Tire buyers are spending more time researching their purchases online and are placing more importance on a tire’s brand and reputation.

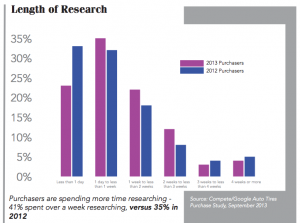

According to “Digital Helps Tire Brands Gain Traction,” a study released in November 2013 by Google, 41% of new tire buyers spent more than a week researching their impending tire purchase, up from 35% in 2012. For the 23-page study, Google partnered with Millward Brown Digital to conduct an online survey using panelists who purchased automotive tires within the previous 12 months. Surveys were completed between Sept. 4-10, 2013.

The results align with tire dealer experiences for the most part, though there were some surprises – such as the increase of online videos as part of the research process, for example (more on that later).

Read on for a breakdown of the main points of the study, as well as input from those in the trenches – your fellow tire dealers – and online tire retailer and research destination Tire Rack.

Research on the Rise

Regarding research prior to purchasing, while 41% of tire buyers spent between one and four weeks or more on research, a large percentage of respondents still only spent one day to less than one week (35%), and even less than one day (23%) researching tires and retailers. This means dealers need to be prepared to offer thorough information – and have easy access to product – in a pinch for those ready to make a quick purchase decision.

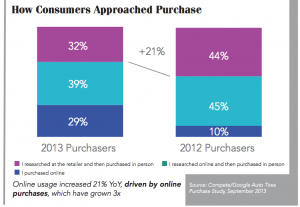

Digital’s role in a tire purchase is increasing, according to the study, which found that 39% of those surveyed researched online and then purchased in person, while 29% purchased tires online (up from 10% in 2012). The amount of tire buyers who both researched and purchased tires at a retailer last year shrunk to 32% from 44% in 2012.

Those last two traits show a major shift away from brick-and-mortar stores for the entire buying process.

The Google study shows that 73% of purchasers visited multiple websites prior to their purchase – 36% visited between two and four sites, while 37% visited five or more sites. Twenty-seven percent visited just one website before pulling the trigger on a purchase.

According to the dealers polled for this article, this prior research is largely in the form of price comparisons.

“Unfortunately, they’re doing a lot of comparison shopping online, mostly for price,” says Julie Yusim, marketing director for Duxler Complete Auto Care, with four locations near Chicago. “There are more people shopping price alone than comparing tires based on quality and cost. Plus, it’s not apples-to-apples if they’re comparing a tire discount store and an independent dealer.”

To remain competitive in the digital landscape, a few years ago Duxler added the ability to offer a tire quote by email. “We may not win against the competition every time, but at least we’re able to participate in the conversation,” Yusim says.

Because of increased pricing competition, independent tire dealer margins have shrunk, according to Alpio Barbara, owner of Redwood General Tire in Redwood City, Calif. “We used to make more on each tire. Now, if someone’s comparing prices online and they ask for yours, you’d better give them the lowest price possible because you’re not going to get a second chance.”

Rather than post prices online, Redwood General uses an online quote system that gives website visitors the ability to input vehicle information and/or tire size. Shop employees then contact the person – by phone, email or text, whichever method is preferred – regarding a price quote. “That way we’re engaged with them – because if I can talk to them on the phone, chances are they’re going to come into my store,” Barbara notes.

On the other side of the coin – and country – Watertown, Mass.-based Direct Tire plans to add online pricing soon, according to CEO Barry Steinberg. “Our clients are complaining that we don’t have prices online,” he says. “We can tell by looking at our website analytics that if people go to the tire information page and spend less than 20 seconds there, they left because there’s no pricing. We need to add online pricing in order to stay competitive.”

Tire Rack has established the benchmark for price, according to Steinberg. “People understand that if they call me for a price on a tire, it’s going to be a certain margin over what Tire Rack charges for a tire and shipping – because they know we’re going to install it, maintain it, fix flats, do rotations, etc.,” he says. “You have to modify your pricing so that you aren’t completely out of the ballpark. We’ve basically attacked Tire Rack head to head; we’re taking their pricing, adding freight and labor, and that’s our price.

“Everyone is scraping their prices to remain competitive,” Steinberg adds. “You can’t not to compete in a market where there are no secrets. Everyone wants it faster, better and cheaper.”

Research Beyond Price

Buyers are researching price, but they also are digging for information on tire features and comparing tire options for their vehicles.

