Steady economic growth, rapid urbanization and increased consumer spending in recent years has catapulted India into the fourth largest automotive market globally. The industry is at an inflection point with the rapid evolution of technology, newer laws and more globally-aligned emission norms, leading to a fast-growing market for everything related to mobility. The tire industry is no exception.

Overview of Indian Tire Industry

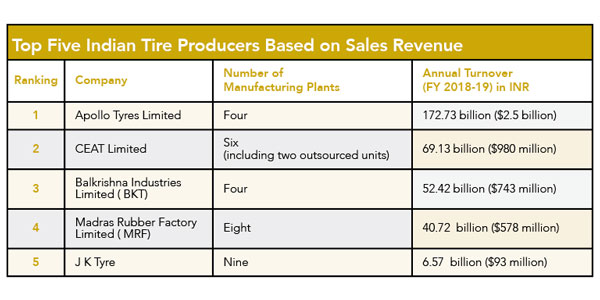

With production figures of 175.4 million tires from 164 operational plants in the country, India has emerged as one of the largest and fastest-growing tire markets globally. With a total revenue figure of USD $8.6 billion (INR $570 billion) in financial year 2017-2018 (according to the All Indian Tire Manufacturers Association), Indian producers exported USD $1.8 billion worth of tires in 2017-18.

During the financial year 2018-19 (FY 2019), India’s economy grew by more than 7%. According to the International Monetary Fund (IMF), the real GDP growth was estimated at 7.2% for FY 2019; and the industrial segment grew at a faster clip compensating for the deceleration in the services sector. However, the Indian automotive industry could not grow according to industry expectations.

Despite the slow growth in the overall automotive sector, the Indian tire industry had a good run during FY 2019. According to the Automotive Tyre Manufacturers’ Association, the tire industry witnessed double-digit growth during FY 2019 and posted a growth of nearly 11% to an estimated USD $9.5 billion. In terms of key segments, the CV segment (truck bus tire) recorded a 16% growth. However, the PV segment posted a flat growth for the concluded year.

The second half of 2018-19 (October 2018-March 2019) was particularly poor for tire producers. This slowdown is hardly surprising as it was not one of the best years for the Indian automotive industry. Original equipment manufacturers (OEMs) accounted for 22-52% of the production of the tire industry, depending on the segment.

Truck and bus tires are the most significant contributors to the Indian tire industry, accounting for nearly 55% of the sales value. Though, in terms of volume, this segment accounts for only 13% of the volume of the total domestic tire industry. Two and three wheelers account for nearly 55% of the total volume but account for 14% of the total value of the tire industry. Passenger vehicles, LCVs and tractors account for 14%, 9% and 8% of the value of Indian tire industry, respectively.

Replacement demand dominates the Indian tire market by contributing about 70% of the total sales value. Original equipment manufacturers (OEM) account for the remaining 30% of the share. The prime reason for the high replacement demand in the country is low ratio of new vehicles sales to existing registered vehicles in the country. Currently, the ratio is a meager 10.3% (New vehicle sales, 21 million; already registered vehicles, 203 million).

Much like the global tire industry, Indian tire producers are striving to include very low tolerances in the manufacturing process, more radials which consume less fuel, low rolling resistance and a focus on better traction and on-road performance to increase fuel efficiency.

Indian tire producers are striving to include very low tolerances in the manufacturing process, more radials which consume less fuel, low rolling resistance and a focus on better traction and on-road performance to increase fuel efficiency.

Radialization has improved by a significant degree in the Indian tire industry. Currently, the passenger car tire segment has a radialization of nearly 98%. Though in the truck and bus segment it is about 35%, while in light commercial vehicles that figure is about 40%.

Indian tire producers are stepping up their manufacturing facilities with technologies that improve heat development in tires with efforts toward less usage of carbon black, which, in turn, contributes to lowering emissions.

Another significant trend is the manufacturing of tires with the use of a higher concentration of silica which helps in the manufacturing process and in improving tire performance by lowering the rolling resistance as well as improving cut and chip resistance.

Concerns around raw material, especially natural rubber, have been a cause of concern for Indian tire producers. The production of natural rubber in the country has been continuously dropping in the last decade, even as consumption has been on the rise. This has led to a huge demand-supply mismatch. During 2018, the problem was further compounded by the floods in the natural rubber growing region (state of Kerala) in the country.

CV Duties on Chinese Imports

In June 2019, the Indian government imposed countervailing duties for five years on new pneumatic radial tires, above 16 inches, which are imported from China. These tires are normally used in buses and trucks.

Earlier in 2017, the Indian government had imposed a duty on trucks and bus radials (TBR) to the tune of around 12-18% when the imports touched a peak of 150,000 units per month. The new duty will be an incremental cost.

“While this is indeed positive for the Indian tire industry, the potential threat of Chinese companies using Thailand and Vietnam for stepped up exports to India continues unabated,” according to Rajiv Budhraja, director general, Automotive Tire Manufacturers Association.

China’s share in TBR imports was 92% in 2016-17 and has decreased to 24% in 2018-19. Thailand’s share has gone up from 2% to 57% in the same period.

Regulatory Environment

The Indian regulatory environment heavily favors domestic tire producers. All categories of tires, including new tires, can be exported freely. There are no World Trade Organization (WTO) bound rates for tires and tubes. However, imports of second hand/retreaded tires are restricted under export and import policy and can be done against an import license. Tires imports in the country under Regional Trade Agreements (Asia Pacific Trade Agreement, Indo-Sri Lanka, SAFTA, India-Singapore, ASEAN, India-Malaysia, etc.) are allowed at preferential rates of import duty. Under open general license (OGL), all the raw materials related to tire production can be imported freely.