Sales of replacement tires for light, medium- and heavy-duty vehicles are an important segment of the auto care industry. The 2008-2009 recession had a dramatic impact on the U.S. consumer tire retail market. However, the following two-year period recorded sales of $31.2 billion in 2010 and $37.3 billion in 2011, registering year-over-year increases of 20.9% and 19.6%, respectively.

Since then, sales have leveled at slightly over $36 billion with very little year-to-year variation. It is interesting to note that the recent uptick in miles driven (+3.5% in 2015 and +2.8% in 2016) does not seem to have had much impact on fairly level sales during the same time frame. Bolstered by a record-setting 3.2 trillion vehicle miles driven in 2016, replacement tire shipments from manufacturers were up slightly – a 0.6% increase from 2015 to 2016.

Despite increased competition, independent tire dealerships dominated the domestic passenger tire retail market with 61% of sales in 2016. Mass merchandisers/chains were second on the list with 12% market share, having experienced a gradual decline in share of 3% since 2006. Auto dealerships, accounting for 8.5% of the market share, have seen their numbers improve since 2010. The remaining market share is comprised of warehouse clubs (9% share), tire company stores (7% share) and miscellaneous outlets (2.5% share).

These stats (found in the 2018 Digital Auto Care Factbook) paint an important picture: While drivers are traveling farther and their cars are lasting longer, so are their tires, thanks to advancements in technology.

It used to be that major changes in technology, and essentially our world, would take years to see advancements that change the way we operate daily. After technology was introduced, there’d be an “adoption period” where a small percentage of early adopters would lead the pack, while the largest percentage of consumers would be lumped into the “laggards” group. This group waited for the best versions, the troubleshooting, and the apprehension associated with an early purchase to subside.

Now, consumers jump at the latest technology. New technology emerges so often and quickly that many barely make it through the adoption cycle before being taken over by something faster, shinier or more efficient. Consumers in our industry are bombarded with these choices at an alarming rate. How does the automotive industry cross this chasm today?

As the technical sophistication of the industry and its vehicles has grown over the last quarter century, our research and analysis of the most relevant industry trends has had to follow suit. Vehicles have become more sophisticated in terms of computerization and software orientation, electrification, connectivity, telematics and hybrid power. Data has evolved from a “nice to have” to an absolute must to maintain efficient business operations. Furthermore, the industry is subject to a political climate that requires each and every one of us to get involved to ensure that our needs are met and our businesses remain thriving. These three trends will continue to drastically shape our industry now and in the future – but we can’t stand idly by.

