Consumers now lean heavily toward digital and online resources when shopping for tires, but still rely on local tire shops for final purchases and installation.

So says “Compete Tire Path to Purchase,” a new consumer research study conducted by Google and Compete in September 2012. The 36-page study dug into where tire shoppers look for information and pricing, how they follow through on their search, and how they follow-up post purchase.

The results were both revealing and a bit surprising, especially as so many consumer product categories have shifted heavily to online purchases vs. brick-and-mortar stores. The study also gave a glimpse at how consumers see both “traditional” and tiremaker advertising efforts.

The study fielded responses of 1,356 recent (within the last six months) tire buyers, and the results were compiled last August. More than 80% reported buying tires in a retail store, but 46% leveraged online and digital tools to do significant pre-purchase research. Some 72% of consumers claim they are open to considering multiple tire brands, tire retailers or both – but tire brands and retailers “have a relatively low familiarity among shoppers.”

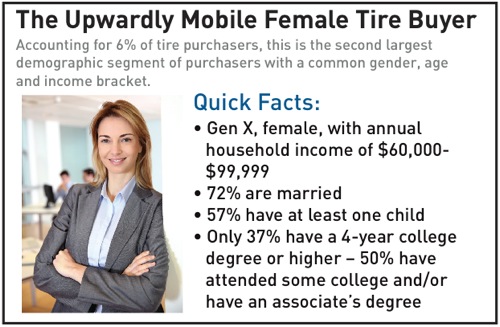

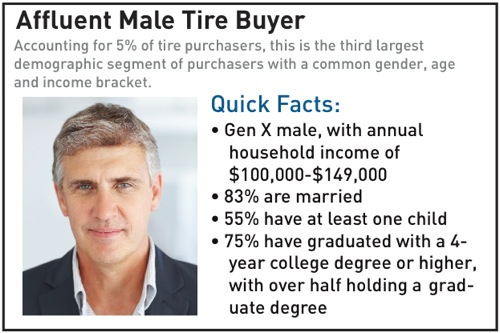

From a demographic standpoint, today’s tire buyer pretty much matches the U.S. population. The respondent was the decision-maker (67%) or was heavily involved in the purchase decision (19%). Among those polled, 45% were female (vs. 51% of the general population), 59% were married (vs. 48%), 42% had children at home (vs. 46%), 49% were college educated (vs. 43%), 20% were non-caucasian (vs. 22%), and 60% were in homes with combined incomes of greater than $60,000 per year (vs. 42%).

When these consumers considered what they were looking for in their next set of tires, durability (tread wear) was the most important at 86%, while traction ranked third at 80%. Squeezed between the two was price at 85%.

At the back of the list were tire brand (55%), carmaker recommendation (46%) and the appearance of the tire (43%).

With regard to durability as the most considered factor, 95% of tire buyersstated that their purchase was driven by worn out tires or a recommendation by the shop that their tires needed to be replaced. Only 8% of tire buyers made their purchase on a seasonal basis (primarily winter tire buys).

How long did it take for most tire buyers to make a purchase decision and take action? For 2012, 65% acted within one week, but 33% said they bought tires the same day they undertook shopping. This compared to 62% buying within a week in 2011, and 20% acting within one day. It took as much as three weeks for 26% of 2012 tire buyers to act, down slightly from 2011’s 30%.

Google/Compete then compared how buyers acted if they purchased offline (at a store) vs. online. In the case of in-store purchases, 48% said they “needed to go” to a tire retailer to have their new rubber installed, and 41% said they did so because they “needed the tires immediately.” Some 34% wanted to see the tires “in person before buying them,” and 30% wanted to make sure tires for their particular vehicle were indeed available for purchase.

The perceived expense of shipping tires (14%) was another reason behind in-store buys, as was the availability of coupons (11%). Just under 9% said they were not “comfortable providing personal information on the Internet.”

But those buying on the Internet were convinced that better prices were available online (42%), that it was faster to buy online (33%), that it saves time (26%), that there was better selection online (25%), that it was personally more convenient (24%), that it helps them avoid “crowds and lines of people” (17%), and it helps them avoid dealing with a salesperson (14%). Another 18% claimed having a positive prior online tire buying experience.