One knows they’re addressing a well-researched consumer when, instead of saying, “I need new tires for my car; I think it’s a 2005 Honda Accord,” a customer says, “I’m looking for a 205/55R16 91H Continental PureContact,” Steinberg says, adding, “We can tell by their language or the tone of their voice over the phone that they’ve done their research online.”

Barbara agrees, explaining that, “Younger customers especially, and high performance in particular, know more about the tire they want than we do.

“When we start talking to a customer about a tire, we automatically bring it up in our computer, so we can at least know what we’re talking about. That customer has already learned everything about that tire,” he says.

Tire Rack, which offers a multitude of research – from independent test results to consumer reviews and much more – classifies three personas of tire buyers, according to Matt Edmonds, vice president of marketing.

“Joe Pro” is the hard-core enthusiast who wants to research every- thing about his vehicle – including tires. “100 Buck Chuck” is shopping based on what he can get for his money. The middle group, the “Responsible Roberto” (or Roberta), is made up of consumers who research any product they buy.

“They aren’t engaged with their tires all the time, but when it comes time to purchase them, they certainly are doing their research and want to educate themselves as much as possible,” Edmonds says. “This middle group also tends to be more understanding of the value of the product; they understand that you get what you pay for.”

He adds that the Responsible Roberto/Roberta group has existed for some time, but with the vast resources now available online, they can do research on their own prior to going to a dealership.

“People spend a lot of time viewing the consumer reviews and Tire Rack test results on our website,” Edmonds says. “Our test results provide information upon the introduction of the product, at a time when there is no information out there other than from the manufacturer. It offers insight into how a product stacks up to comparable products in its category.

“Consumer reviews reflect consumer experience with the product over its lifetime,” he continues. “So that information becomes important to consumers once the product has been out in the marketplace for a period of time. The information gets used equally; we see a tremendous amount of traffic in both areas.”

Brand Consideration

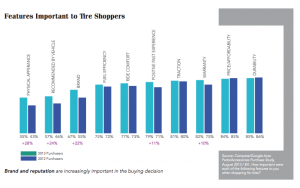

According to the Google study, a tire’s brand and reputation are increasingly important in the buying decision.

When asked about the features that are important when shopping for tires, 67% of survey participants selected “brand,” while 57% chose “recommended by vehicle maker” and 55% picked “physical appearance” – the three responses with the largest increases from 2012.

While those categories saw the most growth, the following ranked highest in features important to 2013 tire shoppers: durability (85%); price/affordability (84%); warranty (82%); traction (81%); and positive past experience (79%).

The study also found that tire buyers are considering more brands: 30% of respondents said they considered at least three other brands in addition to the one they purchased, compared to 21% in 2012. The number who did not consider another brand fell to 22% last year from 31% in 2012.

With same-day access to the majority of tire brands, this may not affect which tires you keep in stock, but it can change your sales pitch.

“You have to know your brands so you can inform the customer and make him feel comfortable with what you’re trying to sell him,” Barbara says. “We offer apples-to-apples options and give three quotes for comparable tires. We use a triangle form; if Michelin is at the top, maybe to the left you put a Bridgestone and to the right a Pirelli.

“If it’s a Bridgestone at the top, then you put a Continental and a Hankook on the sides. It’s always comp- arable tires – we’re not going to offer a lower-tier Chinese import if a customer is looking for a Bridgestone.”

“If someone is looking for a full set in a specific brand, we’ll ask why they’re interested in that tire,” Steinberg says. “We quote them on the tire they want, as well as some other options, and let them decide. We make a recommendation based on their car, their driving habits, what they do in the winter, and the age of the car.”

“When we say they’re considering more brands, that’s partly because there are more brands out there,” Edmonds explains. “But not all those brands are valid; with off-shore product, you get what you pay for – 50% of the price equates to about 50% of the performance.

“As consumers educate themselves and begin to understand the value of a major brand tire that offers technology and performs well, they are appreciating that brand – and thus choosing a tire based on brand.”

While the post-recession reality means most purchases – particularly major ones like a set of tires – are heavily scrutinized, consumers understand overall value versus lowest price, Edmonds adds.

“Because of that, people are doing more research and understand that yes, they can buy a less expensive tire but it only lasts half as long and doesn’t give the best performance,” he says. “People understand value, but they’re still looking for the best value they can get.”

