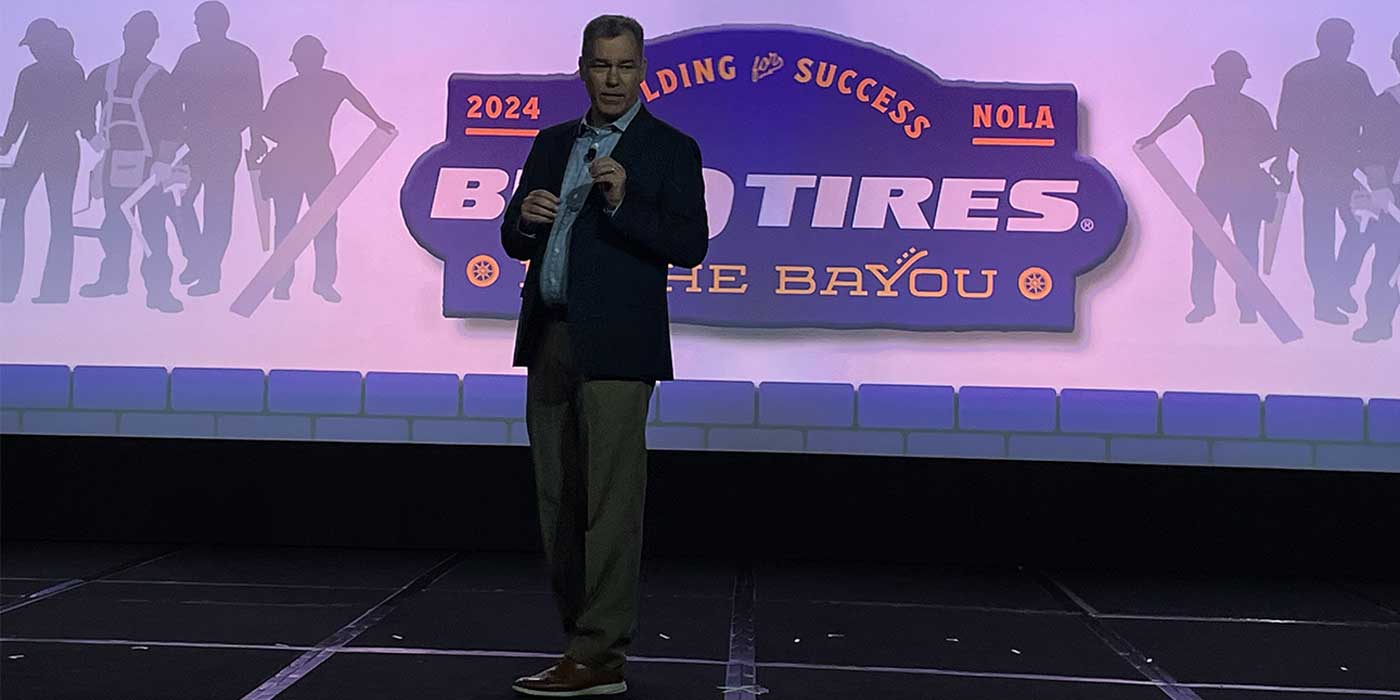

With 121 automotive retail locations and counting, Leeds West Groups (LWG) is a company you oughta know. It is the biggest Big O Tires franchisee and is a private equity-backed company that has reaped rewards from its investment in tire retail. According to CEO Judd Shader, the group will strategically expand its reach, especially on the heels of Big O Tires announcing its intent to go national.

“Expansion, to us, is about opportunity,” says Shader, who founded LWG in 2009 in Colorado with his investment in two Midas stores. “We’ve done a good job over the last three years creating a foundation and we’re excited about the tire space, to capitalize on growth and see where it will take us.”

After acquiring its first Big O franchise in 2011, LWG has amassed 38 Big O locations, with 11 acquisitions in the last 18 months. That doesn’t include the growth of its Midas and Speedee Oil Change locations, which Shader built the company on starting in 2009. Looking ahead, LWG is looking to build out its first Big O Tires locations from the ground up. Shader has secured four of eight plots of land for new builds as part of its greenfield new build program.

“Right now, it’s a pilot program for us. We’d like to do it annually,” Shader says about future growth. “We’re focusing on infill markets that are strong for us where we don’t have good penetration…These are markets where we can enhance our presence and fill in our footprint.”

Currently, LWG has Big O Tires stores clustered in the Southwest and scattered across the Midwest. Shader says two plots of land have already been secured in New Mexico as part of the greenfield expansion. He sees other parts of New Mexico, Colorado and Oklahoma as examples of where their Big O Tires footprint can grow.

“We developed fast in every direction but we don’t have a volume of stores in those areas,” Shader says about LWG’s current Big O Tires locations. “We want to enhance the markets we’re already in and deepen our footprint in those new areas. When we get into a new market, we want to grow vertically by opening up six to eight new greenfield stores year after year.”

Shader says while LWG will use greenfield projects to saturate the existing markets it is in, acquisitions will remain the company’s No. 1 growth strategy in the tire space.

“Acquisitions are fast. After you close, you have the business up and running. It might not be the exact location you want, but it’s a good way to get into a strong market,” he says. “From a greenfield perspective, it takes 12 to 18 months from when you pick the area to build out the location. It’s expensive, but on the positive side, you can pick where you want to be. If you want to stay strong in today’s market, you have to have a mix of both.”

Shader said since the pandemic, he has noticed a shift in the automotive retail landscape. More investment is coming into the industry after COVID reminded investors that “when there is a blip, this industry shines,” he says. Shader and his team hope to provide an outlet for other independents seeking a succession plan.

Shader’s strategy of growing LWG’s Big O Tires footprint fits with the way TBC Corp.’s Big O Tires franchise envisions its growth. Brian Maciak, who was tapped to lead TBC’s tire automotive group earlier this year, told Tire Review in June that in order to take the Big O Tires brand national, it plans to fill holes in its current markets and grow with existing and new franchisees. LWG is part of that plan. “It is poised for monumental growth,” Maciak said of the Big O brand, noting that opportunities exist to introduce the brand on the East coast.

As a franchisee, Shader said growing with the Big O Tires brand has its advantages because they are part of a larger picture. In addition, LWG does not compete with other Big O Tires franchisees due to market exclusivity, which plays into LWG’s goals of same-store growth.

“We don’t have a number [of stores] we have to hit. We just focus on growth no matter where it comes from– it could be a 10% unit growth per year or 10% sales growth,” Shader says. “Big O Tires has strong brand recognition. Its franchisees do an incredible job of marketing it, taking care of customers and maintaining the standard of its image. Any time you have a great tire retail brand and can drive consumers with your offering of tires, it’s going to be a win.”