It’s widely accepted that gathering customer feedback can help a tire dealership better meet its clients’ expectations.

After that, the clear-cut details start to fade. What’s the best way to gather feedback – and exactly what customer satisfaction data should be sought? And once you have the data in hand, how do you translate that to positive changes in your shop?

To shed some light on the subject, we talked to a handful of savvy dealers and representatives from customer research agencies, each of whom are well-versed in the area of customer satisfaction.

Feedback is Critical

In the era of stiff competition – from chains, big boxers, fellow independents and car dealers – knowing what your customers want, as well as their likes and dislikes regarding an experience in your store, is imperative.

“Customer feedback is critical because it’s the key to delivering outstanding customer service,” says Jamie Ward, head of sales and operations for Cincinnati, Ohio-based Tire Discounters. “We strive to deliver a great customer experience at all touch points: each and every time the customer comes to our store, calls our store, or visits our website. Listening to customers, understanding their experience and acting on it will make Tire Discounters a better company. Ultimately, we can’t get better if we don’t get feedback.”

“Our research shows that 21% will use the Internet to look for reviews of businesses, 10% are going to look on Facebook or Twitter; and 25% are going to ask family and friends. Basically, half the people will ask or look for a review of a business.”

According to Steve Schroeder, president of Marketplace Insights (mpinsights.com), a research firm that offers its automotive clients market analysis, as well as services to measure and drive customer satisfaction, retention and acquisition, customers will voice their opinions about your shop – and if you aren’t the one seeking and managing the information, it could harm your business.

“In this industry, word of mouth is very important, and it’s getting to be more and more important with recent trends we are seeing,” he explains. “Our research shows that 21% will use the Internet to look for reviews of businesses and roughly 10% are going to look on Facebook or Twitter; another 25% are going to ask their family and friends. Basically, half the people will ask or look for a review of a business.”

Relating customer satisfaction to a dealership’s bottom line, John Dickey, president of Quality Solutions (qualitysolutions.com), a consulting firm offering clients a wide range of market research support and quality management services, says shop owners ultimately want three things: to maintain their current customer base; to grow their customer base; and to provide cross-sell and upsell opportunities to their existing customer base.

Gathering customer feedback – and adjusting your business accordingly to meet needs – is a tool to achieve all three, he says, citing a couple examples.

“If I had a bad experience at a dealership when purchasing my tires…the likelihood that I’m going to go there to have my brakes worked on is significantly diminished,” Dickey says. “The shop has lost that cross-sell opportunity.

“Now, if a loyal customer needs to replace his tires, the service manager may recommend an upgraded tire that better meets his needs, but at an extra cost of $15 per tire,” he continues. “Loyal customers will be much more interested in listening to what that advisor is recommending – and that’s where you have your upsell opportunity.”

Create a Structured Plan

When seeking to truly examine the customer experience in order to fine-tune your business based on feedback, it’s important to collect the right information using effective methods.

Encouraging customers to leave testimonials on your website or complete online reviews generates positive word-of-mouth for your shop, but it seldom results in actionable feedback. And while there’s nothing wrong with instructing counter people to make follow-up calls to customers during slow times, a more methodical, organized approach is likely to net better results.

“Consistent measurement is very important,” Schroeder says. “There’s nothing wrong with the friendly follow-up, but ‘Sue’ does it differently than ‘Jim,’ so not all customers are exposed to the same questions or attitude. When you have a survey that you’re actually clicking and filling in, you have trackable, measurable results that are consistent. When performance is measured, performance improves.”

Dickey says tire dealers should offer transaction-based surveys to customers, adding his firm offers these services by phone and online. After working with a client to decide what information to seek in a survey, Quality Solutions tracks results on a set scale and sends regular reports. Scores below a certain threshold result in “escalation notices” being sent to a store manager or other designated individual.

“They have that information, and now they can triage that situation internally and determine what transpired that caused that person to be upset with their experience,” Dickey explains. “Now, they can contact that customer directly by phone and offer a resolution.”

Another comparison of feedback methods is inbound vs. outbound. Inbound methods include mirror hang tags, social media reviews or a business card drop box – anything in which a customer must take action to opt into an experience, Schroeder says.