Top 3 Trends: Things to Consider

1. Changing Tech in Automotive

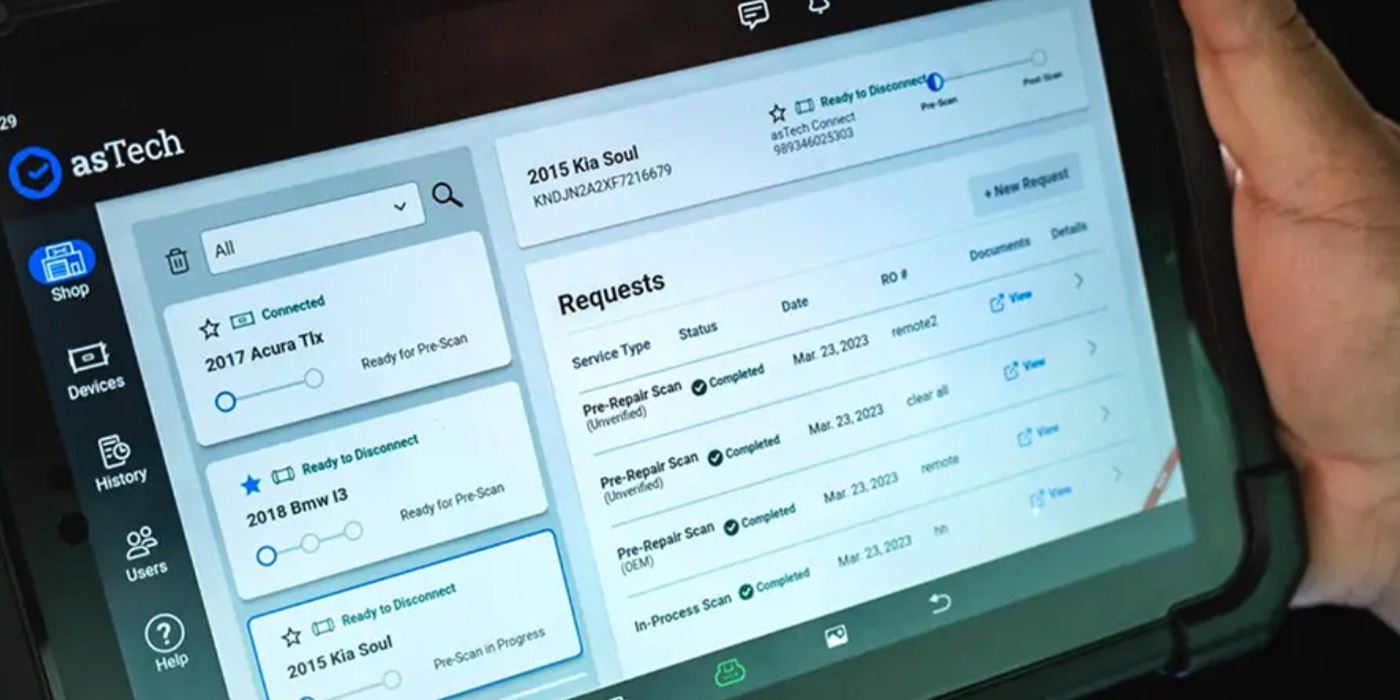

By 2020, experts predict that there will be more than 250 million connected vehicles, and 90% of them will have dynamic two-way communication, according to data from Gartner and IHS Markit. However, Carfax’s Car Tech Study paints a different picture, predicting that half of car technology users have no interest in autonomous cars, and while in-car technology features continue be included in new models, only 29% of consumers are willing to pay for features like Wi-Fi (IHS Markit).

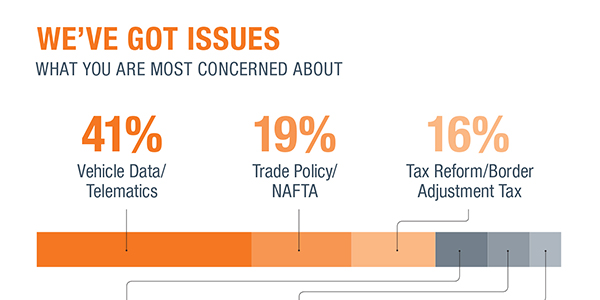

According to a member survey we conducted, 41% of respondents are concerned about access to vehicle data and telematics. The most important question these stats bring up is, “Why?”

While we celebrate these advancements and their ability to make our lives safer and more efficient, there are glaring issues we should all think about. Who earns the right to car data? How will I be able to repair a car or sell the proper part if I’m not provided with the right tools or training to do so? What will happen to the future of the aftermarket industry if these questions aren’t answered?

The answer lies in getting as educated as possible about telematics, standing up for our rights and informing consumers about theirs.

2. More Efficient Use of Data

How can data help your business? Let me count the ways. Data enables us to learn as much information as possible about operations, sales and retention, and even predict purchasing and maintenance trends. Without data, it’s like wearing a blindfold in the dark – there’s no real way to decipher where you’re going without stumbling and stubbing your toe a couple of times – you simply don’t know what you don’t know.

Which brings me to another point: Are you using standardized part and application data? If you aren’t, the consequences can be frightening, including higher product returns, fewer repeat customers and lost opportunities from related items.

Technology standards are critical for efficient business. Suppliers who provide the detailed performance and physical attributes of their product enjoy an advantage over their competition – and can differentiate their products on features and value, rather than price alone. We now live in an electronic world and are not limited to the space constraints of a paper catalog; it is imperative for suppliers to view their e-cat information as a selling tool rather than just a requirement.

3. We’ve Got Issues

We’re not sure about what the new administration will bring to our industry, but what we do know is that 80% of U.S. auto parts exports go to Free Trade Agreement (FTA) partners, so the association advocates for new, strong and ambitious free trade agreements that will significantly enhance members’ ability to grow globally and compete on a level playing field.

The second and third most concerning issues according to our survey are trade policy/NAFTA, followed by tax reform and the Border Adjustment Tax (BAT). We’ve made tremendous strides as an industry (nationwide Right to Repair, right to produce competitive replacement parts and unencumbered movement of auto parts), but the work isn’t over yet. We need to diligently work on addressing new trade, regulation, taxes, and labor laws not only at the federal level, but also at the state level where many of these issues are playing out and we’re earning victories.

If we’re not engaging with policy makers to make sure today’s legislation doesn’t affect your bottom line tomorrow, we won’t continue to make progress on these key issues. Stand up, and be heard.

What key trends has your business observed? Share your thoughts with me on Twitter @AutoCareCEO or feel free to email me at [email protected]. We’ll be listening .