But most online tire buyers lack bays and lifts, so they have to rely on making an appearance at a tire store. And while they were there, 24% ended up having brake work done, 35% got an oil change, 43% got their tires rotated, and 44% had a complete alignment done.

Reasons for Decisions

With all of that in mind, Google/Compete turned its attention to what influenced the final purchase decision – what they referred to as “moments that matter.”

Even as 72% of respondents indicated they were “open to multiple manufacturers, retailers or both,” 64% said they were clearly unsure of the manufacturer but only 33% were unsure of the retailer. This is particularly interesting as the survey did not mention the ages or age ranges of respondents; one can assume that there is an age-related disconnect between shoppers and tire brands and retailer brands.

Some 46% said they engaged in using online resources to make their tire purchases, but of that group, 37% said they researched online and then bought in-store. Nine percent claimed to have researched in-store only to turn around and buy online.

So what were the most powerful influencers on tire selection? According to Google/Compete research, family members were cited by 50% of buyers, followed by the salesperson (45%), TV (26%), newspapers (23%) and radio (14%).

In the online and digital spectrum, tire retailer and service shop websites were the most powerful influencers at 52%, followed by online consumer-generated reviews (43%), general automotive websites (32%), car dealer websites (29%), service shop websites (24%) and newspaper websites (22%).

In looking at media influence on tire buying, Google/Compete found that among those who saw tire brand or retailer ads on TV, 38% did additional research on their desktop/laptop computer (computer), while another 17% used their smartphone or tablet computer (mobile device). Among those seeing a tire brand/retailer ad in a newspaper, 38% did follow-up research on their computer and 10% did it on their mobile device.

Among those spotting a tire brand/retailer ad in a magazine, 42% went to their computer and 19% went to their mobile device for additional research, and among those reading a tire brand or retailer brochure, 53% headed to their computer and 8% pulled out their mobile device for follow-up research.

Going Mobile

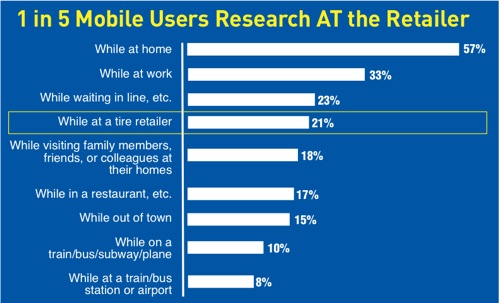

Google/Compete dug a little deeper into how and when consumers use their smartphones or tablets to research tires and stores.

One in five mobile users did their research at the actual tire retailer site. More than half (57%) did their mobile research at home, 33% used work hours to do personal research, 23% research tire brands/retailers while standing in line somewhere, 18% while visiting with family, 17% while in a restaurant, and 18% while either waiting for or on a train or bus.

We’re not trying to be smug here, but it is interesting: A) how people are using their mobile devices, and B) when they are researching tire purchases.

Getting down to the brass tacks of using mobile devices, 33% used them to make sure they were getting the best price, while 28% used them to compare tire brands.

Thirty-one percent used their mobile device to look up the address or hours of a tire shop they were interested in visiting, and 27% used them to seek discounts or special offers.

In terms of specific digital resources on which mobile users depended, respondents turned to professional auto review sites (57%), general auto websites (50%), consumer review sites (48%), search engines (like Google) (45%), tire service center store websites (43%), tire brand sites (37%), carmaker sites (36%), car dealer sites (35%), newspaper websites (32%), video sharing websites (32%) and social networking sites (Facebook, Twitter) (31%).

Conclusions

Google/Compete drew some conclusions from its research work:

• Tire buyers are looking for durability and price, they research on the go, and they usually buy within a week. Recommendation: Maintain a consistent online and digital marketing presence to capture tire shoppers year-round.

• Even as 84% buy in-store, nearly half are using some online or digital means to research their purchases. Recommendation: Work to better understand how online/digital is assisting your sales.

• Tire buyers are “typically” the primary decision maker, and they often are married, educated and skew only slightly male. Recommendation: Capture in-market tire buyers by targeting demographic and tire interests.

• Most tire buyers (72%) are “open” to tire brands and tire retailers – they are not “attached” to any particular brand or store – but tire brands have the lowest familiarity among buyers. Recommendation: Improve familiarity and purchase intent by “introducing your brand” and your key tire brands when undecided consumers approach your store.