“Even though you’re reaching out, it’s in a passive way that is waiting for the customer to let you know if there’s a problem or that they’re extremely delighted,” he explains. “In that methodology, you’re probably never going to get those fence sitters. You’re going to get the people that are really upset or the people that are just really loyal to your business; you’re really missing out on a chunk of customers that are right in the middle.”

Schroeder adds that out of the usual outbound survey methods used – phone, email/online and mail – making customer satisfaction calls by phone is most effective because of the ability to interact with customers and change the tone of the conversation, if needed.

“First and foremost, you want the customer to know that you’re calling because you care about their business, not because you’re trying to complete a research questionnaire,” he says. “It has to be variable, depending upon what the customer says to you.”

MPI customizes surveys for its clients, but the theme is generally similar.

“If the customer says they’re very happy there’s no reason to ask them any other question because you know they’re just going to give you five stars the rest of the way,” Schroeder explains. “If they’re very disappointed, we ask if a manager can call them back. If they’re somewhere in the middle, we ask a couple more questions to try to get true research out of it.”

Methods Used by Dealers

Chris Monroe, owner of Monroe Tire & Service, located in Shelby, N.C., says that because he operates a single location dealership, he is able to regularly interact with customers himself, often visiting the waiting area to ask customers about their experience.

Monroe Tire also contracts with Demandforce for follow-up email surveys that ask five questions, in which customers can rank their experience on a scale of one to five. There also is space for comments after the open-ended questions, which include: “Did you find our place clean?” “Were we attentive?” and “Did we take care of what you needed?”

“Most people are fine with giving us their email address, and we let them know there’s going to be a follow-up so they can let us know how we did,” Monroe says.

Tire Discounters collects customer feedback both in-store through exit interviews and online, by encouraging customers to provide information through its feedback tracking system and website chat feature, as well as through social channels and its own customer research, Ward notes.

“We use this feedback to measure customer satisfaction, identify trends, share best practices and make improvements,” he says. “We also publish a CSI score each month based on the ratio of positive to negative feedback and reward our sales teams with compensation incentives for outstanding scores.

Regarding questions asked, Ward advises, “If you can collect the data, we suggest collecting everything. The most common measurements are Net Promoter Score, overall satisfaction, and likelihood to recommend. However, sometimes it’s the smaller customer comments and feedback that can make a big difference.”

Net Promoter Score

Gaining attention in recent years has been the Net Promoter Score system of gathering, tallying and analyzing customer feedback.

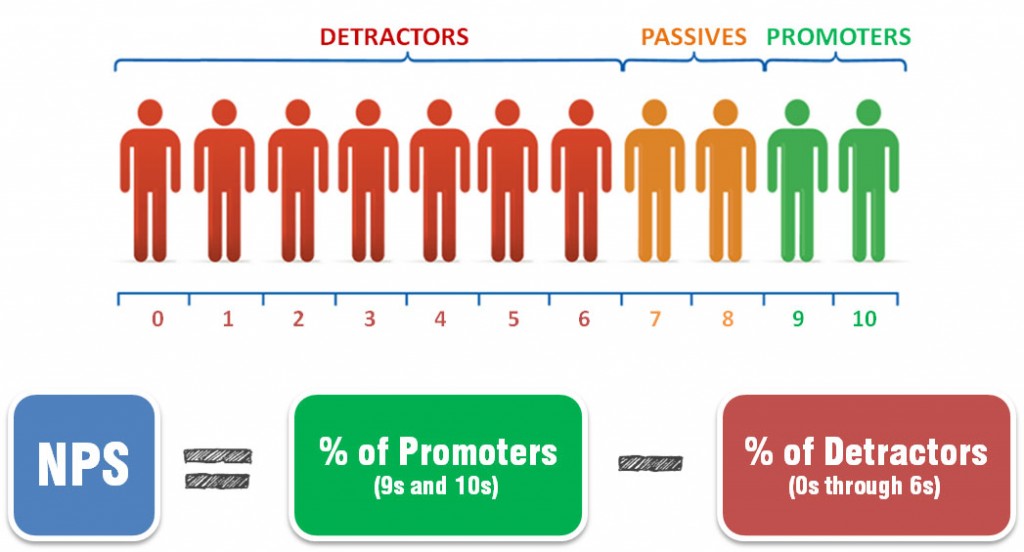

NPS is based on the fundamental perspective that every company’s customers can be divided into three categories: promoters, passives and detractors, according to Netpromoter.com.

