Within the auto care service industry, tire dealers are one of but two segments that show growth in the total number of outlets over the past eight years, up by 0.9% annually since 2007 to an estimated 19,851 locations in 2015. Even more impressive is the fact that the rest of the service sector contracted 0.4% annually during that same time period. The growing number of outlets reflects the 2.1% growth in tire dealer sales since 2007. This positive trend is expected to continue, improving annually from $17.9 billion in 2015 to $20.3 billion in 2019 for auto service, parts and repairs.

When we look at total industry tire sales for passenger cars, light trucks, and medium and heavy-duty trucks, the dramatic post-recession rebound for replacement tire sales of $37.3 billion in 2011 has leveled off to an average of $36.0 billion during the past three years. Since 2011, passenger and light trucks have been level at nearly $30 billion. The greatest sales fluctuation observed has been in the medium and heavy-duty truck tire segment, which saw a dramatic 71% increase in sales between 2009 and 2011, but has since receded 11% to $6.4 billion in 2015.

For the eighth year in a row, independent tire dealerships have dominated the domestic retail marketplace for passenger tires maintaining more than 60% market share, while mass merchandisers have experienced a gradual sales decline down to 13% market share as auto dealerships have steadily been encroaching and growing market share, up to 8% in 2015. Along with this increase in business comes numerous opportunities and challenges familiar to the independent service and repair shops. Finding and retaining trained and qualified technicians, margin pressure, e-tailing, telematics, legislative and regulatory issues and competition from new car dealers – all are among the top issues that may keep independent tire dealers up at night.

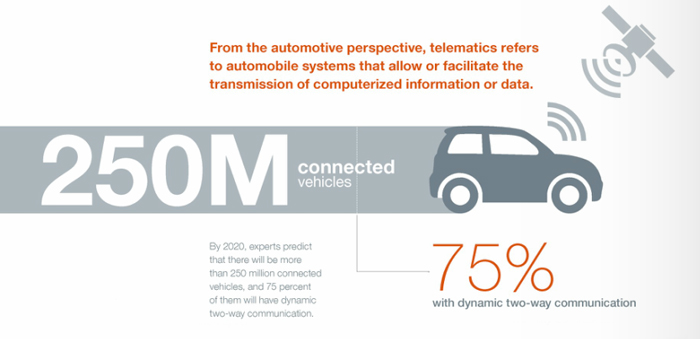

Embedded Telematics Issue

Telematics will provide the ability for vehicles to wirelessly send information to manufacturers and repair facilities, helping them to obtain critical real-time information from vehicle systems.

The Auto Care Association’s No. 1 priority is addressing the need for the independent service industry to have access to embedded telematics systems on vehicles. Access to this data will have a huge impact on shop efficiency, ensuring that the technician can have the right part – as well as all of the needed tools and information to complete a customer’s repair quickly and effectively before the car has even entered the service bay. Further telematics could allow shops to communicate directly with motorists, providing the opportunity for customers to receive updates and alerts regarding the service status of their vehicle.

However, as currently configured, all of the information being transmitted by a vehicle is going directly to the vehicle manufacturer, thus providing a strong competitive advantage to the manufacturers and their service network. Most motorists are not even aware that their vehicle is sending data, never mind the fact that they currently have no control over where the data goes or how it is used.

The Auto Care Association is embarking on a major communications initiative to inform consumers and policymakers about the telematics issue and its impact on consumer privacy and competition. Further, we have been meeting with the vehicle manufacturers in an attempt to obtain a voluntary agreement regarding access to embedded telematics systems. Should they not cooperate, the association is prepared to take the issue to Congress and state legislatures to ensure the industry’s future.

Magnuson Moss Warranty Act

Another issue that is impacting the service industry is misinformation to consumers that using a non-original equipment part or obtaining service from a non-dealer shop could jeopardize their new-car warranty. Under the Magnuson Moss Warranty Act (MMWA), it is illegal to condition a warranty on the use of an original equipment part or service; however, the association continues to file complaints against manufacturers for information in owner’s manuals or service bulletins that attempt to mislead consumers into thinking that they must use either a dealer service or genuine car company parts in order to maintain their new-car warranty.

In order to ensure that consumers understand their rights under MMWA, the association has supported legislation in states that would require that new-car dealers provide a purchaser of a new vehicle with a disclosure regarding the fact that they are not required to use the car dealer for maintenance services in order to maintain their warranty. This legislation was actually enacted in the state of Connecticut in 2015 and we are working in California, Florida, Massachusetts and New Jersey to obtain similar legislation.

Car company and dealer opposition to this effort has been strong; therefore, it is critical that the industry contact their legislators in support of the legislation. We are also specifically asking shops to contact us about incidents of car dealers denying vehicle warranties because the consumer had their car serviced at locations like tire stores.

I encourage Tire Review readers to check out the Car Care Association’s newest publication, “State of Auto Care: Your Industry, Your Association,” that profiles the auto care industry, focusing on key impactful issues while sharing the association’s programs, initiatives and solutions designed to address the industry issues, many of which are of particular interest to tire dealers. You can access the guide at autocare.org/stateoftheindustry.