working with key suppliers on how to take cost out of the solution versus simply trying to cut into supplier margins, companies can not only lower costs but also drive sustained improvements. This approach is designed to encourage valued suppliers and contractors to maintain the critical services mines rely on while teaming to improve total cost elements on both the operator and supplier side.”

This is an opportunity for forward looking tire dealers who partner with their mining customers (and tire manufacturers) to bring needed cost cutting solutions to the table. Services like regular tire maintenance checks, tire management systems, holding inventory, dedicating a worker full-time to the mine site, etc., are all things worth considering to make you an integral part of the mining operation and very difficult for your competition to unseat you.

The key is understanding exactly what these services cost and charging appropriately for them.

The Construction World

There are countless organizations, publications and government statistics giving forecasts for the construction industry. And, while they sometimes conflict, they are all in agreement on one thing: the construction industry is booming again!

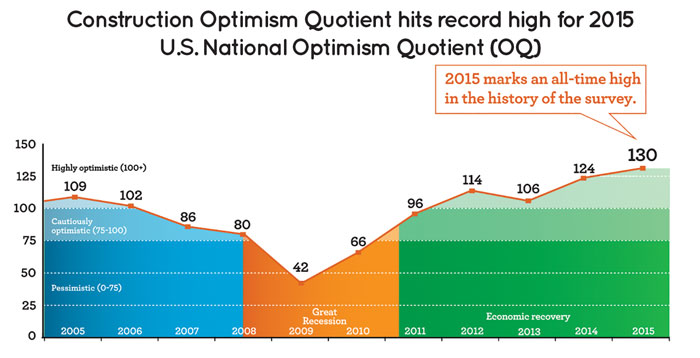

An annual survey of construction contractors and equipment distributors conducted by Wells Fargo Finance showed optimism for construction growth at the highest in over a decade, beating last year’s all-time high. This, despite the fact that one of the main drivers of the past few year’s construction activity came from oil and gas exploration, a once booming sector that has dramatically slowed due to low prices.

So what’s driving this new optimism in construction?

Housing – The boom is currently being led by housing demand. After the 2008 recession new housing starts virtually ceased, down a whopping 75% from the height of the pre-recession bubble. An improvement in the economy coupled with growth in population has created pent up demand that is just now being addressed.

A recently published McGraw Hill Construction-Dodge report forecasted 2015 residential housing starts to increase 20% vs. 2014 followed by a 27% increase for 2016. While still well below the one million plus annual housing starts of 1996-2007, the trend is encouraging and is expected to last at least for the next several years, especially in more urban areas where today’s Millennials are driving a reverse migration back to cities, away from suburbs.

Commercial – Reflecting an improving economy, commercial construction – office buildings, hotels, factories, warehouses, hospitals, schools, etc. – is also experiencing double digit growth forecasted at 10%-12% for 2015 and 13%-15% for 2016.

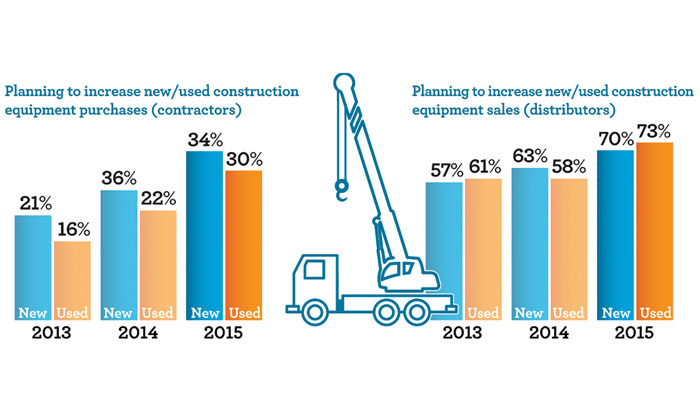

While mining equipment manufacturers have downgraded their sales forecasts, those selling construction machinery are all forecasting improvement. Construction Equipment magazine forecasted close to 9% increase in overall sales of construction equipment.