By asking one simple question – How likely is it that you would recommend [company name] to a friend or colleague? – these groups can be tracked to provide a clear measure of a company’s performance through the eyes of its customers. According to the website, customers respond on a 0-to-10 point rating scale and are categorized as follows:

• Promoters (score 9-10) are loyal enthusiasts who will keep buying and refer others, fueling growth.

• Promoters (score 9-10) are loyal enthusiasts who will keep buying and refer others, fueling growth.

• Passives (score 7-8) are satisfied but unenthusiastic customers who are vulnerable to competitive offerings.

• Detractors (score 0-6) are unhappy customers who can damage your brand and impede growth through negative word-of-mouth.

Chapel Hill Tire Car Care Center, with five locations in the Research Triangle area of North Carolina, has used NPS since 2008, according to co-owner Marc Pons.

“Prior to NPS, we were sort of taking an average of all the scores, and while it was good to have the feedback, we didn’t really know what to do with that number and whether that number was good or not,” he explains. “It was hard to make decisions on an average customer service index or anything like that.”

Pons says with NPS, the actual measurement “is much more sensitive to what’s going on in the shop.” Chapel Hill Tire uses a combination of phone and online surveys to obtain a rolling six-month NPS number, which allows management to see how each store is trending.

“It doesn’t really matter where you start – what you should be focusing on is whether or not the number is improving,” Pons says, adding, “The thing I like about NPS is that, if you get a new advisor on the counter, or if you have a really hectic month where not every customer got the total attention they deserve, the score will drop. It’s very easy to pinpoint where you’re having an issue.”

To further drill into customer feedback data, Chapel Hill Tire separates new customer responses from those of existing customers.

“We want to see how well we’re doing on that pipeline of future loyal customers, so we score that separately because we want to be sensitive to that first impression we make,” Pons adds.

Putting Feedback to Use

Now that you’ve collected this vital information, how can you use it to improve your dealership?

Schroeder recommends complete transparency among your staff. “Make sure people know they’re getting measured, and make sure they get recognized for doing a good job – there should be some incentive. If you’re not disseminating that information, performance isn’t going to improve.”

Pons agrees, adding that management at Chapel Hill Tire sends everyone in the company an email each Friday with NPS numbers for the week prior.

After collecting customer feedback, staff at Tire Discounters makes a point to respond quickly to any complaints.

“For issue resolution, we operate under the same principle that our service managers follow: the sooner we contact our guest, the more likely we will resolve the concern and make a customer for life. Ignoring your customer will guarantee the opposite result,” Ward explains. “Additionally, it’s important to analyze the data. By keeping on top of feedback, you can identify trends, share best practices and improve areas that need to be fixed.”

In addition to sharing customer feedback data with all employees, Monroe employs customer research to steer the shop when it comes to large-scale changes in business. For example, in 2005, Monroe considered closing the shop on Saturdays to give himself and his staff a full weekend off (the shop already was closed on Sundays).

“We looked at sales for the previous three years, and we found the top 200 customers that spent the most money with us on Saturdays,” he explains. “We called them and asked how it would affect our relationship if we were to close on Saturday. We explained that we valued their business, so we wanted to get their opinion. Out of 200 customers, 197 supported us and said they’d come to us during the week if we were no longer open on Saturdays.

“That helped us make that decision, and our business has improved every year since,” Monroe adds.

The bottom line is, any customer feedback is better than none at all. While a detailed plan of action for gathering satisfaction data will be easiest to control for consistent results, encouraging customers to voice their opinion in any way will benefit your business.

“Doing nothing – essentially putting your head in the sand – that’s the biggest mistake you can make,” Monroe adds. “You’re either going forward or you’re going backward – and with all the indicators and benchmarks out there today, it’s pretty easy to figure out which way you’re going.”