The Role of Mobile

Not surprisingly, the role of mobile (smartphones and/or tablets) is growing in importance among tire shoppers. Those who performed research on a mobile device spent more on tires: 45% of mobile researchers spent more than $200 on tires, versus 21% for computer-only researchers, according to the Google study.

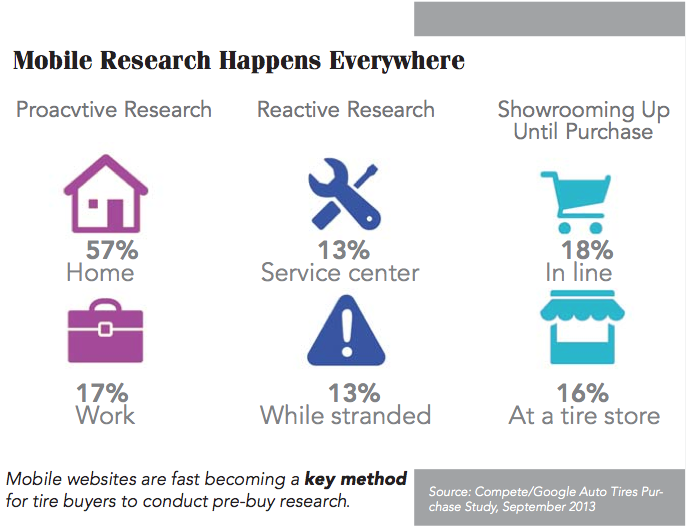

When asked where they used a mobile device to shop for tires, 57% of respondents said they did proactive research at home, while 17% performed the task at work. Regarding reactive research, 13% used mobile devices at a service center and another 13% did so while stranded. The mobile trend doesn’t end there – 16% said they used their mobile devices for research at a tire store, and 18% admitted to performing mobile research while in line for their purchase.

Dealers agree that having a mobile-friendly version of their dealership’s website is a must. Yusim says the biggest portion of Web traffic Duxler receives is now from mobile devices. Redwood General’s mobile site brings in between $70,000 and $80,000 per month in sales, according to Barbara.

Mobile sites most often are scaled-down versions of a shop’s regular website. The Google study listed the following most common activities conducted on mobile devices: 53% looked up a store’s hours of operation; 51% looked up pricing information; 44% looked for discounts/offers; 39% checked prices at other locations; 37% checked to see if tire(s) were available for in-store pick-up; and 19% scheduled an appointment.

Online Video Growth

Lastly, the study found that online video usage has an increasing role in tire research – a fact that surprised dealers polled for this article. Forty-one percent of 2013 purchasers used online video when researching tires (up from 25% in 2012), and 78% of these video researchers said they plan to watch tire videos the next time they shop for tires.

What exactly are tire buyers watching? Here’s the breakdown: 41% watched tire comparison videos; 35% viewed product feature videos; 30% studied professional review videos; 23% watched TV ads online; 16% viewed racing or sports videos; and 15% sought out DIY videos.

When asked which actions, if any, were performed as a result of watching online videos about tires, 31% of consumers said they visited a tire retailer or store website, while 30% physically went to a retailer that sells tires and 27% purchased the viewed tires.

While online researchers may be seeking more video, the time, talent and cost associated with producing quality materials makes for an uphill battle for independent tire dealers, particularly when such videos already are available from other sources.

“I don’t see us doing that at all,” Barbara notes. “Maybe in 5 to 7 more years depending how our clientele’s behavior changes. They do far more reading for research now – but then again, 10 years ago I never would have thought we’d be having this conversation about online usage.”

Edmonds says Tire Rack has seen an increase in viewership of its videos.

“Younger consumers like to obtain their information, it seems, through video. We’re constantly working to enhance and make that format as valuable as possible to consumers. It’s another way to engage the consumer and get information to them.”

He adds Tire Rack’s video strategy is constantly evolving “based on the technology we have available to us, feedback from viewers, etc. We try to make the videos as appealing as possible to consumers and fulfill their needs – and obviously, that’s a moving target.”

“A moving target” certainly is an accurate way to describe the habits of tire consumers. The only way to keep up – thus ensuring your dealership remains competitive – is to keep the pulse of industry trends.

Seek out resources like the Google study featured here (visit google.com/think to view the study in its entirety), the other offerings in this special State of the Industry supplement to Tire Review, or our annual Sourcebook (last month’s issue). Your customers – and your business – will thank you.