Especially noteworthy is that more than 50% of all new equipment is being purchased by rental companies. Rental companies have enjoyed explosive growth the past few years primarily due to uncertainties created by the economy and by government regulation, making it less risky for contractors to rent than to commit long-term capital to a project.

For example, the U.S. Highway and Transportation Funding Act expired May 2015. There have been two temporary extensions, one to July 31, and a second two-month extension when that expired to see Congress through their August recess. Without a long-term (5-6 year) commitment, few contractors will gamble on road construction equipment knowing funding could halt midway through the project.

Half of all new tires working in the field are controlled, in one form or another, by companies like United Rentals, Sunbelt Rentals, Cat Rental, etc. That fact has not escaped the attention of many tire manufacturers who race to tie up these companies with long-term national account agreements. If you are not currently calling on rental companies, you are missing a growing opportunity.

Construction Employment

With this resurgence in residential and commercial construction, it is small wonder that more than 80% of the members of the Associated General Contractors of America (AGC) recently predicted they would add to their payrolls and hire more people in 2015. In fact, the number one complaint by contractors was the shortage of trained construction workers.

This is great news not just for construction workers, but for the OTR tire industry as a whole. A few years back, at the annual TIA OTR Conference, Angie Jones of Bridgestone Americas showed statistics linking OTR tire demand to construction industry employment. Tracking these two statistics over a long period of time showed that each time construction employment improved, OTR equipment and tire sales increased after a short lag time. There was almost a straight-line correlation. If that continues, the next several years promise to be good ones for commercial tire dealers.

I say commercial dealers, and not specifically OTR dealers, because unlike with mining tires that require specialized handling equipment costing hundreds of thousands of dollars, and OSHA/MSHA trained technicians to work mine sites, serving the construction industry can be done by the majority of truck tire dealers.

As with truck tires, there are relatively few sizes to inventory with more than 70% of all units sold either 24- or 25-inch wheel diameter, tires that more often than not can be handled by current service truck equipment. Chances are many of your truck tire customers also have pieces of construction equipment. If you don’t service them, someone else will, opening the door to competition.

A case in point is skid-steer tires. There are more than 800,000 skid-steer machines operating in the U.S. today with more than 600,000 of them on rubber tires. That’s a running population of 2.4 million units, all of which scrub off their treads very rapidly due to the very nature of the machine and their operation. And even better news is two sizes – 10-16.5 and 12-16.5 – cover the vast majority of fitments, making it relatively easy to inventory.

Supply and Demand

I started this by referring to the cyclicality of the OTR business and that many tire manufacturers around the world rushed to expand production during the last tire shortage. In the U.S. alone, Bridgestone built a new state-of-the-art giant OTR tire factory in South Carolina, and Titan increased production of giant mining tires. In India, BKT and Alliance have added to existing plants while currently building new factories for radial OTR production. And in China, no fewer than six manufacturers have recently added a tremendous amount of capacity specifically in radial and bias OTR tire production. This, all at a time when global demand appears to have stalled.

What a good time to be an OTR tire dealer. With all this new capacity coming on board your phones will be ringing even more than usual. And the OTR business will not be dominated solely by the global giants; new hungry players, many unfamiliar today to North American customers, will emerge and many more brands will be offered.

Conclusion

The OTR market is a mixed bag today, with mining down and construction up. Many new players will be entering an already crowded market, some with surprising technology and manufacturing quality. With choices expanding, it will be critical to choose your supply partner wisely. OTR tires are expensive to make, expensive to service, and very expensive if you make a mistake.

Make sure you pick a supply partner who:

• Has the technology to make a quality product with a commitment to R&D to innovate for the future.

• Stands behind their product, either with performance guarantees or quick resolution of warranty claims

• Is committed to working with you to offer solutions to your customers, not just price.

• Has technical support on the ground to help with training, applications and field problems.

• Is committed to your success and to your independence.